The need to keep generating trading profits means the US banking giant has to take greater risks

Goldman Sachs experienced a total trading loss of $687 million on two days during the third quarter, according to regulatory filings by the bank. The losses, one of $407 million and the other of $280 million, were disclosed in Federal Reserve filings because the bank breached its daily value-at-risk limit on both occasions.

The August volatility was sparked by a 12% decline in Japanese equities on 5 August, which led to sell-offs in other markets and prompted a brief pre-opening hours spike in the VIX index to a record 66%. The volatility attracted regulatory scrutiny, with the Bank for International Settlements referencing carry trade unwinds and the quote-based mechanism for VIX calculations as causes of the turmoil.

While Goldman Sachs enjoyed $5.5 billion of trading revenues during the quarter as a whole, the two days of losses underline the vulnerability of the bank to sudden market reversals amid a time when stocks and other risk assets are reaching record highs.

While Goldman Sachs enjoyed $5.5 billion of trading revenues during the quarter as a whole, the two days of losses underline the vulnerability of the bank to sudden market reversals amid a time when stocks and other risk assets are reaching record highs.

As part of the Fed’s application of Basel rules, large US banks incorporate VaR in their market risk capital calculation. Banks use VaR to predict their largest trading loss up to the 99th percentile, and breaches of this limit are reported as backtest exceptions.

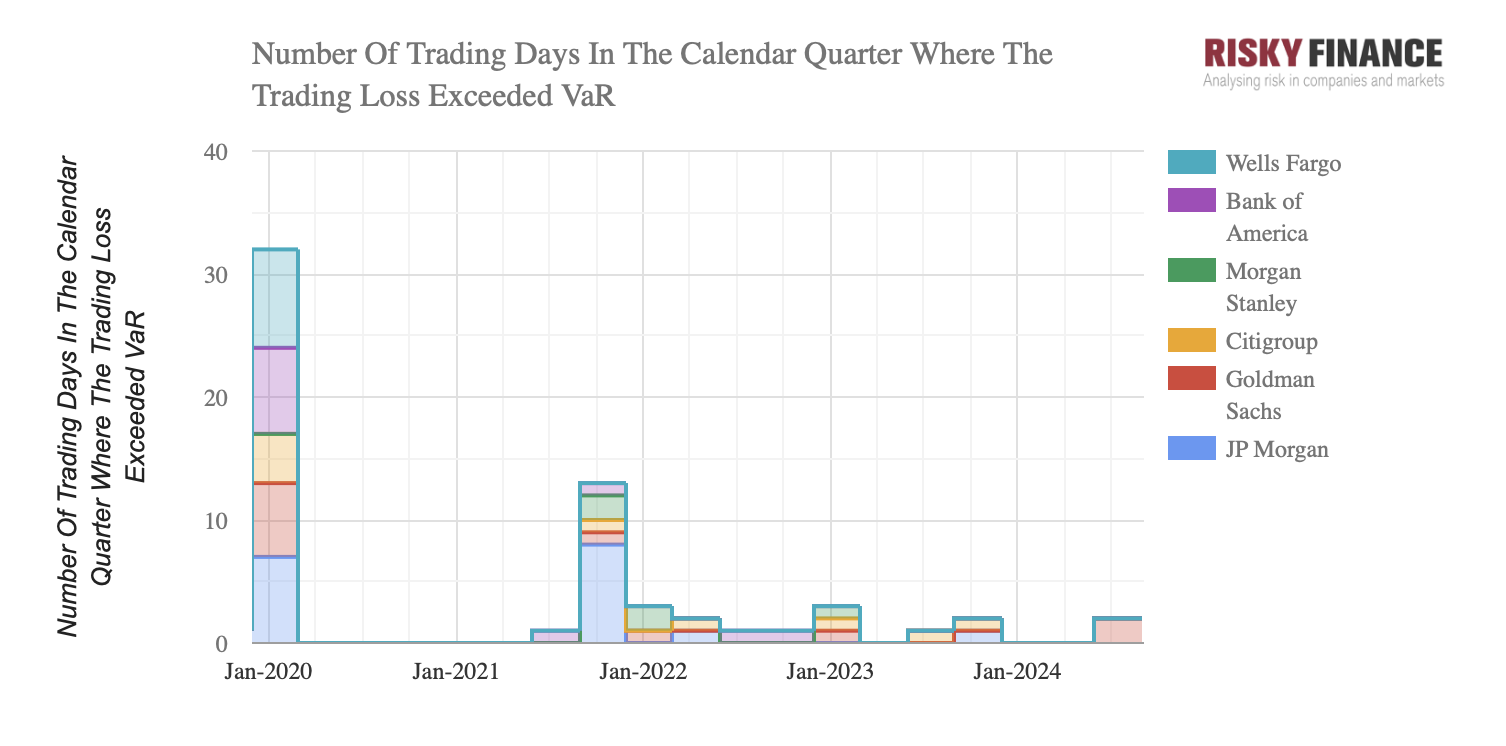

Under normal market conditions, banks are expected to stay within daily VaR limits. There are about 62 trading days each quarter, so the 99th percentile VaR limit should be crossed once every two quarters, on average.

Clusters of VaR exceptions indicate that markets are behaving abnormally, but such clusters are not uncommon. The top five US banks collectively reported 32 VaR exceptions during the first quarter of 2020, when markets plunged at the onset of the Covid pandemic. Another cluster of VaR exceptions occurred in the fourth quarter of 2021, when JP Morgan breached its VaR limit eight times and Morgan Stanley did twice.

