MIAX PEARL Equities has started trading test symbols after Members Exchange launched last week as the fifteenth US equity exchange.

Last week MIAX PEARL Equities said it has begun trading in all NMS test symbols and will launch its first symbol on September 29. The exchange will roll out additional symbols from October 2.

Today, trading began in all NMS test symbols on MIAX PEARL Equities, our first equities exchange. We are excited for MIAX PEARL Equities to officially go live and to bring innovation, choice and competition to the equities marketplace. https://t.co/5PtWzO2uJz

— MIAX Exchange Group (@MIAXexchange) September 25, 2020

The exchange is owned by Miami International Holdings, who already operate three options exchanges as part of the MIAX Exchange Group.

Thomas Gallagher, chairman and chief executive of MIH, said in a statement: “Through the outstanding work we’ve done at our options exchanges and our demonstrated ability to manage complex trading initiatives, we’ve established a level of confidence with the trading community that constitutes the bedrock for the success we anticipate in MIAX PEARL Equities.”

The MIAX equities platform will supplement its existing three US equity options exchanges which have had significant market share gains this year according to a new report from Burton-Taylor International Consulting, part of TP ICAP’s data & analytics division.

“Burton-Taylor expects MIAX PEARL Equities to become successful, with market share expected to build over time,” added the report. “MIAX does face challenges competing against 14 established equity exchanges many of which operate multiple market models, as well as the launch of MEMX which has broad support from its founding members.”

MIAX is using an equity rights program an an incentive to participate in the new exchange and participants include Citadel Securities, Hudson River Trading, Jump Trading Group, Simplex Trading, Susquehanna Securities, and UBS.

Industry-leading firms such as UBS and Citadel Securities will begin trading equities on MIAX PEARL beginning September 25. Learn more about how we’re bringing performance, transparency and risk management to the equities marketplace. https://t.co/6X5bz93NrP

— MIAX Exchange Group (@MIAXexchange) September 14, 2020

“The MIAX ERP members represent some of the largest participants in U.S. equity markets with access to retail order flow from fintech brokers like Robinhood, WeBull and Public,” added Burton Taylor.

Participants in the program have the right to invest in MIH in exchange for the prepayment of certain exchange fees and meeting certain liquidity volume thresholds on the new exchange.

“If all participants fully perform over the duration of this equity rights program, MIAX PEARL Equities’ market share from these participants would be 5.5% of average daily volume,” said MIH.

MEMX

Jonathan Kellner, chief executive of Members Exchange, said in a blog that MEMX traded more than one million shares in seven symbols from 31 different members in its first week.

After almost one week of trading, we have executed over one million shares between 31 of our members, with activity increasing each day. Our blog has an update on the week and includes our latest rollout plans:https://t.co/5TAJ3wTkaU pic.twitter.com/KtkiPh929U

— MEMX (@memxtrading) September 26, 2020

Kellner said the exchange is changing its timeline for rolling out more symbols and 12 will now be added on 29 September in order to optimize performance and ensure members are experiencing the technology in the way it was designed.

“From there we will take a methodical approach to rolling out more names with the goal of being live in all NMS names in October,” he wrote. “We want to maintain flexibility to adjust both timing and additional listed names as we go.”

Burton-Taylor said in the report that MEMX is expected to see immediate success, almost entirely on the strength of its founding members, especially Citadel and Virtu Financial, who have clearly announced their intentions to support the exchange with order flow.

”MEMX faces a number of challenges to its success including operational risk associated with launching its first trading platform built from scratch; limited experience in operating an exchange; competing against 14 established exchanges many of which operate multiple market models; and the pending launch of MIAX Pearl Equities with its low cost, technology advanced trading platform,” added the report. “ Its members also have conflicting business models that will need to be managed by MEMX management.”

Equity exchange revenue

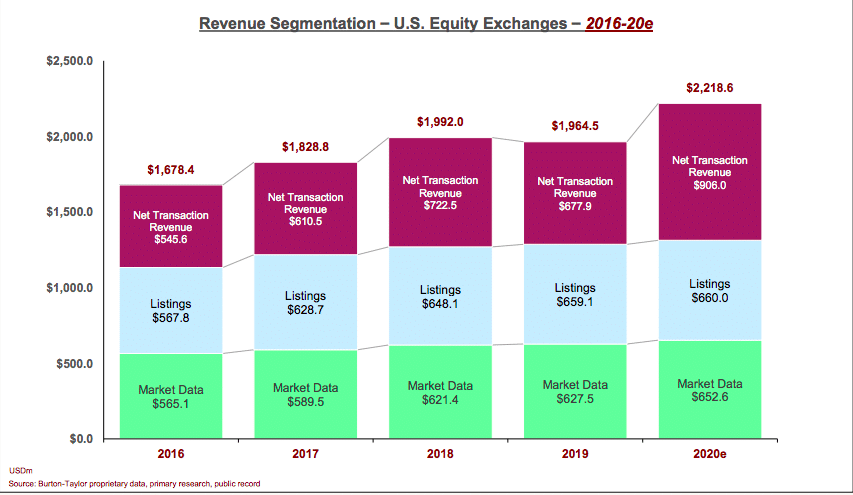

The consultancy forecast that total US equity exchange industry revenue will increase 12.9% this year to a record $2.2bn (€1.9bn) due to a surge in trading.

Andy Nybo, managing director at Burton-Taylor, said in a statement: “Although incumbent exchanges are well-positioned to fend off competitive threats posed by these new entrants, the new exchanges will have a considerable impact on equity market structure resulting in shifting market shares, greater structural complexity, and changes in industry governance practices.”