Traders prioritise O/EMS analytics as liquidity dries up

OMS/EMS stacks need to help traders assess trading conditions in 2022.

The DESK’s research into buy-side execution and order management systems (O/EMS) for fixed income markets has found evidence that more integrated trading workflows are the priority for traders. This stands on several points. We found that traders are prioritising analytics, both pre- and post-trade, in the O/EMS more than they did in previous years; they are looking for better primary markets integration, and better integration between EMS and OMS.

Bond markets in 2022 have been characterised by illiquidity, triggered by reduced market-making activity, less accurate on-screen pricing and directional market activity. The response based on anecdotal evidence has been an increased reliance on non-traditional execution routes as well as a doubling down on strong dealer relationships.

With far higher pressure on secondary market trading efficiency, it is natural that traders need greater workflow integration.

Improvements traders want in their O/EMS

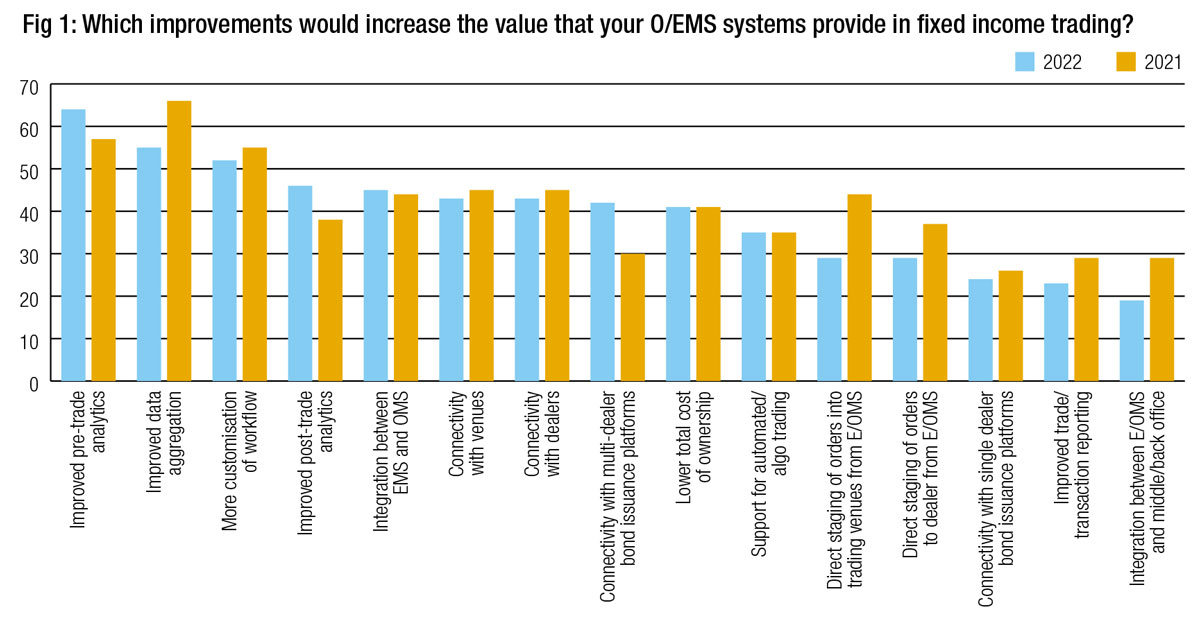

Better data aggregation and pre-trade analytics are still the two most important improvements demanded in O/EMS technology (Fig 1), but pre-trade analytics now takes top place with the first big change.

The second big change this year is that post-trade analytics has been reprioritised, moving to fourth place in the priority list up from ninth in 2021. With the shift of pre-trade analytics to the top spot, this indicates a refocussing on delivering useful output for traders.

The third and proportionally largest change is the increased importance of O/EMS with bond issuance platforms. This has been hinted at by Bloomberg, which made an important step towards primary market efficiency earlier this year when it allowed issued securities data to be brought into trading workflows more easily. It has also been a top priority for Liquidnet’s primary markets tool.

