Green, social, sustainability, and sustainability-linked bonds are on track to represent 14% of total issuance.

Sustainable bond issuance is expected to approach $1 trillion this year as all categories of environmental, social and governance-labelled bond issuers, except social bonds, were found to be decarbonising faster than the global control portfolio.

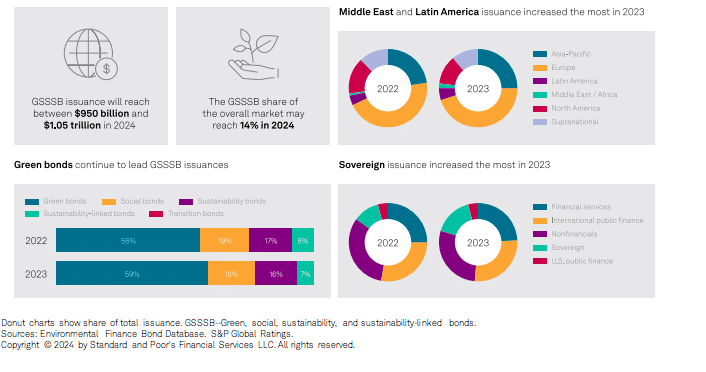

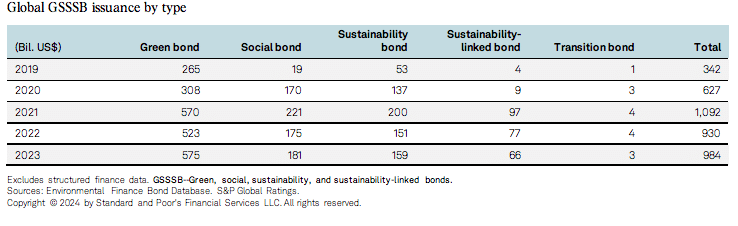

S&P Global Ratings forecast in a report in February 2024 that green, social, sustainability, and sustainability-linked bond (GSSSB) issuance will increase from $0.98 trillion last year to between $0.95 trillion and $1.05 trillion this year.

“GSSSB issuance could represent 14% of total bond issuance in 2024,” added S&P. “ In our opinion, GSSSB issuance will rise at nearly the same pace as conventional bond issuance for the second consecutive year.”

Sustainability-linked bonds are any instrument for which the financial or structural characteristics can vary depending on whether the issuer achieves predefined sustainability objectives.

Green bonds raise funds for projects with environmental benefits; social bonds raise funds for projects that address or mitigate a specific social issue; and sustainability bonds raise funds for projects with both environmental and social benefits.

The ratings agency said growth in issuance will be driven by increased adoption of sustainable taxonomies and transparency initiatives and growth from emerging markets as the Middle East and Latin America were the two fastest-growing regions in 2023, with 149% and 56% growth respectively. Asia-Pacific also now accounts for 25% of GSSSB issuance, its highest-ever proportion.

However, the report said certain macroeconomic factors could also restrict issuance, including uncertainty associated with high interest rates and if there is wider economic slowdown in key regions such as Europe and Asia-Pacific.

Green bonds will continue to dominate the sustainable finance market according to S&P, but the ratings agency expects greater diversity in bond types and regional participation in 2024.

In 2023 green bond issuance rose 10% year-on-year to $575bn, which S&P said was largely due to increased issuance from Europe as there was another year of contraction from North American issuers.

“Non-financial corporates still make up the largest portion of the green bond market, but the financial services sector now has nearly equal volumes after three consecutive years of growth,” said S&P. “Sovereigns had their strongest year on record in 2023, as their GSSSB issuance reached $160bn, breaking the previous record of $117bn in 2021.”

Sovereign green bonds were issued by countries including France, Germany, Italy, and the U.K, who each issued more than $10bn each in 2023.

Decarbonisation performance

ICE used its data to analyse the relative decarbonisation performance of GSSSB issuance.

Ian Stannard, climate transition finance manager at ICE, asked in a blog if ESG-labelled bond issuers are more likely to decarbonise faster than other issuers.

Stannard wrote that all categories of ESG-labelled bond issuers, except social bonds, decarbonised faster than the global control portfolio.

“The relative climate performance of sustainability-linked bond issuers and ESG-labelled bond issuers with temperature targets suggest the commitment to decarbonisation plans have an additional impact on climate performance and net zero alignment, especially if there are potential financial consequences for non-achievement,” he said.

Sustainability-linked bond issuers reduced Scope 1 and 2 emissions by 46.4%, followed by sustainability bond issuers with a 44.66% reduction of emissions since 2015.

“The relative out performance of SLBs should not come as a surprise given the emphasis on emission reduction key performance indicators,” said the blog.

Green bond issuers had a Scope 1 and 2 carbon emission reduction of 30.43% since 2015.

“This could be seen as surprising given the climate focus of most green bonds, although this is still a faster pace of decarbonisation than the global control portfolio,” said Stannard.

He concluded that ESG-labelled bond issuers were, on average, more aligned to the NGFS Net Zero 2050 scenario compared to the broad global control portfolio.

Transition bonds

S&P expects climate transition bonds to increase their share in the GSSSB market, although growth will only be moderate in 2024.

Transition bonds can be either sustainability-linked or use-of-proceeds bonds issued specifically to support climate transition goals. S&P said transition bonds can support projects which may not be “green”, but still support climate transition.

Energy companies have been the largest issuers of climate transition bonds but S&P said that total issuance has been less than $15bn since the first transition bond in 2019.

“To date, however, the market has not coalesced around a single definition for transition finance, nor have there been widely recognized transition bond principles to which issuers could align their frameworks or issuance,” added S&P. “This may have disincentivized issuers and investors alike.”

About two-thirds of all transition bonds have come from Japanese issuers and the country is looking to further establish itself as the global leader in the sector by committing up to JPY 20 trillion ($130bn) of transition bonds in the next decade, including issuing $11bn in February 2024.

“Japan published the world’s first sovereign transition bond framework in November 2023, which includes project categories such as nuclear energy, carbon capture, and alternative fuels and feedstocks for the manufacturing industry,” said S&P. “The country’s Ministry of Economy, Trade, and Industry also released transition roadmaps for sectors including iron and steel, chemicals, and cement, underlining its commitment to tackling the transition for hard-to abate sectors that have a high dependence on fossil fuels and no simple solutions for reducing emissions.”

Blue bonds

S&P expects a similar scenario for blue bonds, as they increase their share in the GSSSB market in 2024, although growth will only be moderate.

Blue bonds emphasize the importance of the sustainable use of maritime resources and of the promotion of related sustainable economic activities, as a subset of green bonds.

“As of December 2023, blue bonds worth $6.8bn in total had been issued, representing 0.2% of overall GSSSB issuance since 2019, the year the first blue bond was issued,” said S&P. “We believe that the rise in issuance last year is related to the September 2023 release of ICMA’s guidance around bonds to finance the sustainable blue economy.”

The ratings agency expects blue issuance to rise as more data and policies that promote the sustainable blue economy become available.