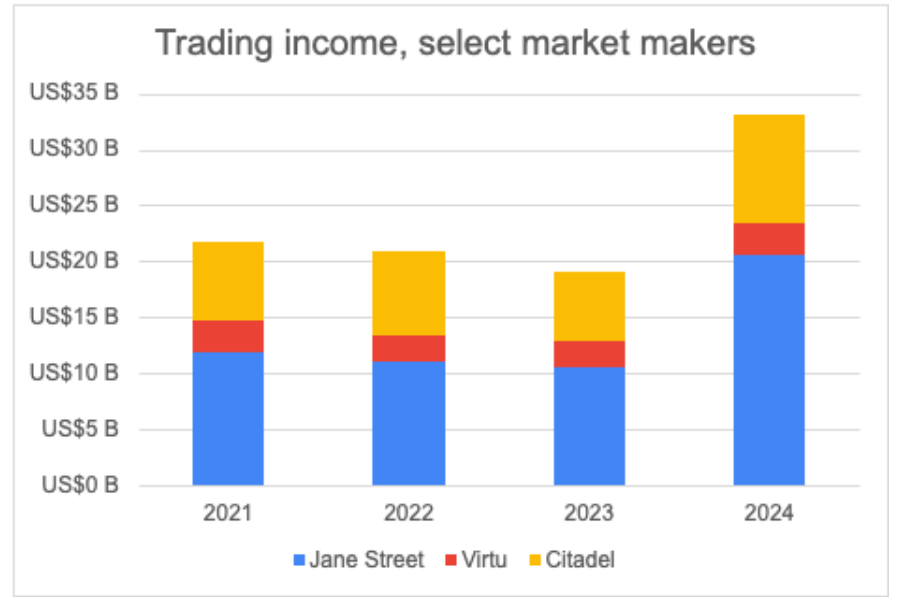

Jane Street has raced ahead of the market maker competition with 2024 net revenues, reporting US$20.5 billion for the year and taking more than 10% of North American equity market share.

By comparison, runner-up Citadel Securities reported US$9.7 billion.

According to documents seen by Global Trading, the firm averaged US$2,407 billion in global equity trading volumes each month over 2024. This represented more than 10% of the North American market, and more than 2% of market share across 18 countries.

In exchange-traded funds (ETFs), Jane Street averaged US$707 billion in trading volumes each month. It took 24% of the primary and 16% of the secondary market in US-listed funds, and 17% of secondary market activity in Europe.

Across options, Jane Street made up 8% of all Options Clearing Corporations (OCC) volumes, trading close to one billion OCC contracts.

“In addition to our market-making activity, options also play a large role in our risk management,” the firm stated. “As part of our hedging activity, we use options to hedge firmwide tail risk and to manage risk from idiosyncratic exposures across various trading strategies.”

Members’ equity volumes have exploded since 2019, ballooning from US$3.8 billion to US$29.9 billion in the last five years. As of year-end 2024, members’ equity represented 74% of Jane Street’s trading capital.

The company’s US$20.5 billion net revenues are almost double its 2023 results of US$10.6 billion, driven by record trading revenues in Q3, and then Q4, 2024. Jane Street attributes the growth to its market making transactions and positions it has acquired from other liquidity provisions.

Elsewhere in market making, Optiver took a distant third place with US$3.8 billion in trading revenues over 2024. Virtu reported US$2.9 billion, and Flow Traders US$530 million.

During an earnings call, Virtu was questioned on its competitive capabilities against Jane Street and Citadel.

“We’re frenemies, I guess,” responded CEO Douglas Cifu. “Their offering is more of a white label request-for-quote product that connects to a bank partner, and we’ll provide them with liquidity that their partner could repackage, mark up, and share with their clients.”

“[That business] can be focused on one or two larger dealers, and it’s a holistic partnership. We did that historically with the banks in New York and in FX. It doesn’t scale particularly well, and it’s very intensive. It can be very profitable. Our business is more of an agency aggregation tool for smaller regional broker dealers and asset managers and it’s got, it’s more commoditised and it scales exceptionally well. It has a larger addressable marketplace.”

Jane Street declined to comment on these figures.