Meanwhile, the need to generate trading profits means the banks have to hold larger and larger trading portfolios as equities rise in value. The total trading assets reported by the six banking giants reached record highs in the third quarter, as did equity trading portfolios and the notional amount of equity swap contracts.

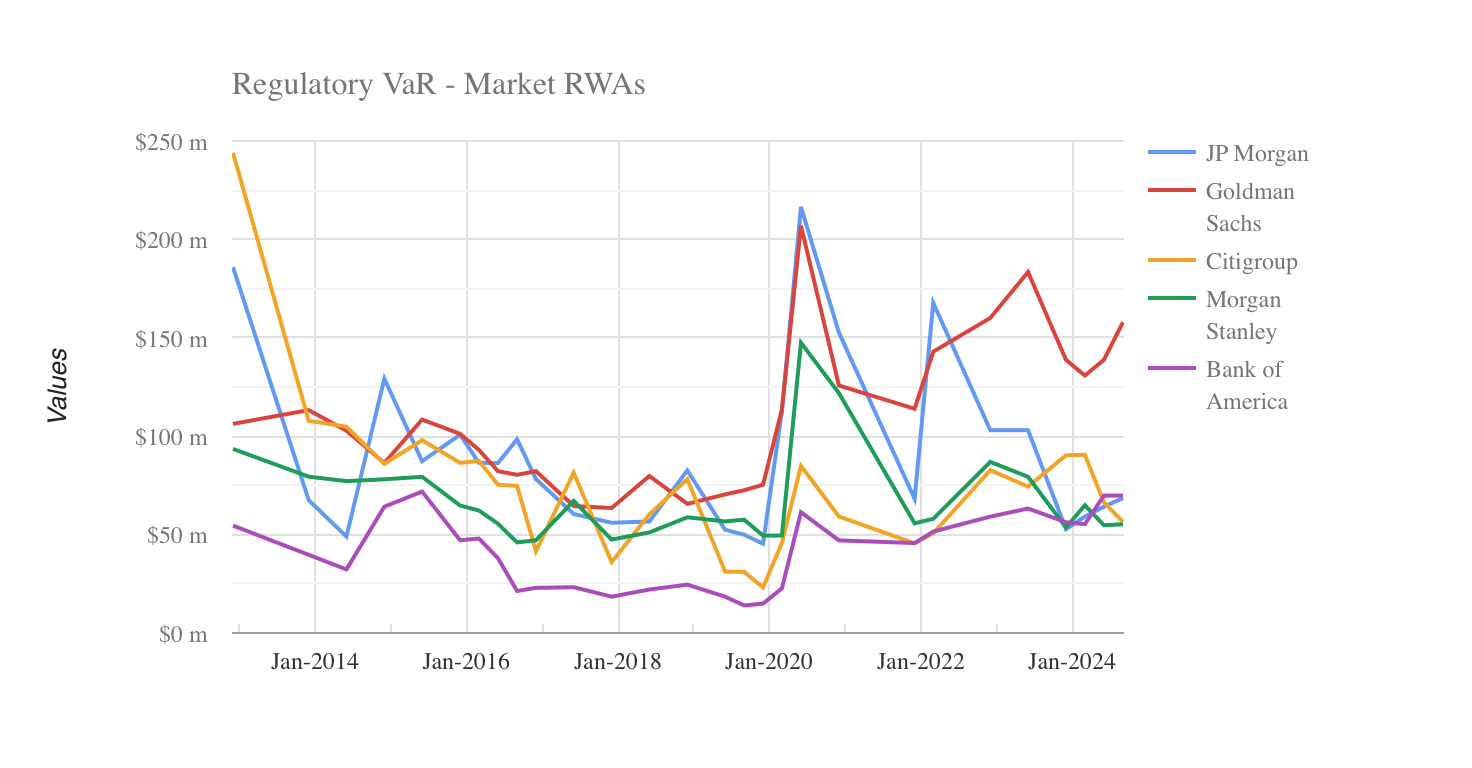

JP Morgan is the largest bank under these metrics, with $786 billion in trading assets, $223 billion in listed equities and $855 billion in equity swap notional, according to the standardized disclosures required by the Fed, with Goldman in second place. However, when measured using risk metrics, Goldman is an outlier, emphasising the riskiness of its trading book.

The bank’s one-day VaR averaged $158 million during the quarter, more than double the $69 million reported by JP Morgan and the $70 million at Bank of America. The Fed also requires banks to report ‘stress VaR’ which measures the riskiness of their current portfolios when subjected to the market conditions at the height of the 2008 financial crisis. By this measure, Goldman’s third quarter stress VaR was $336 million, with JP Morgan in second place with $130 million, despite Goldman having a smaller trading portfolio.

The bank’s one-day VaR averaged $158 million during the quarter, more than double the $69 million reported by JP Morgan and the $70 million at Bank of America. The Fed also requires banks to report ‘stress VaR’ which measures the riskiness of their current portfolios when subjected to the market conditions at the height of the 2008 financial crisis. By this measure, Goldman’s third quarter stress VaR was $336 million, with JP Morgan in second place with $130 million, despite Goldman having a smaller trading portfolio.

The bank may hope that market-making fees will continue to outweigh the kinds of losses experienced in August, but this depends on its VaR continuing to grow in line with market valuations. Speaking to investors in October, CEO David Solomon said, “I think one of the things that people forget is that these businesses are correlated to growth in the world. They’re correlated to market cap growth in the world.”

In 2007, Citigroup’s then-CEO Chuck Prince said that the bank had to ‘keep dancing’ as markets boomed. Solomon’s quote could be interpreted in a similar way – which could return to haunt him in the future.

©Markets Media Europe 2024