Another change has been the prioritisation of integration between EMS and OMS, now in fifth position, over connectivity with dealers and venues, the sixth and seventh slots respectively.

Division of labour between EMS and OMS

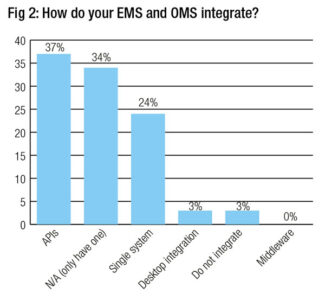

The differences between OMS and EMS tools are often said to be blending. As 24% of respondents only have a single system performing both functions (Fig 2), and 34% report only having an OMS or EMS, rather than both, some caution is needed when breaking out functionality by the type of system used.

The differences between OMS and EMS tools are often said to be blending. As 24% of respondents only have a single system performing both functions (Fig 2), and 34% report only having an OMS or EMS, rather than both, some caution is needed when breaking out functionality by the type of system used.

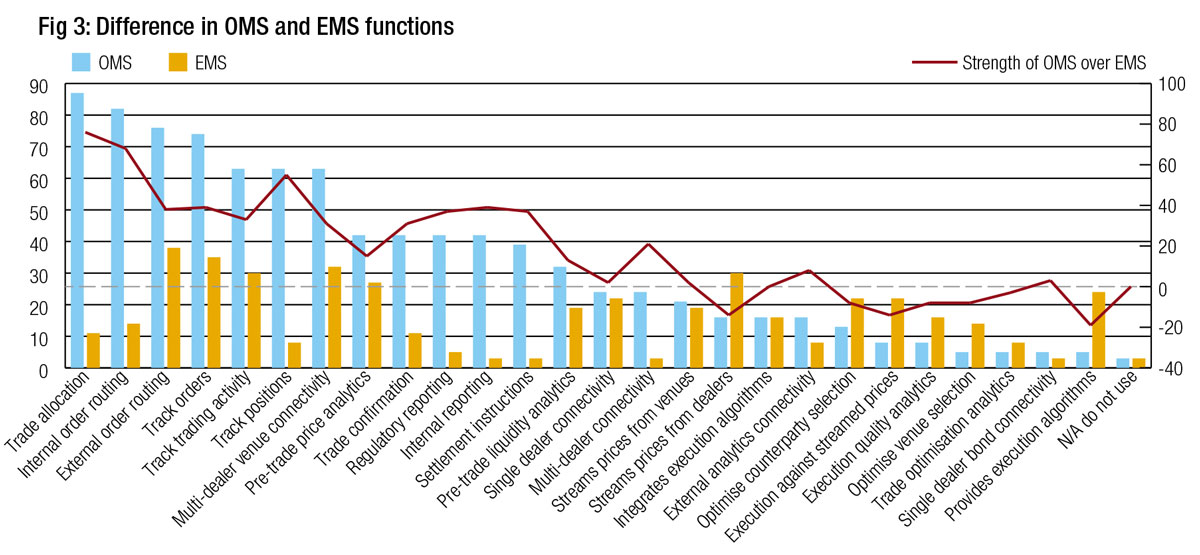

Based on user defined functional use, we find several key areas where an EMS typically provides greater service than an order management system, defined by the line on the bar graph (Fig 3) with negative scores indicating an OMS underperforms an EMS.

The first relate to direct dealer connectivity. EMSs are found to be more effective at streaming prices from dealers and also at providing execution against directly streamed prices from sell-side counterparties.

The second is the provision of execution algorithms, which allow for lower-touch trading to be supported, creating scale on the trading desk without the need for additional personnel.

The final area is in the optimisation of counterparty selection, trading venue selection, and analysis of execution quality.

