Financial market infrastructures Deutsche Börse, DTCC and Euroclear are all expanding in digital assets.

Deutsche Börse has become the latest regulated financial market infrastructure that is planning for an expansion in digital assets, following initiatives from the US DTCC and Euroclear.

Theodor Weimer, Deutsche Börse

Theodor Weimer, Deutsche Börse

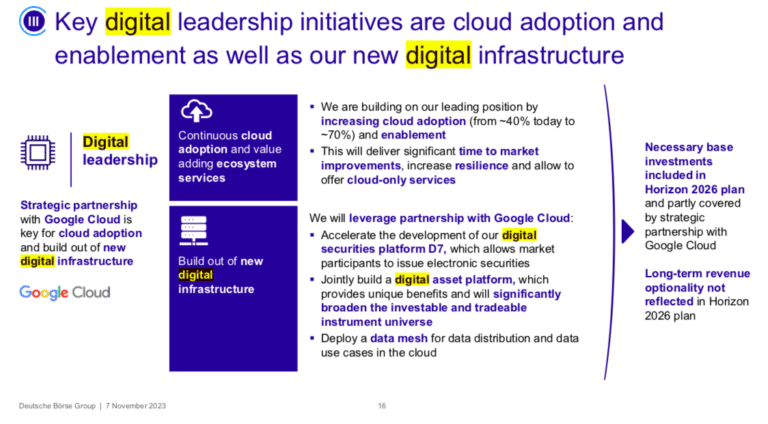

Theodor Weimer, chief executive of Deutsche Börse, presented the exchange group’s new strategy, Horizon 2026, at its investor day on 7 November. One of Deutsche Börse’s strategic priorities is to take a leading role in the digitalization of assets, and increase efficiency using artificial intelligence and the cloud, in partnership with Google Cloud.

The partnership allows the group to accelerate its efforts in setting up platforms for new digital asset classes and to deploy a data mesh for distribution and data use cases in the cloud.

Weimer firmly believes that tokenization will occur at scale and, therefore, Deutsche Börse needs to be prepared as a platform provider. Tokenization can democratize access to financial markets as well as improve cost efficiency and enhance collateral mobility by cutting settlement times for transactions.

“These digital asset leadership efforts are important for our future and we cannot risk not investing,” he added. “We strongly believe there is a Tesla moment on the horizon.”

Serbian-American Nikola Tesla (1856-1943) is credited with thousands of inventions, but is best known for inventing the alternating current (AC) power system which allowed power transmission at higher voltages and over longer distances, enabling the widespread use of electricity.

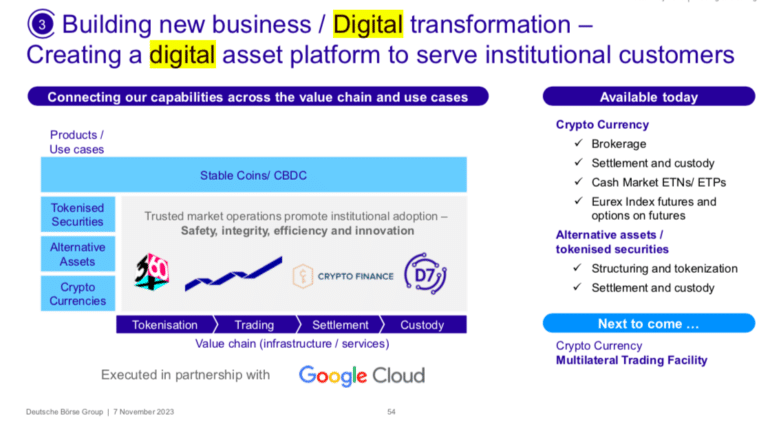

Thomas Book, member of the executive board of Deutsche Börse responsible for trading and clearing, said at the investor day that the group is positioned for the growth of digital assets with an offering across the full value chain for institutional clients.

Book continued that the partnership with Google Cloud will accelerate the development of Deutsche Börse’s digital securities platform D7, which allows market participants to issue electronic securities. D7 will be the group’s next-generation risk management platform with a new “state of the art” data mesh platform which will upgrade the data architecture and distribution of market data.

“We believe our proposition is strong as a neutral and trusted market operator,” Book added. “We have constantly developed and built new markets in regulated environments.”

He continued that Deutsche Börse’s focus is to enable crypto, tokenized securities, alternative assets and stablecoins across the entire value chain by connecting the dots across the group.

“We already offer digitally native capabilities in trading, settlement and custody of crypto,” said Book. “Next will be the launch of our MTF, a regulated trading venue for crypto, which is scheduled to go live in the first quarter of 2024.”

DTCC & Euroclear

In addition to Deutsche Börse expanding in digital assets, DTCC, the US market infrastructure, announced in October that it has agreed to acquire Securrency, a developer of institutional-grade, digital asset infrastructure. Securrency will become a fully-owned subsidiary of DTCC and will operate under the name DTCC Digital Assets.

Lynn Bishop, chief information officer at DTCC, said in a blog that one of the keys to growing adoption of digital assets is having a trusted and robust infrastructure to underpin the market and protect the safety and stability of the financial system.

