By Lucy Carter

By Lucy Carter

Imagine for a moment that there was a single equities exchange in Europe. It would list stocks with a total market cap of €20 trillion, and have a daily average notional volume of €27 billion. Such a UK-EU champion would be a strong competitor to Nasdaq’s total listed market cap of €24 trillion, or NYSE’s daily closing auction volume of €17 billion.

Now, wake up from that dream and face reality, where European markets are a multi-headed beast fraught with fragmentation. Global Trading’s inaugural European exchanges survey shone a light on this problem.

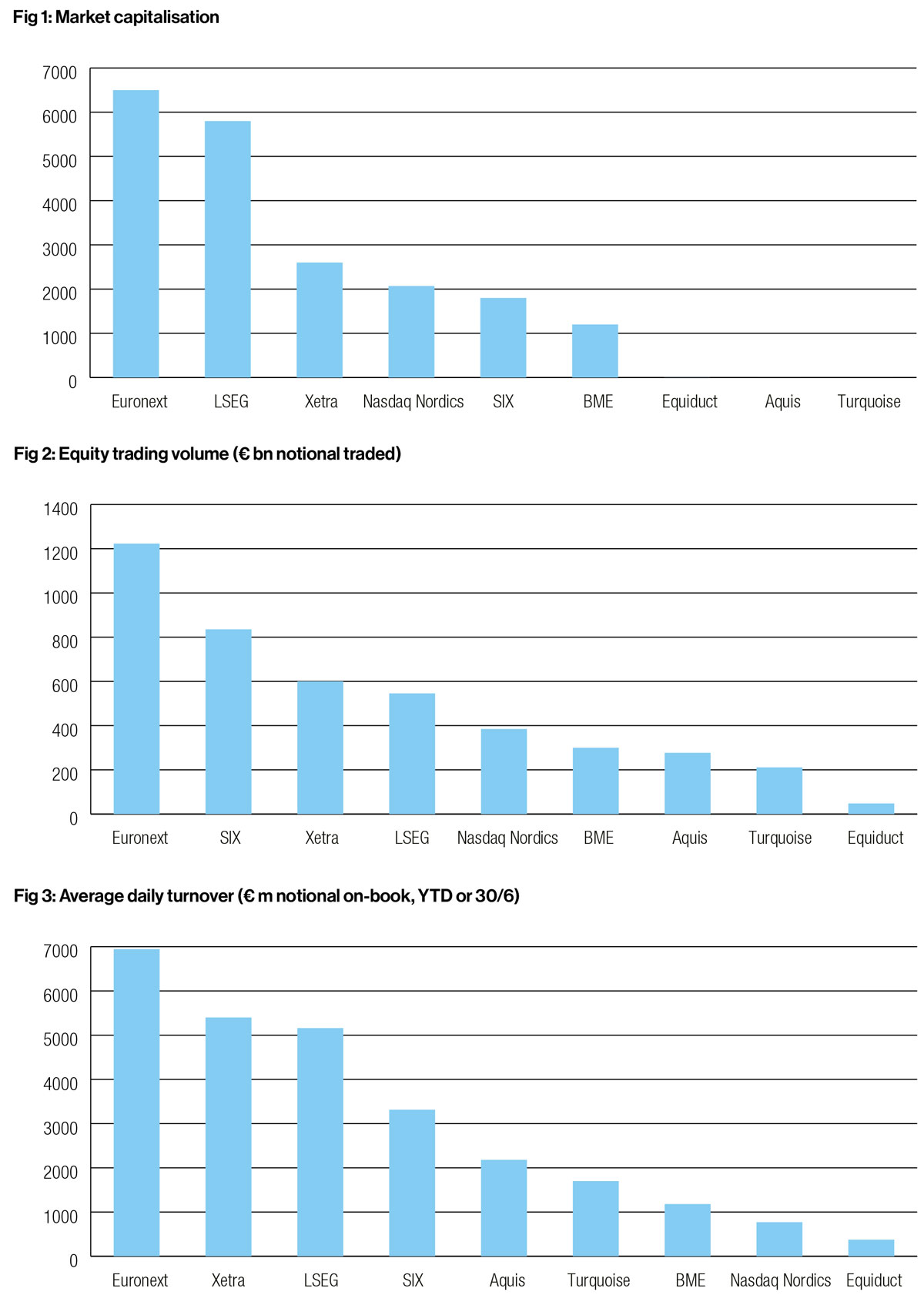

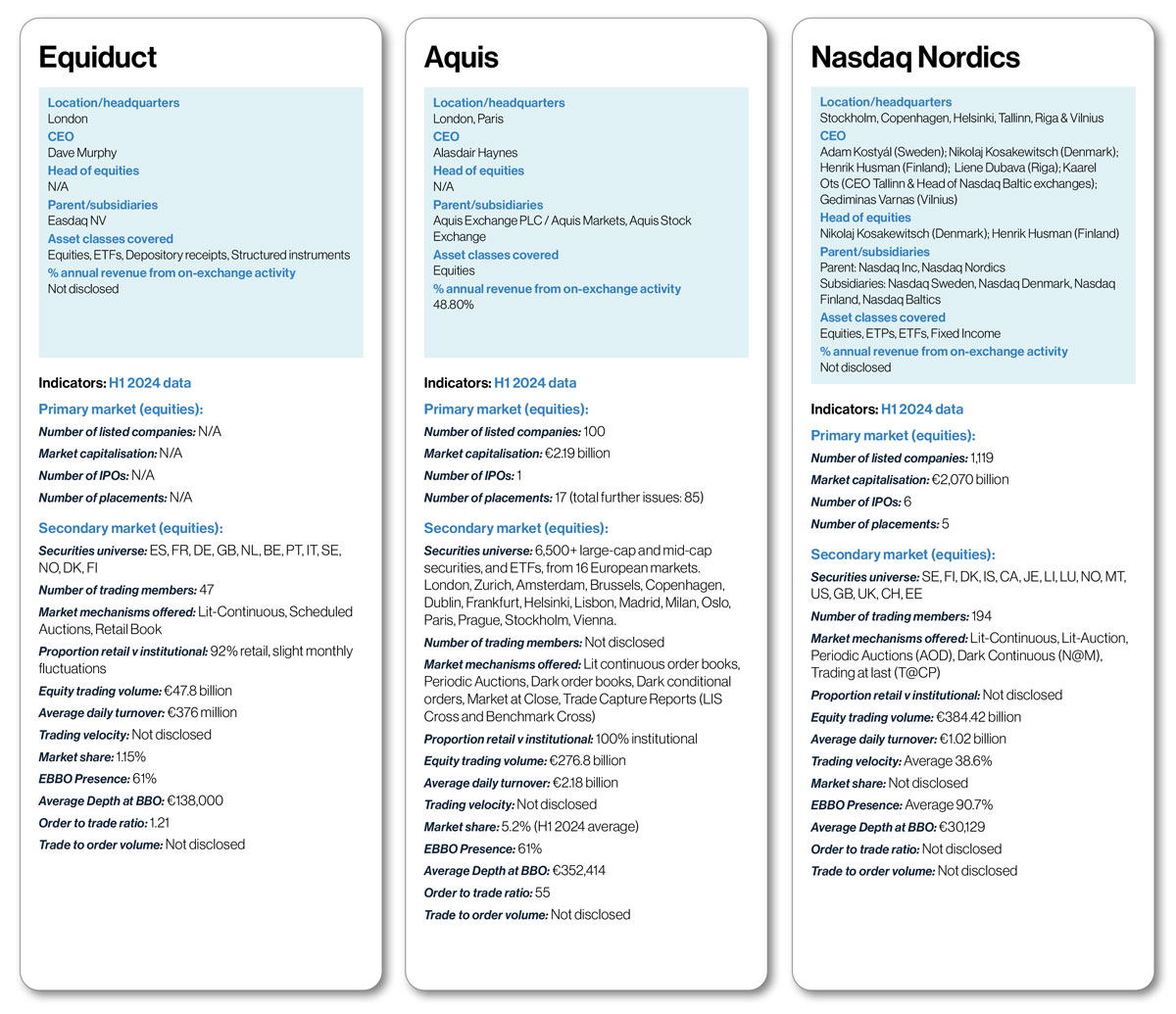

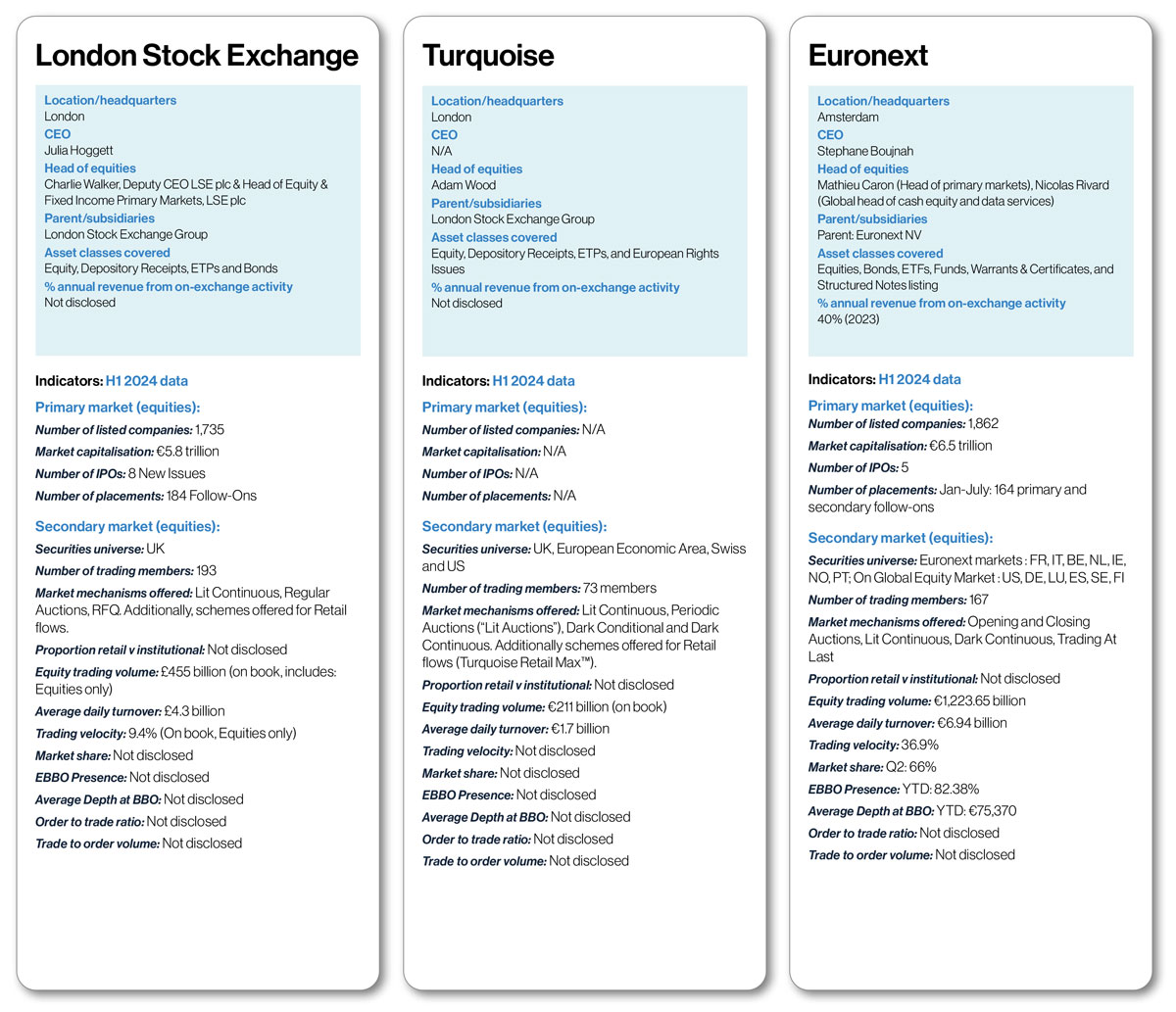

As can be seen in the results below, many exchanges offer the same securities and services, and market share is split across not only the nine entities who took part in the survey but the 20-plus (per the FESE European Equity Market Report) that operate across the continent. The information gathered here draws attention to the strength the region could have with greater consolidation; Euronext’s dominance across the board makes this abundantly clear.