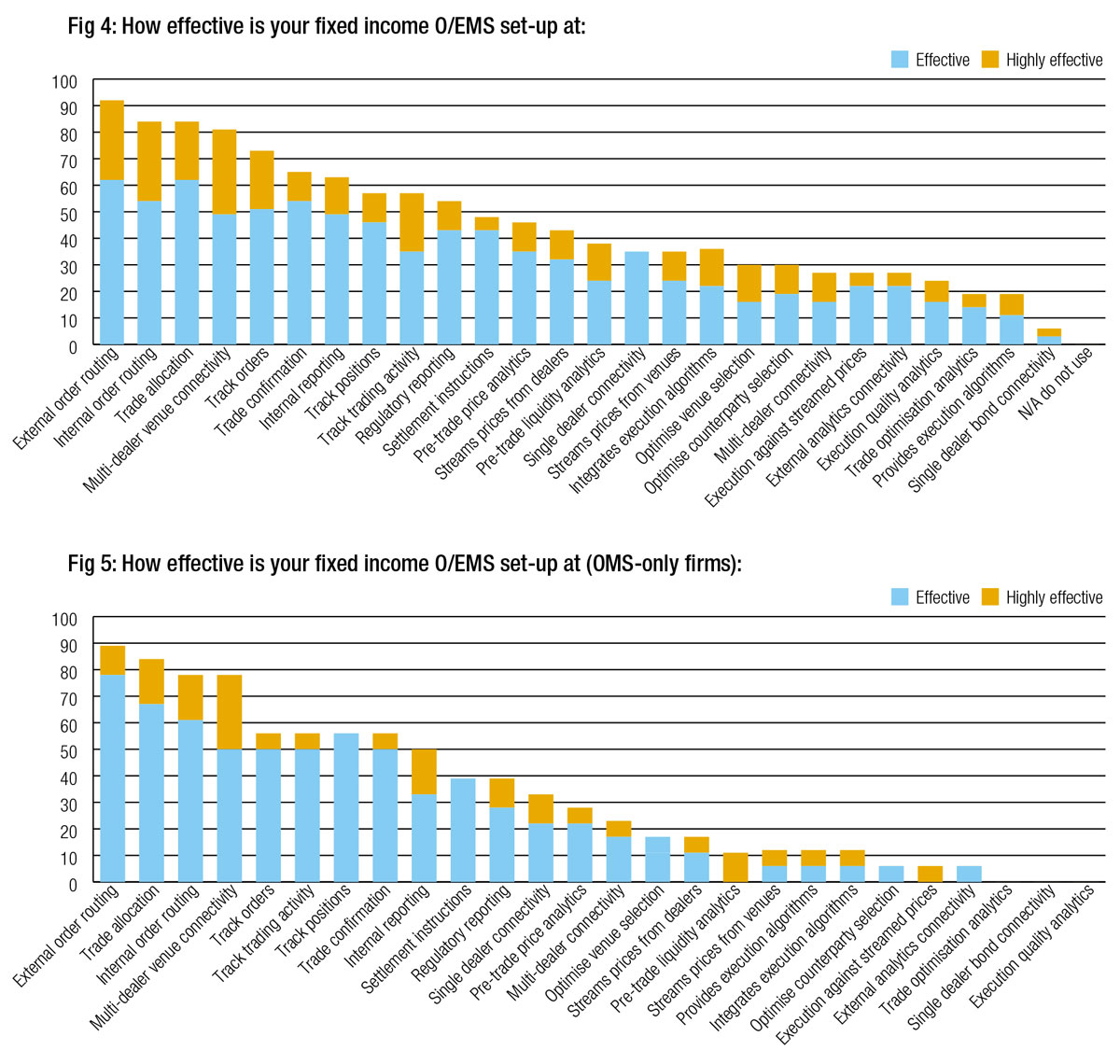

If we look at the effectiveness of these tools across all firms, the broad trends (Fig 4) indicate front office technology is able to provide internal management of positions and orders, with associated reporting. Less effective are the abilities to optimise execution activity, which suggests that while the heavy lifting of process is being handled, adding value to traders in more skilled areas is broadly challenging.