In October Euroclear, the international central securities depository, announced the launch of its Digital Financial Market Infrastructure (D-FMI) platform, which has been built using R3’s Corda distributed ledger technology platform. The inaugural digital native note on the platform was issued by the World Bank which raised €100m to support the financing of its sustainable development activities.

Todd McDonald, co-founder and chief strategy officer at R3, highlighted in an email to Markets Media that the first live issuance of a digital bond with Euroclear’s ICSD was not a sandbox or proof of concept, but a live market issuance that demonstrates the role DLT can play in transforming capital markets.

“The digitization of capital markets won’t happen overnight, but this shows that the journey is certainly underway and we’re excited to be working with financial market infrastructures like Euroclear in delivering a more efficient, open and trusted digital economy,” said McDonald.

Institutional interest

McDonald also said the financial world is rocketing towards one filled with digital assets and cited a research report from Bernstein which estimated that $5 trillion in assets could be tokenized on blockchains in the next five years.

Colin Butler, global head of institutional capital at Polygon Labs, which provides blockchain technology, told Markets Media there has absolutely been an increased institutional interest in tokenization and it is now a very prevalent theme in blockchain.

Butler expects a tidal wave of mass adoption of blockchain being used as a utility infrastructure to reduce costs, increase revenue and reduce risk with shorter settlement times. He added: “The sweet spot is probably between 30% and 50% in savings overall.”

He continued that there had previously not been a catalyst for institutions to shift to DLT but now they can see competitors gaining an advantage as they reduce costs.

For example, in February this year Siemens issued the first digital bond on a public blockchain in Germany. Two months later, US asset manager Franklin Templeton announced that the Franklin OnChain U.S. Government Money Fund had reached $270m in assets under management. This was the first U.S.-registered fund to use a public blockchain to process transactions and record share ownership.

“A big unlock is approaching whereby all the great benefits of blockchain can be realised for the first time, leading to a Cambrian explosion of use cases across the industry in 2024,” said Butler.

Simon Forster, global co-head of digital assets at TP ICAP, said in an email to Markets Media that tokenization has become the narrative of the digital assets landscape over the last 12 months.

In the years ahead TP ICAP expects to see a compression of the life cycle of an asset, with the blockchain/DLT layer absorbing a significant amount of the services currently provided by firms in the post-trade area. Therefore, it is unsurprising that financial services firms focused on clearing and settlement are positioning themselves for this shift.

“The outstanding question remains what the future state of market infrastructure will look like as this technology continues to be adopted and we begin to realise some of the benefits it allows – precision settlement, automated corporate events etc,” Forster added. “Major technology shifts in industries often lead to a totally new landscape, with distinct winners and losers and we believe this will be no different.“

Interoperability

Bishop said the Securrency acquisition will allow the combination of DTCC’s digital capabilities with technology that can fast-track development of its enterprise digital asset platform. She continued that a very important aspect of the transaction is to license the technology to other market participants.

“DTCC has been a strong advocate for industry-wide collaboration and has advocated for interoperability for many years,” she said. “What’s very exciting is that the technology can address interoperability by acting as a DLT-agnostic harmonization layer that also promotes liquidity, transparency and security.”

Butler highlighted that Polygon is interoperable and that in the future, private blockchains will be able to connect to the ecosystem, which is the second largest community outside Ethereum.

“I think the industry is going to bridge that gap between public and private chains and the future state is where Layer 2’s can all flow to a shared security layer with zero-knowledge technology which provides the highest level of security and decentralization,” said Butler. “The more participants in that security layer, the lower the costs, which creates a mega flywheel.”

McDonald said Corda is emerging as the technology of choice because it was designed for regulated markets from the ground-up, ensuring resiliency, scalability, security and perhaps, most importantly, interoperability.

“The interoperability of previously siloed ledgers will be crucial in enabling wholesale institutions to tokenize once illiquid assets,” added McDonald. “As different distributed ledger technologies are used to solve various tokenization use cases, interoperability can connect the pieces and enable seamless asset exchange.”

David Easthope, head of fintech research on the market structure and technology team at consultancy Coalition Greenwich, said in an email to Markets Media that traditional financial institutions are paying attention to the tokenization opportunities that blockchain technology presents so infrastructure players and banks continue to buy, build, and partner.

“This includes CSDs such as DTCC and Euroclear, who have a meaningful role to play in the realm of tokenized securities and seek to have a strong offering to support a healthy market over the coming decade,” he added.

David Easthope, Coalition Greenwich

David Easthope, Coalition Greenwich

Easthope continued that as 2024 nears, banks are experimenting with both public blockchains and interoperability with private, distributed ledgers to tokenize financial and real-world assets.

“While there are a number of projects underway, in our conversations with leading financial institutions we have observed a resonance around projects that involve tokenizing financial and real-world assets,” Easthope added.

He gave the example of Project Guardian in Singapore, a collaborative initiative under the Monetary Authority of Singapore with the financial industry that seeks to test the feasibility of applications in asset tokenization and DeFi. Outside Asia, other banks are quite engaged and motivated by recent activity in the EU and U.K. and are participating in the DLT “sandboxes” that provide pathways forward.

“Even as new infrastructure is being developed, guardrails are clearly needed,” said Easthope. “The DLT pilot regime in Europe, MiCA and the FCA sandbox have offered the banks avenues for legal and compliant experimentation.”