Advanced predictive signals and dynamic adaption to fast-changing market environments are the hallmark of the CLSA Adaptive Trading Algorithms.

By Christian Meier, Senior Execution Quant, CLSA

Algo developers often stress the importance of alpha predictors over short and long-term horizons. Good alpha predictors can help modulate trading plans and improve the timing of executions. However, accurate predictions of volume over the day are essential for the determination of any execution plan, most notably in IS, VWAP or Market on Open (MOO). Another example is the Market on Close (MOC) strategy, where we allocate a given trading quantity at the close and the rest to trade in the pre-close session over a given trading schedule in order to minimize market impact in the close auction.

Volume under-estimation results in an execution plan that starts too early and exposes the order to unnecessary execution risk. Volume over-estimation leads to an execution plan that starts too late and can have a potentially worse outcome in terms of excessive market impact and / or residuals.

Our Adaptive Volume Model provides more accurate volume predictions and decreases the probability of such under-or overestimations. Furthermore, forecasts are updated every 5 minutes helping to account for intra-day volume shocks.

Volatile Volumes

Accurate volume forecasting is even more important when we consider that volumes are famously very volatile. What is more, large changes can also persist over several days. The upper chart of Figure 1 shows the likelihood of a high volume environment that persists for 3 or 5 days, given we observe at least a doubling of yesterday’s volume. This phenomenon is also consistent across markets.

.jpeg)

High and low volume regimes make it difficult for models based on historic averages to account for shocks. The lower chart in Figure 1 shows the total daily volume of Vedant Fashions Ltd. (VEDN.NS). The orange line, indicating a 15-day moving average, first underestimates the total number of shares and, after the volume decreased back to historical levels, overestimates this number.

Deep Learning guided by Trading Research

The Adaptive Volume Model is a deep neural network predicting the remaining volume of the day. A key characteristic of the model is, that it allows predictions even before the market has opened. It leverages a wide range of input features: liquidity shocks observed over the day, previous day volume shocks, time of day indicators and market microstructure metrics. During the initial research, we considered a wide range of alternative features including time, price, volatility and order book features. Empirical market microstructure research guided our analysis. For example, we previously wrote about the quote-trade ratio and its distinctive change before the close auction in China (Assessing the “Closing Phase” in China’s Equity Markets, 2022), which we have also integrated in the model. The model is recalibrated regularly to account for changes in the market environment and shifts in the importance of input features.

We used an extensive hyperparameter tuning process with a Bayesian oracle to search the space and find optimal values, such as the number of hidden layers and the number of neurons together with the activation function. We ran a large number of trials and chose the best parameter based on validation loss and model complexity (each set of parameters was run twice to eliminate the impact of the random initialization of weights).