When we split out the results between firms that only have an OMS and those that also have an EMS, the difference in capabilities that EMSs provide becomes more apparent. The OMS only data (Fig 5) shows that these firms are benefitting from overall effectiveness at processing, but see limited outperformance.

In some areas they see no functional services – notably pre-and post-trade analytics – but also connectivity with single dealer bond issuance platforms.

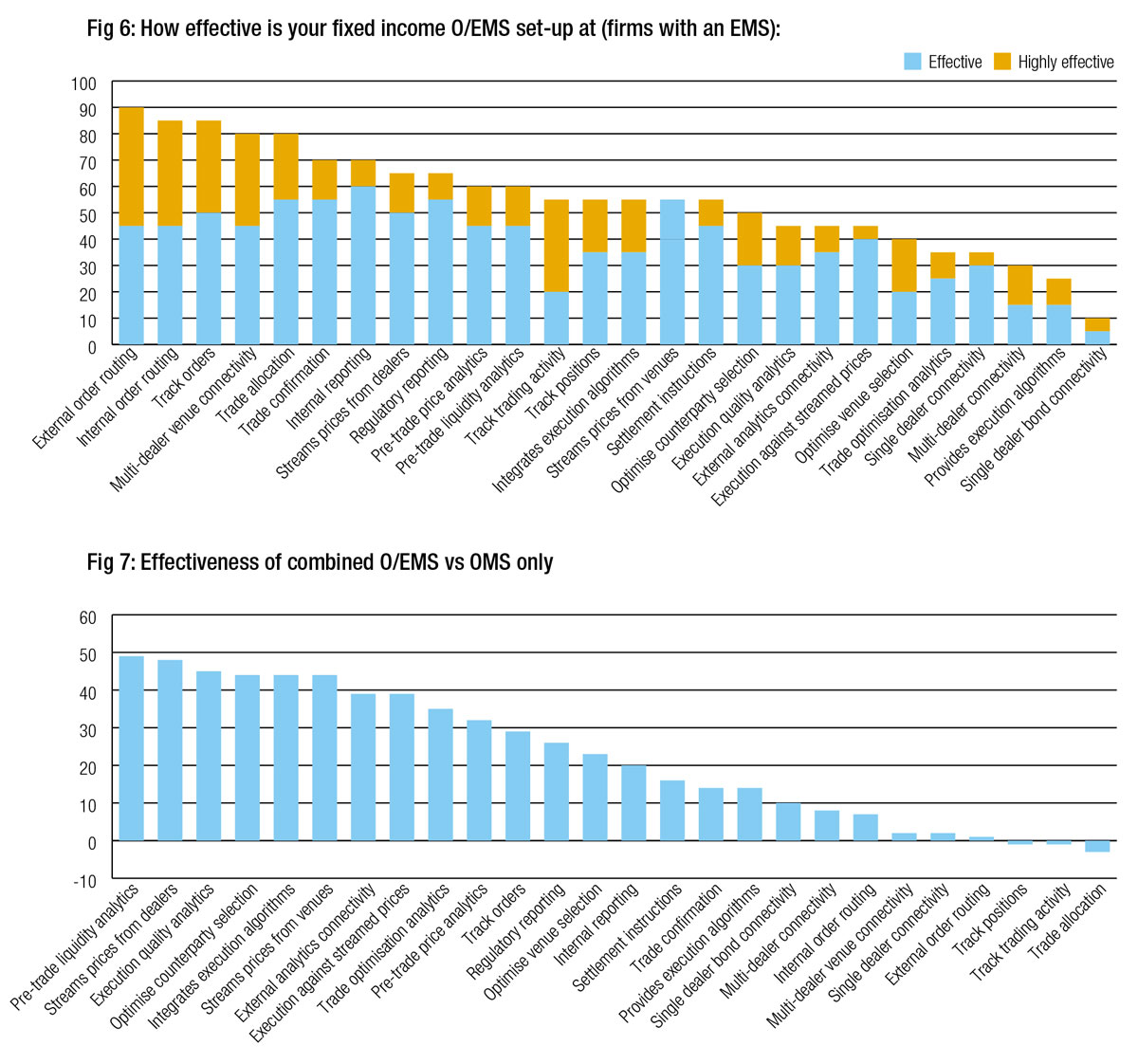

Those firms using an EMS alongside an OMS (Fig 6) find the combination is ‘highly effective’ far more often, leading with those functions managed primarily by an OMS. The first apparent takeaway here is that having an EMS can increase the effectiveness of the OMS itself.

The second is that some functions which are absent when only using an OMS are very much in use for a significant number of those asset managers which have both OMS and EMS, although not necessarily for the majority, as with ‘trade optimisation analytics’.

If we analyse the differences in performance, it is very marked. The difference in effectiveness (Fig 7) for pre-trade analytics, streaming prices from dealers and trading venues, execution quality analytics, optimising counterparty selection, and integration with execution algorithms are all found to be more effective by over 40 percentage points. There are double digit increases in effectiveness across 18 categories.

