By Jim Kaye, Executive Director, FIX Trading Community

Artificial intelligence

It is well known that AI, though hardly new, has very much gained public attention in the last year or two. AI in various flavours has been used in trading, particularly algorithmic trading, for many years. However, the newer generative AI systems have yet to make a broad impact on trading directly. Instead, we are seeing investment in productivity tooling (e.g., morning notes, research, software) and pre-trade decision support. One point that comes up again and again is the importance of consistent and high-quality data. This is hardly a new concept, but investment in and usage of advanced AI tools with poorly understood or poorly maintained data is at best going to be a waste of money and at worst a source of risk. Having said that, AI can also help with the solution, providing the ability to spot inconsistencies in large data sets and assist with the repair. FIX has a role to play here in working with industry participants to identify these issues and propose solutions.

Operational resilience

Regulators around the world are focusing on the need to manage operational risk across the industry. Most notable, probably because of the catchy name and imminent go-live, is DORA, though the FCA’s equivalent is only two months behind it and there are similar rules in place or coming across the globe. Though this is clearly a broad area, one topic that keeps being raised is that of outage communication. This originated specifically looking at venue outages and has broadened to more general communication of incidents across all types of market infrastructure, participants and their clients. Another is algorithm testing, with regulatory focus on the need to ensure that algorithms are tested not only to ensure they don’t cause issues in markets but that they react sensibly should those issues arise through the actions of or issues at third parties (including the venues themselves).

