CEO Adena Friedman said a lack of regulatory clarity was a factor in not launching Nasdaq Digital Assets.

Adena Friedman, chair and chief executive of Nasdaq, said the group has decided to halt the launch of Nasdaq Digital Assets, which aimed to start with providing custody.

Friedman said on the second quarter results call on 19 July: “We have made the decision to halt our launch of the US digital assets custodian business and our related efforts to pursue a relevant licence.”

However, she said Nasdaq will continue to build and deliver technology capabilities that position the group as a leading digital assets software solutions provider.

“More broadly, we remain committed to supporting the evolution of the digital assets ecosystem in a variety of ways including our ongoing engagement with regulators, the delivery of comprehensive technology solutions across the trade lifecycle and our partnerships with potential bitcoin ETF issuers to support tradable exchange-listed products,” Friedman added.

The group had announced the launch of the digital asset business in September 2022. Nasdaq Digital Assets aimed to initially develop custody which would bring together hot and cold crypto wallets through an innovative technology offering, subject to regulatory approval in applicable jurisdictions.

Nasdaq had decided to start with custody because it is a foundational layer for cryptocurrencies, NFTs [non-fungible tokens] or other digital assets. The business was led by Ira Auerbach who joined from crypto firm Gemini, where he had been global head of Gemini Prime, and Nasdaq had recruited digital-native talent to support the project alongside the existing market technology team.

Friedman explained that Nasdaq is halting efforts to become a US digital assets custodian because it prefers to operate in environments with a well-known regulatory underpinning.

“The fundamental business opportunity changed over the last several months, and the regulatory overhang made us decide that it is not the right time for us to enter that business,” she added.

Adenza

On the results call Friedman defended the $10.5bn acquisition of Adenza which was announced on 12 June, but led to a fall in the group’s share price. She described the planned acquisition as a “seminal step” in Nasdaq’s journey to becoming a leading technology provider to the global financial system.

Adenza provides capital markets risk and regulatory technology through two software platforms – Calypso’s front-to-back suite of capital markets risk management, treasury, cash, collateral management, and post-trade solutions; and AxiomSL’s regulatory reporting, global shareholder disclosure, capital and liquidity management, transaction and ESG reporting solutions.

Friedman said that as the financial industry faces a steady stream of new regulations and reforms, Nasdaq is positioned to be a key partner in helping participants manage those risks.

“Most notably, we will enable our clients to meet regulatory mandates to reduce financial crime, manage liquidity risk, and provide resilient capital markets infrastructure, all while reporting on their compliance to over 100 regulators and agencies around the world,” she dded. “The addition of Adenza’s capabilities to the Nasdaq platform will increase our serviceable addressable market market by approximately 40%.”

Secular growth drivers are regulatory and market reforms, digitization and modernization, and vendor simplification as financial institutions move from in-house to trusted-partner solutions.

In the first half of this year Adenza maintained a strong annualised recurring revenue growth in the high teens as compared to the prior-year period, which was underpinned by continued strength in gross and net revenue retention at 98% and 115%, respectively according to Friedman.

Friedman argued that Nasdaq is making a long-term conviction decision to grow and expand its platform to be able to serve financial institutions more holistically.

However, Adenza is a private company so there was a lot for investors to learn and Nasdaq is also making a big capital allocation decision.

“We’re trying to make sure that we continue the educational journey with investors and we’ve provided a supplement today that hopefully gives a little bit more colour on the depth of the clientele the nature of the products and we look together,” she said. “Over time we feel very confident that we will be able to demonstrate to both clients and shareholders that this is a great business to have within Nasdaq.”

To finance the Adenza acquisition Nasdaq has secured approximately $5bn in financing through a debt offering. Nasdaq issued $4.25bn in US dollar denominated debt across 2, 5,10, 30 and 40-year terms and a €750m denominated 8-year bond with a weighted average interest rate of just under 5.5%.

Ann Dennison, chef financial officer, said on results call: “As we embark on our integration planning with Adenza team, we remain confident in our ability to deliver on $80m in net cost synergies by the end of the year after closing.”

Once the acquisition closes, Friedman said Nasdaq will focus on maximizing client and shareholder benefits. Capital allocation priorities over the next three years will be to meet the debt targets disclosed in the deal announcement; to increase dividends and to buy back stock.

“We do not anticipate making any significant acquisitions that would deter us from executing sizeable stock buybacks over the next three years,” she added.

The acquisition is expected to close in five to eight months, subject to regulatory approval and customary closing conditions.

Divestitures

In the second quarter Nasdaq announced its plan to sell its European energy trading and clearing business which Friedman said aligns with Nasdaq’s renewed focus towards investing in opportunities that deliver the most value to clients and shareholders.

The sale is expected to close in the first half of 2024, upon completion of outstanding closing conditions. The transfer of membership interests will occur shortly afterwards. An analyst questioned whether Nasdaq could sell other parts of its European business, such as the Nordic and Baltic exchanges.

Friedman said: “Our European trading and markets business is an integral and strategic part of who we are.The Nordic markets are, in my opinion, the shining star of Europe and and they’ve got great retail participation.”

She continued that team in Europe sits next to the market technology team, and their expertise is often deployed in other markets around the world such as for surveillance and market structure.

“Europe has obviously been a leader in ESG and brought that culture into Nasdaq and helped us design products that we now provide to our corporates,” she added. “ We also have Puro.earth, a carbon removal marketplace, that helps corporates meet their net zero commitments.”

Nasdaq has also been on a very specific path to integrate technologies so they are more consistent between the US and the European markets, especially thorough its Fusion platform.

“Over time we are going to be able to demonstrate even more scalability across our markets business as we continue to expand that technology,” she added. “As you can tell, Europe is big part of who we are and we are really proud and pleased to be integrated into the Nordic businesses and markets.”

Financials

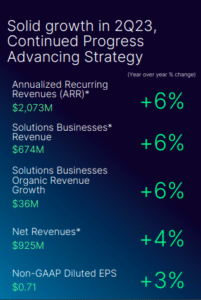

In the second quarter net revenues increased 4% to $925m from the same period in 2022.

Trading Services net revenues were $250m in the second quarter of this year, a decrease of 1% from a year ago, which Nasdaq said reflects flat organic growth and a $2 million negative impact from changes in FX rates.

Anti-Financial Crime revenue increased 19% compared from the second quarter of 2022 as large financial institutions are accelerating their adoption of Verafin’s fraud detection and anti-money laundering solutions, according to Nasdaq.

Dennison said: “Our solid financial performance in the second quarter reflects the durability and recurring nature of our business and the resilient demand for our diversified set of client solutions. Our consistent cash flow generation makes Nasdaq well positioned to execute our deleveraging plan while making focused, organic investments that advance our strategy, while executing our dividend growth and share repurchase strategies.”

Nasdaq also highlighted that Chile’s central securities depository, Depósito Central de Valores (DCV), has launched Nasdaq Central Security Depository platform for issuing and settling digital securities.

In addition Nasdaq signed a 10-plus year partnership with Brazil’s largest stock exchange, Brasil, Bolsa, Balcão (B3), to build a next generation clearing solution under which B3 will migrate to Nasdaq’s real-time clearing platform and work as a product roadmap development partner.

Friedman also said Nasdaq executed the second-highest ever one-day Closing Cross volume in June during the annual Russell U.S. indexes reconstitution. The exchange executed approximately 2.6 billion shares representing $62bn in market value in 0.86 seconds across Nasdaq-listed securities.