Analysis of solution providers

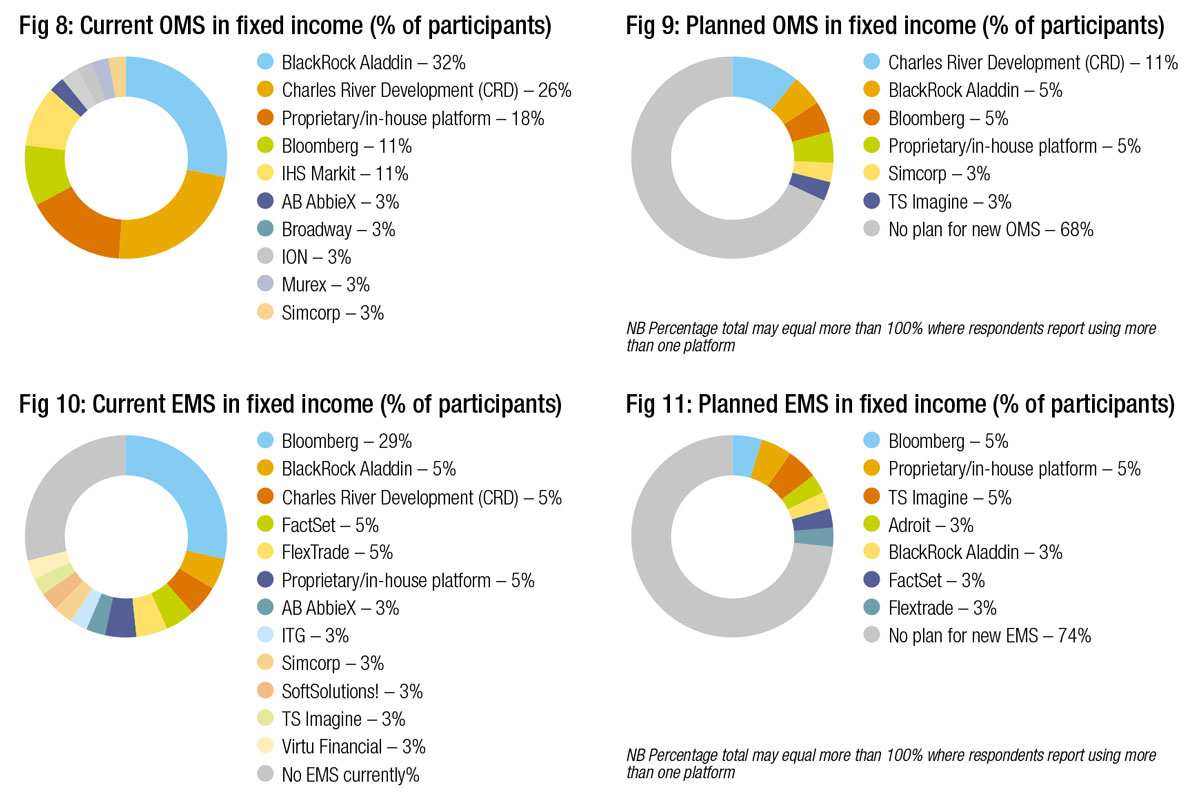

The most used OMS providers (Fig 8) amongst the buy-side firms we surveyed were BlackRock (32%), Charles River Development (CRD – 26%), proprietary systems (18%) and Bloomberg and IHS Markit both with 11%. Although 68% of respondents reported no plans to onboard a new OMS, 11% of trading desks (Fig 9) reported that they were planning to onboard CRD, while 5% were planning to onboard either BlackRock, Bloomberg or an inhouse system.

Amongst execution management system providers (Fig 10), Bloomberg is by far the most popular (29%) with all other firms registering in single digit use, the largest being BlackRock, CRD, Factset (incorporating Portware) and