Post-trade processing

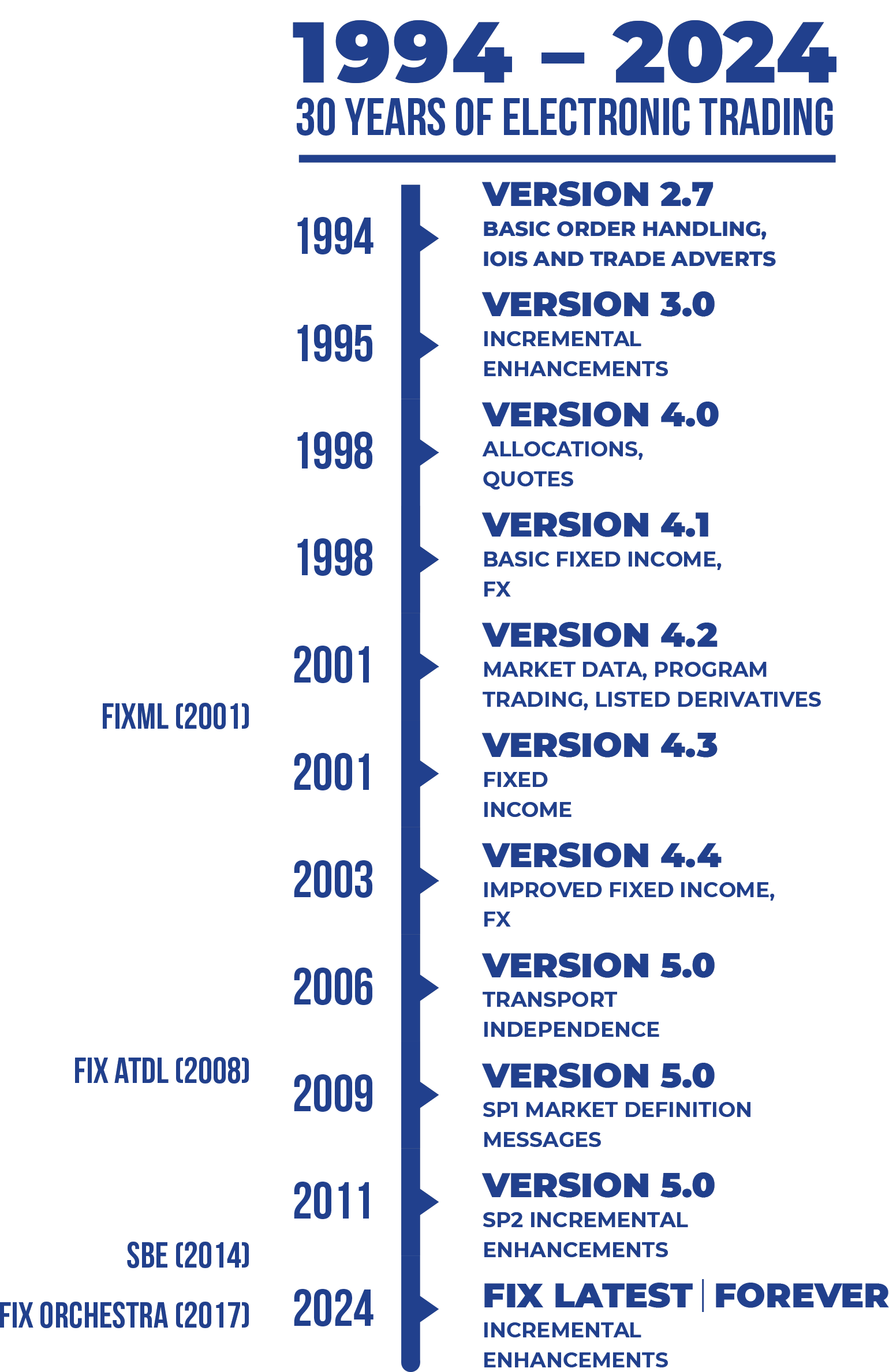

The T+1 migrations in North America are generally regarded as having proceeded smoothly, with good planning, strong regulatory leadership and an immoveable deadline being cited as key factors in its success. With the UK and, more recently, EU having announced their deadline of October 2027, there is now a target to aim for. Though there are many areas to consider from FX and funding to the complexity of Europe’s post-trade infrastructure, there are two areas where market participants can make critical improvements without significant external dependencies. One is to eliminate manual processing from middle office processes and realise a true real time middle office through electronic communication, consistent use of data and consistent workflows. The other is the electronification of securities lending, with the UK T+1 taskforce calling out loan recalls as a key focus area. FIX developed messaging for allocations, confirmations and settlement instructions over 20 years ago with the intention of eliminating emails and spreadsheets from the middle office. There is clearly a way to go, but now also a strong incentive to do so.

MiFIR and European consolidated tapes

2025 is the year European consolidated tapes move from theory to practice, with selection processes taking place during the year and the possibility of a live tape for bonds at the end of the year. Getting the data standards right, both in terms of how to move data in and out of consolidated tape providers, and what those data actually look like to end consumers, is absolutely key, particularly when considering the fact that the UK and EU tapes will be operating under slightly different transparency regimes. FIX’s work in pinning down definitions of addressable liquidity, identifying trade flag usage for various trading scenarios and clarifying reporting logic (who should report, when and why) is key to achieving the highest level of quality and maximising the benefit to the industry.

The green transition

FIX has been working with the Organization for the Advancement of Structured Information Standards (OASIS) on co-developing standards for energy trading in the US. There is a desire to move this a step further and tackle standards for trading carbon emissions and similar instruments, working with industry associations, standards bodies and practitioners in that space. Having these various asset classes as easy to trade as shares or bonds may be a way in the future, but getting the standards developed early will certainly help.

And not forgetting…

…the desire to automate primary issuance processes, supporting the development of tokenised securities, front office implications of US treasury clearing, plus the continued evolution of markets technology and services and the day-to-day innovations playing out in hundreds of financial institutions around the world.

The FIX Trading Community, through its broad, global, cross-asset membership of buy side firms, sell side firms, venues and vendors and its relationships with other industry associations and standards bodies, is actively involved in all of these areas. We are grateful to our members for the huge amount of work they have done this year and invite anybody interested in these topics to get in touch at fix@fixtrading.org to learn more and get involved.

©Markets Media Europe 2025