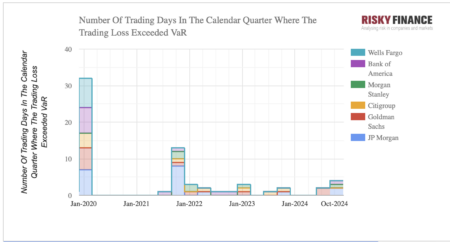

US banking giants reported four breaches of value-at-risk limits and near-breaches on two more days during the last three months of 2024, according to Global Trading analysis of Federal Reserve filings.

Chasing near-record trading revenues, the biggest US banks are increasing their risk exposures – and taking occasional hits to show for it. The worst losses were experienced by JP Morgan, which has also lagged its peers in trading revenue growth. The bank breached its regulatory VaR limit twice during Q4, with one-day trading losses of $164 million and $67 million respectively, resulting in a total trading loss of $231 million on these two days. Despite the losses, the bank reported overall trading revenues of $5 billion across equities and fixed income during the same quarter.

CFO Jeremy Barnum told analysts, ” Equities was up 22% on elevated client activity and derivatives amid increased volatility and higher trading volumes”.

Bank of America experienced a single VaR exception, which resulted in a $82 million loss according Global Trading analysis of the bank’s Federal Reserve filings. Morgan Stanley, which operates with a lower VaR limit than the other banks, also reported a single VaR breach, the result of a $55 million one day trading loss. However, the bank came within a hair’s breadth of breaching the same limit on two other days during Q4. Taken together, the bank’s total loss was $161 million over these three days.

Taken together, the losses are small compared with the $687 million trading losses suffered by Goldman Sachs on two days during the previous quarter, which reflects Goldman’s far larger risk exposures.

Goldman lost $687m on two days during August turmoil – Global Trading

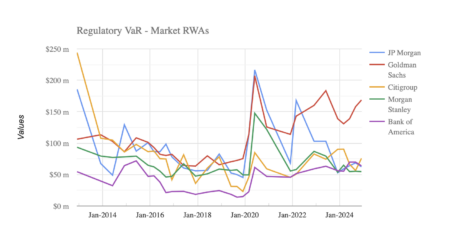

At the end of 2024, Goldman’s regulatory VaR was $168 million, compared with $64 million for JP Morgan and Bank of America, and $54 million for Morgan Stanley. Trading assets for the six largest US banks totalled $2.5 trillion in December, led by JP Morgan with $637 billion and Goldman with $579 billion.

A spokesman for JP Morgan declined to comment on the losses. A spokeswoman for Morgan Stanley also declined comment. Bank of America did not respond to a request for comment.