Flextrade and proprietary systems. Complicating this picture are those platforms seen by users as a single O/EMS, which in many cases may only have been referred to as an OMS. There were also 29% of firms who said they had no EMS currently being used.

Although 74% of firms are not expecting to onboard a new EMS, a wide range of firms reported plans to take on new systems, across a varied range of firms (Fig 11).

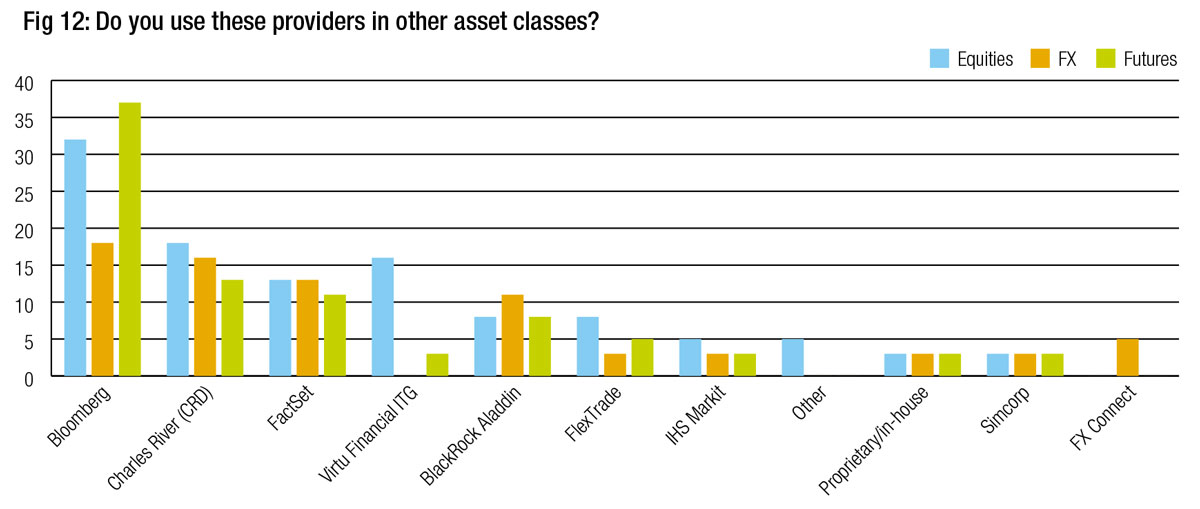

Some platform providers are also proving effective at multi-asset support (Fig 12) with Bloomberg standing out, having over 30% of firms using it in equities and futures. CRD and Factset are also doing well in this regard, based on the use by respondents currently.

