Aim is to improve fill rates and reduce market friction in exchange trading.

The US Securities and Exchange Commission has approved Nasdaq’s first order type driven by artificial intelligence, Dynamic M-ELO, which the group is preparing to roll out over the next few months.

Adena Friedman, chair and chief executive of Nasdaq, said on the third quarter results call on 18 October that the firm has continued its innovation in AI and received regulatory approval in September to launch Dynamic Midpoint Extended Life Order (M-ELO).

Friedman said that one of the three key trends that Nasdaq is capitalising on is the market modernization, especially through innovation and the firm’s ability to adopt and leverage technologies including cloud and artificial intelligence across markets and products.

For the last several years, Nasdaq has offered a midpoint extended life order (MELO) order type for clients seeking larger trade sizes at the midpoint which introduced a fixed holding period to gather order interest before application. After extensive testing and consultation, Nasdaq found trade execution could be improved under certain market conditions by applying adaptable holding periods. This led to the creation of Dynamic MELO which uses AI to adjust the length of holding periods throughout the trading day on a stock-by-stock basis to improve fill rates and reduce market friction.

In testing Dynamic M-ELO has achieved more than a 30% improvement in average combined volume-weighted order fill rates according to Nasdaq.

“We are very excited to roll out this enhanced prototype to our clients in the coming months,” said Friedman. “We see significant opportunities ahead to drive the application of AI and other emerging technologies across our markets.”

For example in October, Nasdaq launched a test version of an anti-money laundering tool that will use AI to automate portions of clients’ anti-money laundering money processes.

Adenza acquisition

Friedman said the $10.5bn acquisition of Adenza, which was announced on 12 June, is progressing well towards closing in the fourth quarter of this year. The anti-trust review has been completed and the seller, private equity firm Thoma Bravo, is on track to obtain remaining approvals from the Nordic and Baltic financial regulators to become a major shareholder in Nasdaq.

Adenza provides capital markets risk and regulatory technology through two software platforms – Calypso’s front-to-back suite of capital markets risk management, treasury, cash, collateral management, and post-trade solutions; and AxiomSL’s regulatory reporting, global shareholder disclosure, capital and liquidity management, transaction and ESG reporting solutions.

“Since the transaction was announced, we’ve held extensive integration and planning discussions with the leadership team in Adenza and we’re very excited about the opportunities ahead,” added Friedman. “As a result of our early interactions we have developed a very clear path and process for integration that we intend to execute successfully, starting on day one post-close.”

In the first nine months of this year Adenza has signed 17 new clients. Friedman highlighted that more than half, 55%, of sales have been for cloud delivery solutions, compared to 27% over the same period in 2022, as cloud solutions are modern, modular and more flexible.

“Banks are more ready to accept cloud delivery solutions and we have seen that across all of our solutions at Nasdaq,” she added. “They are just more ready to have cloud be a big part of their infrastructure and some banks are purposely trying to move out their data centres.”

Nasdaq also sees the benefit of cloud in its own infrastructure, especially through its relationship with AWS.

“I think the expertise we have in creating very efficient cloud infrastructure, particularly from a data ingress and egress perspective, is going to be very helpful,” said Friedman.

Listings

Friedman said there was modestly improving momentum in Nasdaq’s listings business and a gradual reemergence of the US initial public offerings despite increasing equity market volatility and rising long term interest rates.

She added: “35 operating companies chose to list on Nasdaq during the quarter and based on our client conversations in our growing IPO pipeline, we remain cautiously optimistic on the outlook for the upcoming year.”

The majority of the pipeline is looking to come to the market in the first half of next year rather than in the fourth quarter of this year.

Financial results

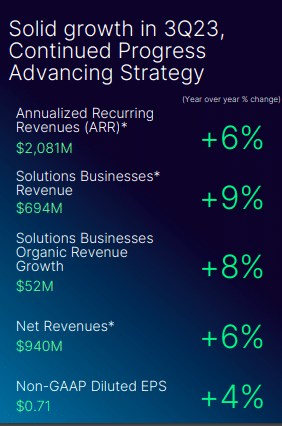

In the third quarter Nasdaq reported $940m in net revenues, an increase of 6% compared to the prior-year period and an increase of 5% on an organic basis.

Friedman highlighted that index revenues grew 15% from the prior year period, which reflected strong year-over-year market performance with $24bn in net inflows over the past 12 months, including $5bn in the third quarter.

Nasdaq said it achieved a new record for third quarter US cash equities closing cross volumes, US cash equities revenue and revenue capture. Closing cross volumes in the third quarter included a special rebalance of Nasdaq-100 that had approximately 500 million shares and $70bn notional traded.

CFO transition

In August Nasdaq announced the appointment of Sarah Youngwood as chief financial officer, effective 1 December 2023. She will succeed Ann Dennison, who has held the role since 2021 and will remain at the company until the end of the year to ensure an orderly transition.

Friedman said: “I would like to take a moment to acknowledge Ann Dennison after eight years at Nasdaq. She has been a guiding voice to the market on our financial performance, a leader in enhancing our Investor Relations and ESG reporting efforts and a steward to our company’s transformation.”

Youngblood will join from UBS group where she was a chief financial officer and a group executive board member, and held a key role in modernizing the bank’s infrastructure and the acquisition of Credit Suisse. Prior to UBS, Youngwood spent more than two decades at JPMorgan Chase in a number of executive roles.

Dennison said on the results call: “We delivered broad-based revenue growth in the third quarter and had particularly strong performance in our index and anti-financial crime businesses. With our continued strong cash flows, we are fully prepared to execute our capital plan to pay down debt, continue to increase our dividend, and repurchase shares in the coming quarters to achieve our financial goals with the announced Adenza acquisition.”