Artificial intelligence is one of four enterprise priorities in 2024.

Nasdaq will roll out Dynamic M-ELO, its first order type driven by artificial intelligence in the first quarter of this year, as AI is one of four enterprise priorities in 2024.

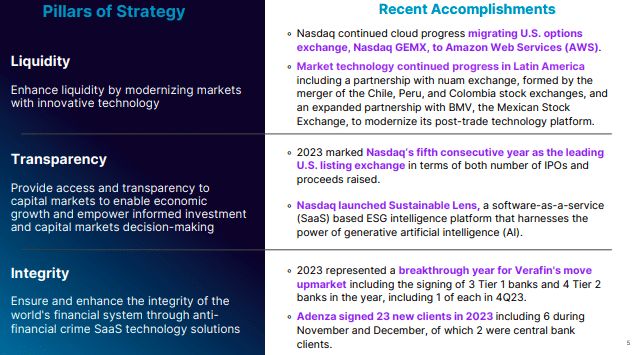

Adena Friedman, chair and chief executive of Nasdaq, said on the 2023 results call on 31 January that the group had continued to contribute to the modernization of markets last year.

“We moved our second US options exchange to AWS and our first AI-driven order type, Dynamic M-ELO, will be rolled out in the first quarter,” she said.

Nasdaq successfully completed the migration of the core trading system of Nasdaq GEMX, one of Nasdaq’s six options exchanges, to Amazon Web Services (AWS) in November last year.

The new cloud-enabled market infrastructure delivers up to a 10% improvement in latency and the ability to more seamlessly adjust capacity in response to changing market conditions according to Nasdaq. GEMX processes 12 billion in daily messaging, 71% higher daily message volume than the MRX Options Exchange, which migrated to AWS in December 2022. Nasdaq Bond Exchange (NBE) also moved to AWS in 2022.

Dynamic M-ELO

The US Securities and Exchange Commission approved Dynamic Midpoint Extended Life Order (M-ELO) in September last year.

Nasdaq has offered a midpoint extended life order (MELO) order type for several years. MELO introduced a fixed holding period to gather order interest before application for clients seeking larger trade sizes at the midpoint. After extensive testing and consultation, Nasdaq found trade execution could be improved under certain market conditions by applying adaptable holding periods.

Therefore, Dynamic MELO uses AI to adjust the length of holding periods throughout the trading day on a stock-by-stock basis to improve fill rates and reduce market friction. Nasdaq has said that in testing Dynamic M-ELO has achieved an improvement of more than 30% in average combined volume-weighted order fill rates.

“We will further amplify the impact that AI has on the business and in our products,” said Friedman. “Our focus on AI coupled with our vast product proprietary data sets that we have created over decades, and our solutions covering investment analytics, investor relations and anti-financial crime, means we are confident that we can extend competitive advantage in the years ahead.”

Adenza integration

On 1 November last year Nasdaq completed the $10.5bn acquisition of Adenza from software investment firm, Thoma Bravo. Friedman said the firm immediately combined the teams to create the operating model going forward.

“We were pleased to complete the Adenza acquisition and we are now working as one team to further our clients goals for risk management and regulatory reporting excellence,” she added. “With the establishment of our divisional structure and the Adenza acquisition, 2023 was a transformational year for our business. ”

Adenza provides capital markets risk and regulatory technology through two software platforms – Calypso’s front-to-back suite of capital markets risk management, treasury, cash, collateral management, and post-trade solutions; and AxiomSL’s regulatory reporting, global shareholder disclosure, capital and liquidity management, transaction and ESG reporting solutions.

Nasdaq said Adenza continued new client wins and cloud progress by adding six new clients in November and December, including two new central banks.

In total, Adenza won 23 new clients in 2023, up from 17 in the prior year, which Nasdaq said highlighted continued demand for mission-critical products in a dynamic market environment.

Overall, cloud represented nearly 50% of new annual contract value in the year, which Friedman said underscores the ongoing cloud progress at Adenza which Nasdaq aims to bolster and accelerate.

Nasdaq also launched a new cloud-based architecture and capabilities in its surveillance business. Friedman said 50% of Nasdaq trade surveillance clients are now using cloud deployed solutions, which support access to 200 sophisticated alerts across more than 160 markets globally.

“With the completion of our Adenza acquisition, we have created a financial technology powerhouse of anti-financial crime, surveillance, market technology, and risk and regulatory reporting solutions which positions us as a key risk management partner to the global financial system,” she added.

