The broker has added securities coverage in its Hong Kong dark pool and launched BlockCross.

Instinet, the agency broker owned by Nomura, has expanded securities coverage within its dark pool in Hong Kong and launched conditional order management platform BlockCross in Asia.

Ian Lauder, head of liquidity strategy, Asia Pacific at Instinet, told Markets Media that securities from Indonesia, Malaysia and Philippines were added to the agency broker’s dark pool in Hong Kong on 9 March this year.

“We will further be expanding our securities coverage in BlockMatch Asia to provide trading for additional APAC markets,” Lauder added.

Markets in APAC can have higher frictional costs of trading, wider spreads at BBO (best bid and offer), and higher market impact in comparison to other regions according to Lauder. Therefore, dark mechanisms can provide for potential impact cost savings and spread savings.

Instinet launched BlockMatch Asia with Hong Kong securities in February 2022. One of its main features was the addition of a conditional book for the submission and management of conditional orders, which helps institutions source larger block-size liquidity by resting a large parent order, while simultaneously working the order elsewhere in the market.

Lauder said: “There has definitely been an increase in client interest and awareness of conditional order types in APAC over the past two years in particular, and we think that trajectory will continue.”

BlockCross

In addition to expanding securities coverage on 9 March, Instinet launched BlockCross in Asia on the same date. Ned Millington Buck, head of BlockCross, Asia Pacific at Instinet told Markets Media this was in response to client demand for a new and innovative solution to address the challenges of liquidity sourcing in Asia Pacific and BlockCross provides conditional order and blotter integration functionality.

“The launch of BlockCross marks the first time clients will have manual conditional crossing capability against Instinet’s global franchise flows,” added Millington Buck. “The launch in Asia Pacific follows on the success of BlockCross in the US and the growth trajectory underway for the platform in Canada and Europe.”

Investors could be worried about conflicts of interest when interacting with Instinet’s global franchise flow but Millington Buck argued that BlockCross has a unique counterparty selection functionality that gives clients granular control over the types of contra flow they choose to interact with.

“This will include Nomura Group flows for those clients who choose to opt in,” said Millington Buck.

Lauder added that when Instinet overhauled its Hong Kong venue in February last year, the broker introduced counterparty selection to provide clients with the choice to interact with a wider spectrum of liquidity. Participants within the venue are designated by one of five categories, based on trading intent, which allows clients to be more granular about the type of contra liquidity they wish to interact with.

Millington Buck contended that a differentiator for Instinet in Asia Pacific is the broker’s position in Execution Services within the Nomura Group, which allows for an expanded strength of harmonized expertise and broad capabilities globally, particularly in Japan.

“This is the first time a conditional crossing platform has the backing of an investment bank, and that’s something that’s been very well-received by clients,” he added.

In Asia approximately 80% of blocks traded in conditional crossing pools are executed manually through platforms like BlockCross, with the remaining 20% coming through electronic channels like Instinet’s Algo Suite including Nighthawk or external broker algos, according to Millington Buck. He described the conditional crossing landscape in APAC as being at the development stage and10 years or so behind the US.

“The successful launch of BlockMatch Asia and the conditional pool has provided us the springboard to introduce BlockCross in Asia,” said Millington Buck. “We’re incredibly excited to expand market coverage, provide innovation in the venue, develop the ecosystem for conditional orders, and deliver a superior crossing platform to our clients.”

Japan

Across Asia, BlockCross interacts with the BlockMatch Asia venue in Hong Kong. However, Millington Buck said that in Japan BlockCross will seamlessly integrate with Nomura’s existing pool, NX.

“Nomura NX accounts for approximately 40% of dark crossing in Japan,” added Millington Buck. “This will provide valuable access for clients looking to interact with Japanese domestic flows and marks a major shift in the way foreign institutions can trade there.”

Competition has increased in Japan since Cboe Global Markets completed its purchase of Chi-X Asia Pacific, an alternative market operator, in 2021 allowing the US exchange group to enter Japan and Australia and establish a significant presence in Asia Pacific for the first time. On March 27 this year Cboe Australia, formerly known as Chi-X Australia, migrated to Cboe technology and BIDS Trading, Cboe’s block trading ATS, was launched in the country. Cboe BIDS Japan is due to launch in the fourth quarter of this year.

Lauder said: “We have always welcomed trading innovation in the marketplace, supporting the ability of clients to execute, and we think that the arrival of a venue-type model is very encouraging for the APAC marketplace. Instinet provides access to BIDS in Europe and APAC and we think that will help grow adoption of conditional orders in the region.”

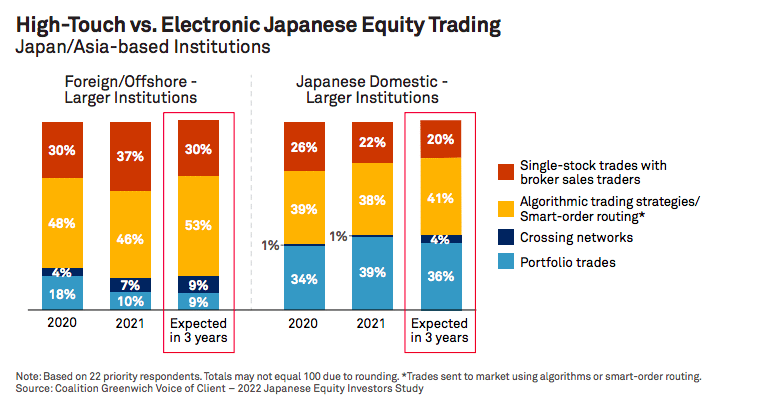

Consultancy Coalition Greenwich said in a survey that adoption of algorithmic trading has been limited among domestic Japanese institutions with only 24% of the sample active in algorithmic trading, compared to 36% of offshore institutions.

“Foreign/offshore investors plan to significantly expand the role of algorithmic trading on their Japanese equity desks,” added the report. “By 2025, these institutions expect to be executing more than half of their Japanese equity trading volume via algos.”

Japanese domestic institutions are planning modest increases in their use of algorithmic trading which will bring algo execution to about 40% of overall equity trading volume in the country.

“Meanwhile, domestic institutions plan to maintain their reliance on portfolio trades, which are expected to account for 36% of Japanese equity trading volume in 2025, compared to less than 10% among foreign/offshore institutions,” said the report. “These strong preferences are creating differentiation in the offerings of banks, with domestic banks further strengthening portfolio trading capabilities and the foreign banks pioneering in algorithmic capabilities.”