The firm reported the greatest market capitalisation of the group (€6.5 trillion), with the only exchange in a similar ballpark being LSE with a €5.8 trillion market cap. Euronext consistently outperformed other exchanges in the handbook – unsurprising, given its presence across seven European markets and the 1862 companies listed on its exchanges.

LSE, however, fell down the league tables when it came to equity trading volumes. Surpassed by Euronext, SIX and Xetra, despite dwarfing the latter two in terms of market capitalisation, the London exchange’s volumes are particularly low – just 9% of its market capitalisation (€545.8 billion notional traded) in H124. By contrast, Euronext’s volumes constituted 18% of its market cap, and Xetra 23%. The exchange with the greatest volumes relative to its market cap was SIX at 46%, by far the highest proportion of those taking part in the survey.

The second tranche of exchanges, in terms of market capitalisation, was led by Xetra at €2.6 trillion. Nasdaq Nordics, comprising the Swedish, Danish, and Finnish exchanges, followed with a €2 trillion market cap, while SIX and BME reported €1.8 trillion and €1.2 trillion respectively.

Alongside its strength in equity trading volumes, Xetra put up a fight in terms of average daily turnover. Cementing it as a key player, the exchange reported ADV of €5.4 billion in H124 – surpassing runner-up LSE’s €4.3 billion. SIX also performed well here, recording ADV of €3.3 billion in the first six months of the year. Breaking from the hierarchy seen in other areas of the study, Aquis’s €2.1 billion ADV put it on the map in this category.

The survey’s results highlight just how disjointed European equity markets are. Combined, Europe has the potential to rival some of the world’s largest and most powerful exchanges – but as it stands, the disparate nature of the region means that its wings are clipped. Euronext’s success illustrates how consolidation can drive growth, but with liquidity concerns growing across the continent, it’s clear that the problem is far from resolved.

By Lucy Carter

By Lucy Carter