Tal Cohen, co-president of Nasdaq, and Friedman have been visiting clients over the past few months, and she said there is a lot of excitement around potential opportunities now that Adenza is part of Nasdaq.

Friedman continued that Nasdaq’s first priority is to continue the successful integration of Adenza and the firm is confident of delivering on the goals that were laid out when the deal was announced last June.

The second priority is to accelerate the impact of the divisional structure to activate and unlock new opportunities.

In 2024 Nasdaq also has a focus programme to organise client data, advance its customer relationship management systems and enhance processes across the group to gain a holistic understanding of clients and drive partnerships and cross-selling opportunities.

Digital assets

On Nasdaq’s second quarter results call in July last year, Friedman said the group had decided to halt the launch of Nasdaq Digital Assets, which aimed to start with providing custody. On today’s call Friedman continued that the group made a conscious choice not to become a custodian because there are several competing businesses who are doing well, and because it is a very capital intensive business.

However, the technology has been built, and Nasdaq can offer it to clients around the world.

“In our view, we are better served being a market operator for digital assets and being a technology provider to that industry,” Friedman added.

Nasdaq will continue to provide technology to cryptocurrency exchanges for trading clearing, and surveillance and also to traditional financial market infrastructures who want to enter the digital asset space. For example, a central security depository client wants to make sure that it can include digital assets on its settlement system.

In addition, BlackRock’s spot bitcoin ETF is listed on Nasdaq.

“We are really proud to partner with BlackRock as the ETF gives investors an opportunity to express a view on bitcoin in a highly regulated marketplace and without having to actually buy bitcoin,” Friedman added. “I think it creates more accessibility for retail investors.”

Financials

The earnings call was the first for the new chief financial officer, Sarah Youngwood. She said: “In an uncertain environment, we delivered solid financial performance and strong cash flow generation.”

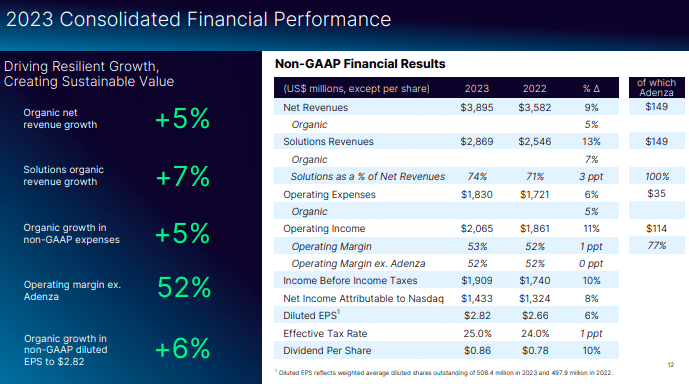

Friedman said that in the fourth quarter, Nasdaq crossed the $1bn mark for net revenue for the first time in a single quarter. Revenue of $1.1bn in the fourth quarter was an increase of 23% over the final quarter of 2022 and an increase of 7% organically.

Total net revenue for 2023 was $3.9bn, an increase of 9% over 2022 and 5% organically. The revenue included $149m from Adenza,.

The index segment generated $31bn in exchange-traded product net inflows during 2023, including $10bn dollars in the fourth quarter. At the end of 2023, Nasdaq indices had $473bn in assets under management as clients also launched 83 new ETPs.

“We have seen a continued increase in proprietary data revenues, driven largely by higher international demand,” Youngwood added.

The anti-financial crime business reached a significant milestone in 2023 according to Friedman, by signing its first three tier one banks, and four tier two banks. In total, Verafin gained 237 new clients in 2023, with 100 in the fourth quarter alone.

In addition, Nasdaq has developed its first AI tools for Verafin to reduce time and resources spent on manual tasks and processes to increase operational efficiency for clients.

In cash equities, Nasdaq had a 72% market share in the Nordics.

“At the beginning of May, we leveraged our technology and data to provide European markets clients with transparency to help them generate alpha,” added Youngwood. “This enabled us to help our clients improve execution quality and has been key to our ability to reclaim our 72% market share, a 2% increase.”

In addition, Nasdaq continued to demonstrate a leading market position in the US equities and options markets according to Friedman. She added: “Market volumes are off to a solid start in 2024 and interest in the suite of technology solutions remains very strong.”

Youngwood continued that Nasdaq is cautiously optimistic that there could be a recovery in initial public offerings this year.