Investors have been increasing their exposure to infrastructure due to an expanding definition of the maturing asset class, as well as uncorrelated returns.

Infrastructure investing and private credit will continue to grow this year according to a report from consultancy McKinsey, as European asset manage Amundi has acquired Alpha Associates, an independent asset manager offering private markets multi-manager investment solutions.

Amundi said in a statement that Zurich-based Alpha Associates is a founder-led, specialist in private markets multi-manager solutions, which currently manages €8.5bn of assets and will be combined with the Amundi’s existing private markets multi-manager set-up.

Valerie Baudson, chief executive of Amundi, said in a statement: “Within the asset management industry, private markets have seen sustained growth in recent years, as investors have increased their allocation to this asset class in their portfolios. This move, which is fully in line with our strategic objective to increase our footprint in alternative and real assets in Europe, will allow us to create substantial value for our clients and shareholders.”

In a report, Ten considerations for private markets in 2024, McKinsey said investors have been increasing their exposure to infrastructure due to an expanding definition of the asset class, its growing maturity and uncorrelated returns.

“Recent depressed fundraising totals have been a sell-side phenomenon, and LPs are likely to increase commitments shortly—should their actions match their stated intentions,” added McKinsey.

McKinsey continued that buyout sponsors are competing for assets compete for assets within the overlapping space e.g environmental services) and energy transition investing is playing a big role, government-backed dollars to be spent in the sector providing a tailwind.

An example of the demand for energy transition investing is shown by Brookfield Asset Management raising $10bn in the first closing of the second Brookfield Global Transition Fund in January 2024. The fund focuses on investments to accelerate the global transition to a net zero economy.

Connor Teskey, Brookfield Asset Management

Connor Teskey, Brookfield Asset Management

Connor Teskey, chief executive of Brookfield Renewable Power & Transition, said in a statement: “Corporate demand for decarbonization technologies is now the primary driver of transition investment, delivering significant economic value as well as meaningful environmental benefits. The strong first close for the latest Brookfield Global Transition Fund demonstrates the growing appetite among leading global investors to capitalize on these trends.”

In another sign of the growing demand for infrastructure investment, asset manager BlackRock also announced the $12.5bn of Global Infrastructure Partners (GIP), an independent infrastructure investment platform, in January 2024.

Bayo Ogunlesi, founding partner, chairman and chief executive of GIP, has said the “golden age of infrastructure” is about to begin.

The deal marked the ninth of its kind since the start of 2022 as managers look to capitalize on the promising growth outlook in infrastructure according to data provider PitchBook.

Private credit

Higher interest rates have made private credit more attractive, and capital has poured into the asset class.

“As banks continue to limit their own lending, opportunities to put capital to work will be numerous as dealmaking resumes, prior vintage loans reach their cliffs, and private lenders foray into new areas, including asset-backed and investment-grade loans,” added McKinsey.

However, the consultancy also highlighted that crowding could hamper spreads, and competitive differentiation may become increasingly important.

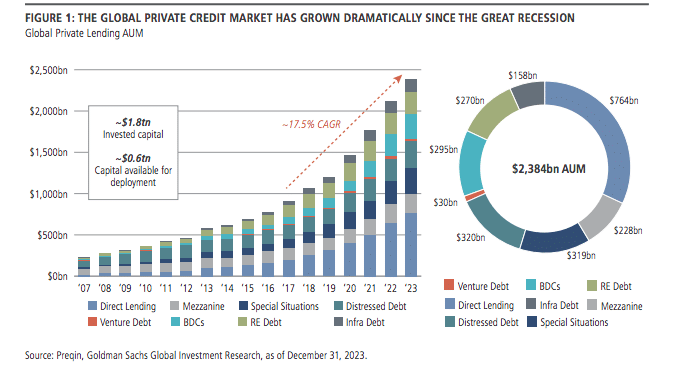

Private credit began growing after the 2008 financial crisis as banks shrank their balance sheets due to higher capital requirements and regulatory scrutiny. In addition, investors began expanding into riskier asset classes as they searched for yield in an environment of near-zero interest rates.

Fund manager Neuberger Berman said in a report that a vast menu of private credit arrangements now finance nearly every aspect of the real economy and the market has grown from $230bn after the financial crisis to more than $2 trillion.

Nearly all investors, 90%, said private debt performance has met or exceeded their expectations according to a survey from Preqin. The data provider also said in a report that half, 51% of LPs, intend to increase commitments to private credit, while 40% intend to maintain their commitments which was by far the highest numbers of any asset class.

“More money’s coming in,” added Preqin. “Arcmont Asset Management announced the final close of a €10bn fund for direct lending in Europe and Benefit Street Partners closed a $4.7bn vehicle for mid-market North America. “

The data provider forecast an average internal rate of return (IRR) in private debt of 9.8% between 2022 and 2028 , compared to 14.3% for venture capital; 12.6% for private equity; 11.5% for secondaries; and 10.9% for infrastructure – all of which have higher risk profiles.

Preqin also warned that the asset class is not risk-free for investors.

“If the economy slows, some companies will struggle to service debts at higher rates. US credit default risk could peak in mid-2024,” said Preqin. “At best, this would hit returns to LPs. At worst, it could put a few GPs in deep water.”

Neubeger Berman said the growth of private credit has been partly driven by bank regulation, particularly the Basel III Endgame which could increase capital requirements against risk-weighted assets for large US banks.

The fund manager argued that selective private capital providers help bolster the overall stability of the financial system because, unlike banks, that are match-funded so their assets and liabilities have similar duration profiles.

“We find that private credit funds often take on less balance sheet risk by employing either modest leverage (up to 1-times equity capital) or none at all. Banks, by comparison, tend to be levered 10 to 1,” said Neuberger Berman. “We believe private credit arrangements can be more transparent than critics suggest.”

In addition, the funds manager believes that private credit will be durable in the face of unprecedented economic volatility , especially as rising interest rates over the last 18 months have not dampened the performance of the private credit market.

“Looking ahead, we expect the burgeoning market for private credit will continue to expand and evolve, driven by shifting regulatory regimes, deepening partnerships with traditional lenders, and the continued potential for attractive risk-adjusted returns,” added Neuberger Berman. “Moreover, we believe the remarkable rise of private credit reflects its increasingly important long-term role within an ever-changing financial landscape.”