Respondent demographics

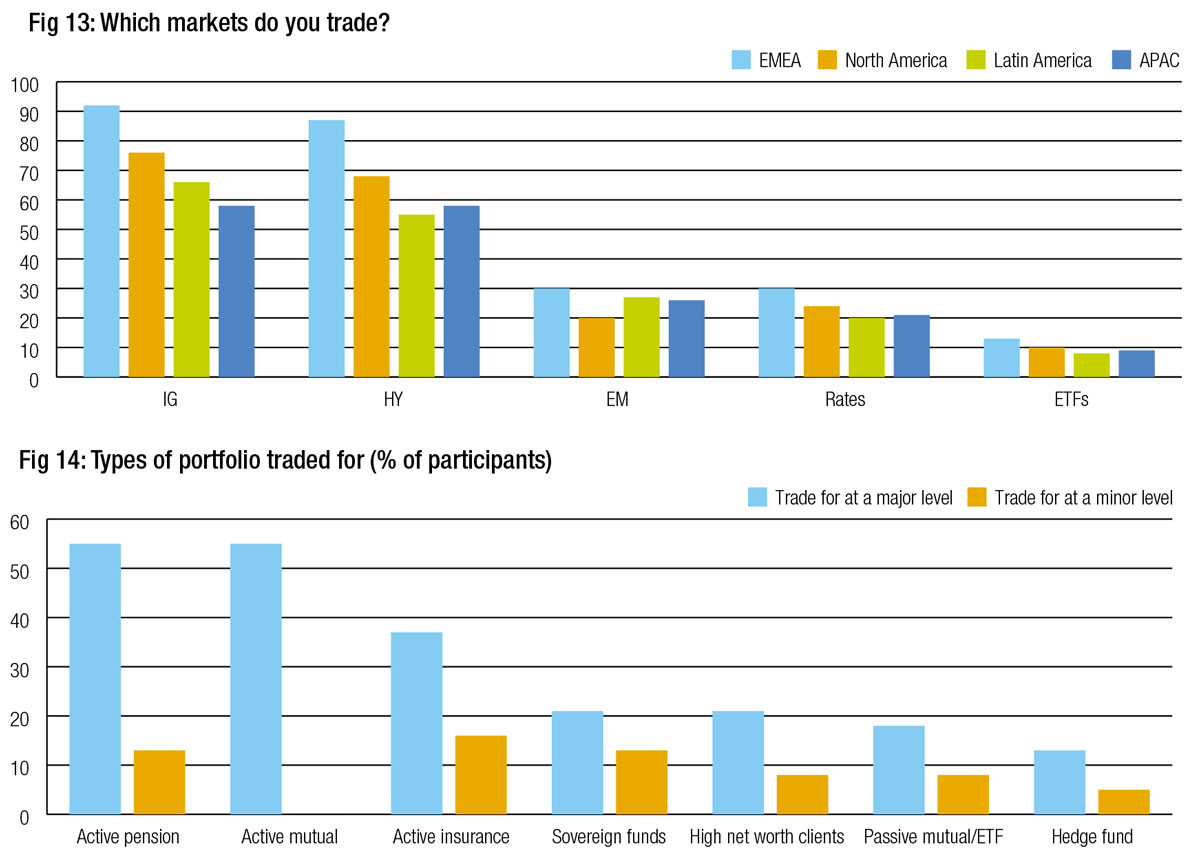

We surveyed 38 buy-side firms (Fig 13) across Europe, the US, and Asia Pacific to find out which systems they used for order management and execution management in the fixed income space.

Of these firms, most trade for actively managed mandates and portfolios, in traditional long-only investment strategies (Fig 14). Close to a fifth of respondents also trade for sovereign wealth, private wealth and passive funds, which allow for a more varied set of trading styles and resourcing for buy-side desks.

This demographic represents a good proportion of typical buy-side firms making the research valid for getting a picture across the asset management industry.

©Markets Media Europe, 2022

TOP OF PAGE