Consistent Predictive Power

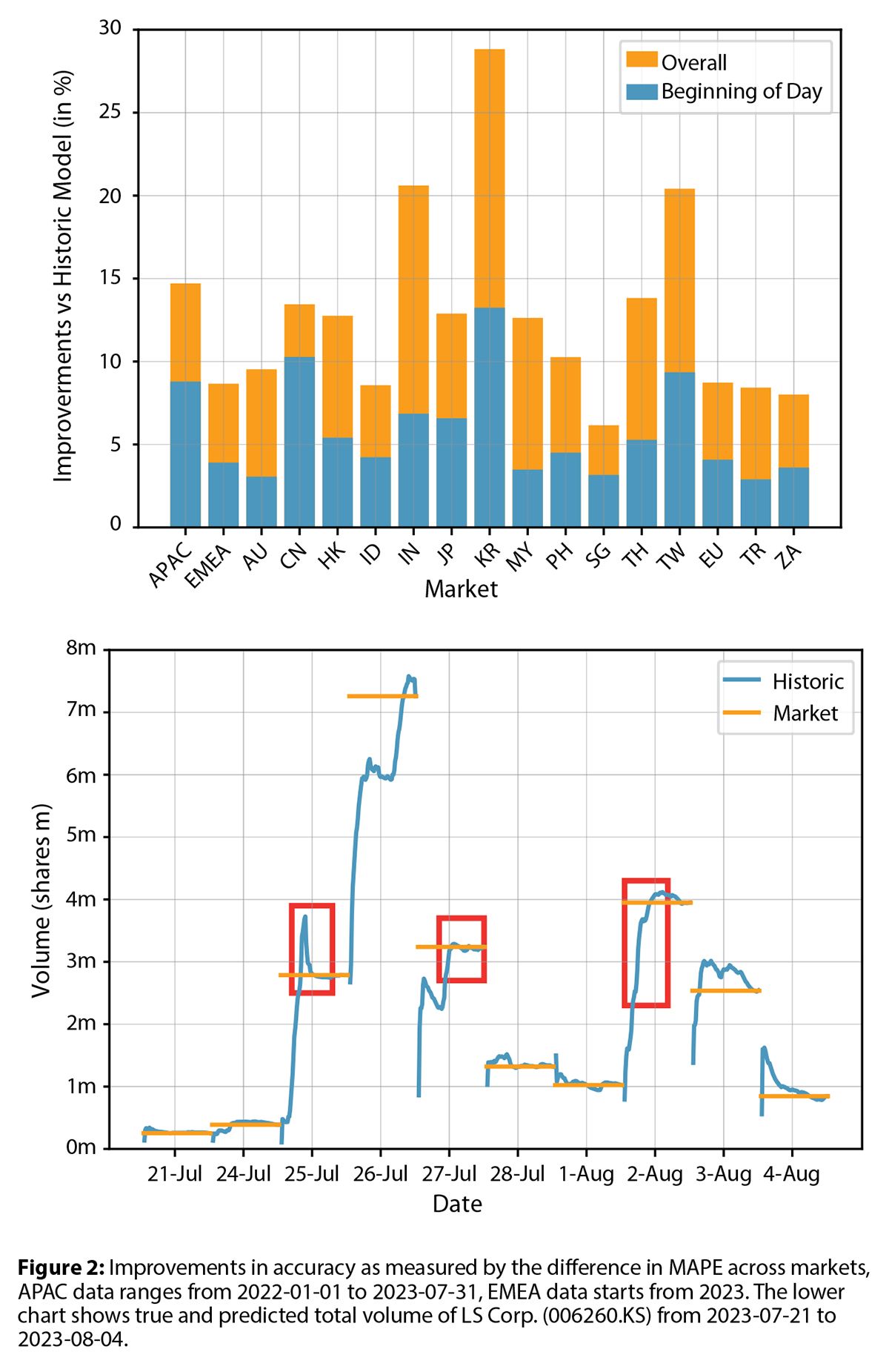

The upper chart in Figure 2 shows performance improvements against the 15-day moving average, which we call historic model. The Adaptive Volume Model provides significant and consistent improvements across a large variety of markets (orange bars). The blue bars show further that the model reduces the error for predictions done at the beginning of the day.

The lower chart in the same figure shows how well the model handles volume shocks with a following reversal in total volume. The displayed volume is for LS Corp listed in South Korea. The red highlighted areas show the Adaptive Model inferring a volume shock and hence, adjusting the predicted volume up.

Application to Algorithmic Execution

We stated in the introduction the importance of accurate volume forecasts for a variety of trading strategies, such as VWAP, Implementation Shortfall or Market on Open/Close. VWAP strategies, for example, benefit from improved volume forecasts as we are able to better align the execution plan with the market volume on that day.

