Trading across asset classes and regions requires resources that managers may not have in-house.

Outsourced trading began as a move to cut costs but is increasingly being used by asset managers to expand into new asset classes and geographies.

Stephanie Farrell, head of integrated trading solutions at Northern Trust, described outsourced trading as a “really exciting” story since the firm formalized its offering in 2017. She said the increase in outsourced trading started as a cost efficiency as margins compressed and fund managers turned to providers that could help alleviate some of those costs, which was coupled with regulatory change, such as MiFID II in Europe.

However the recent spikes in volatility and changes in the macroeconomic environment, with rising inflation and in interest rates, has led to fund managers changing their investment strategies and, therefore, how they trade.

Stephanie Farrell, Northern Trust

Stephanie Farrell, Northern Trust

“Increased volatility is synonymous with uncertainty so managers need an outsourcing partner with a broader set of tools and more access to liquidity,” added Farrell. “We are having some dynamic front office conversations with our clients as they make shifts in their investment process.”

In addition, portfolios are increasing allocations to fixed income and clients may not have that expertise in-house, so they turn to outsourcing. Farrell said: “On the consulting side we are sitting around the table, seeing where the challenges are and designing an execution plan for those managers which takes the relationship to another level,”

Trading in-house across multiple asset classes and regions requires a deep breadth of expertise. Northern Trust, for example, has global trading capabilities for equity, fixed income, derivatives and listed options, and ETFs. Outsourced foreign exchange is also in demand.

Farrell said: “Outsourced trading has shifted from a purely defensive play into an offensive move that allows firms to grow.”

Increased competition

The buy side has become increasingly comfortable with outsourced trading and the number of outsourced trading providers increased from nine in 2018 to more than 40 in 2022, according to consultancy Coalition Greenwich.

“Outsourced trading has grown from something of a niche offering in the market to one of its mainstays,” Coalition Greenwich stated in a July 2022 report. “Moreover, as large firms (as well as small) continue to expand their use of supplemental trading with outsourced firms, there will be an ongoing institutionalization of the space, providing more avenues and opportunities for expansion.”

In January this year BNY Mellon announced a new outsourced trading offering for buy-side institutions globally. The offering from BNY Mellon Capital Markets will be powered by xBK, the buy-side trading division that executes more than $1 trillion in volumes on average annually for the company’s investment management franchise.

Subsequently, in March, State Street announced the acquisition of CF Global Trading, which specializes in outsourced trading on an agency basis across asset classes. State Street said the deal will expand its current outsourced trading services to new clients and enable it to offer a complete global trading solution. Farrell said the competitive landscape is blossoming which shows outsourced trading is the next evolution in the industry, and an optimization play for fund managers.

“It has been really interesting to see the evolution of outsourced trading which we welcome,” she said.

Differentiation

Farrell argued that one of Northern Trust’s differentiators is that the ability to interface directly with custodians is a huge benefit for clients as building a 24×6 global operating structure in house is not achievable for most asset managers.

“Our settlement process also covers FX and, as a result, a lot of our US clients have turned to us for that global coverage, which has become a big driver,” she said.

Northern Trust can also provide an enhanced toolset, according to Farrell, by adding the settlement component which is very valuable for clients through alleviating operational risk; adding transaction cost analysis (TCA); commission management and regulatory reporting. The settlement component will become even more important when the US reduces its settlement cycle for securities.

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, by one day to T+1 with a planned implementation date of 28 May 2024. T+1 will be a big toll on internal infrastructure in terms of people, processes and technology and there will absolutely be a rise in middle office outsourcing and settlement providers according to Farrell.

“There will be a real need to have a 24×6 settlement process and our outsourced trading solution is uniquely coupled with trade communication and settlement,” she added. “As soon as a trade is complete we can send that to a custodian and start the straight-through settlement process.”

Growth

Northern Trust Capital Markets said in March this year that growth in its Integrated Trading Solutions business more than doubled over the past three years, including adding 22 new clients in 2022. The firm has more than 90 Integrated Trading Solutions clients across the globe.

Glenn Poulter, global head of brokerage at Northern Trust, said in a statement: “Achieving alpha is more difficult than ever before, and by outsourcing their trading function, clients can focus on investment decisions that deliver meaningful results.”

Farrell continued Northern Trust can take a holistic view and help clients move into a future state while they redeploy their resources to focus on generating alpha. She added: “This has allowed us to establish deep, integrated relationships across that full trade lifecycle, and become an extension of the investment process.”

She is “very optimistic” on future growth due to the number of conversations the firm is having with investment managers of all shapes and sizes, and because increasingly larger fund managers are looking at certain components of the business.

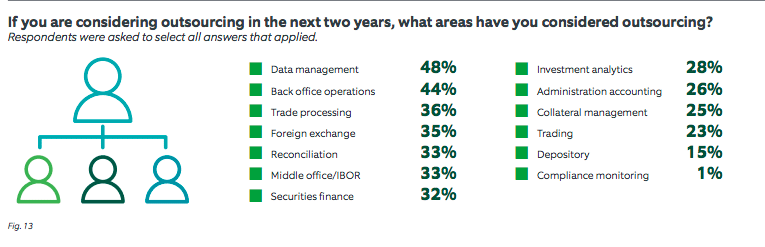

A survey last year, conducted for Northern Trust by WBR Insights, found that the new way of hybrid working following the global pandemic has influenced investment managers’ views about outsourcing.

Respondents said the remote work environment (60%), cost of maintaining in-house capabilities (52%) and staffing challenges (51%) have increased their likelihood to outsource.

They were also looking at outsourcing across a wide range of capabilities from back office operations (44%) to trading (23%).