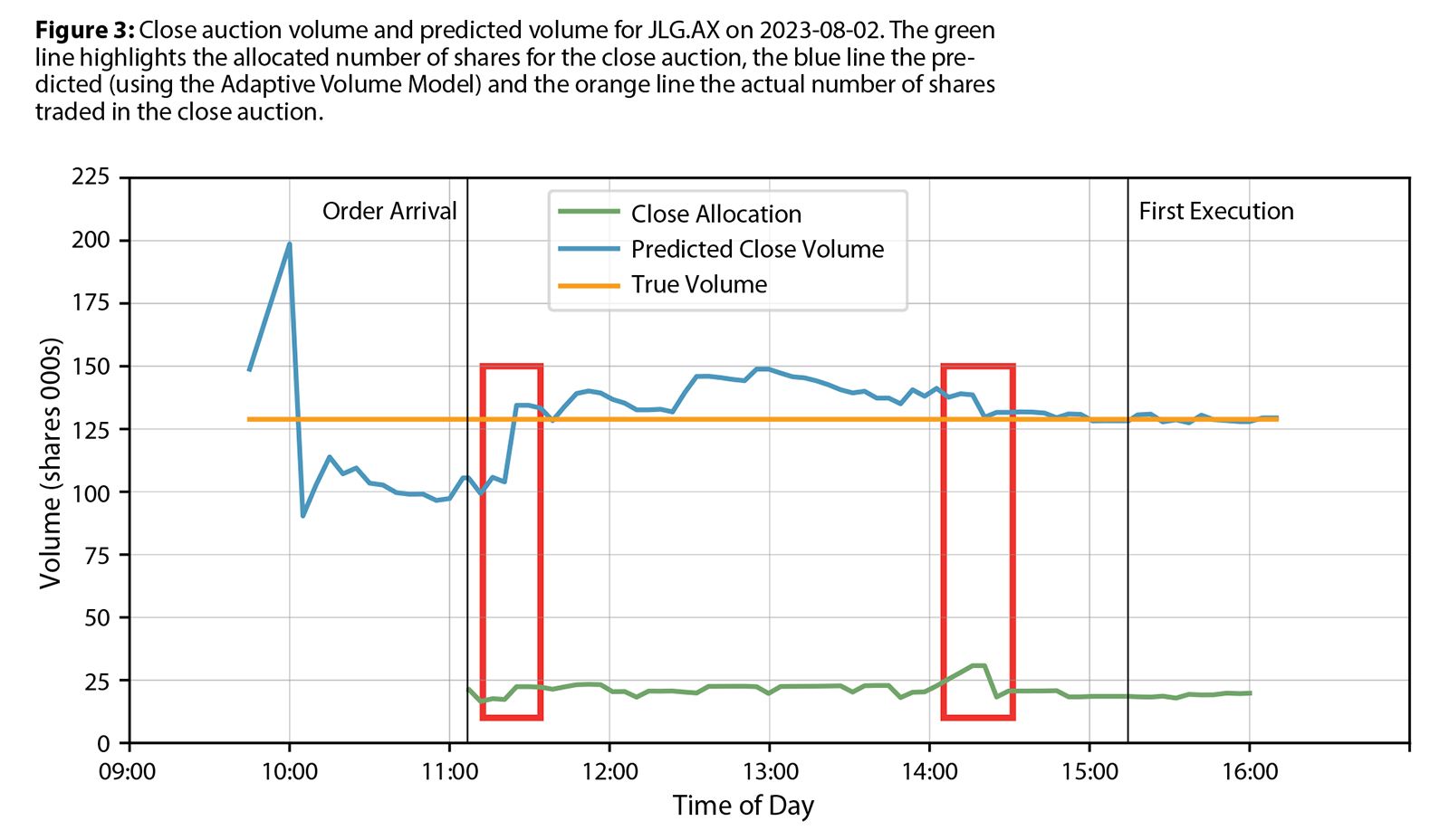

The following example is a Market on Close order. The CLSA MOC Adaptive strategy determines its execution plan by balancing expected market impact, timing risk and expected price drift. Smaller orders that can be executed at the auction without excessive impact have their execution plan determined to do so. Execution plans are adjusted dynamically as estimates of volume, volatility, market impact and alpha change.

In Figure 3, we can see how the predicted close volume leads to changes in the number of shares allocated for the close auction. The first highlighted area shows the effect of an increase in predicted volume: more shares are allocated into the auction. The second area highlights that, although the predicted close volume decreased, the close allocation reached a maximum. This is due to the dynamic balancing of market impact, risk and alpha.

Conclusion

The Adaptive Volume Model incorporates a set of diverse, intuitive and economically relevant features. An extensive hyperparameter search helped to create a model that performs consistently well across markets and regions. The improvements in accuracy are also consistent over a long time horizon. Dynamic forecasts help to adapt to volume shocks within a short time period.

Advanced predictive signals and dynamic adaption to fast changing market environments are the hallmark of the CLSA Adaptive Trading Algorithms. The previous example of an MOC order executed through our MOC Adaptive strategy illustrates how better volume predictions affect and improve executions. •