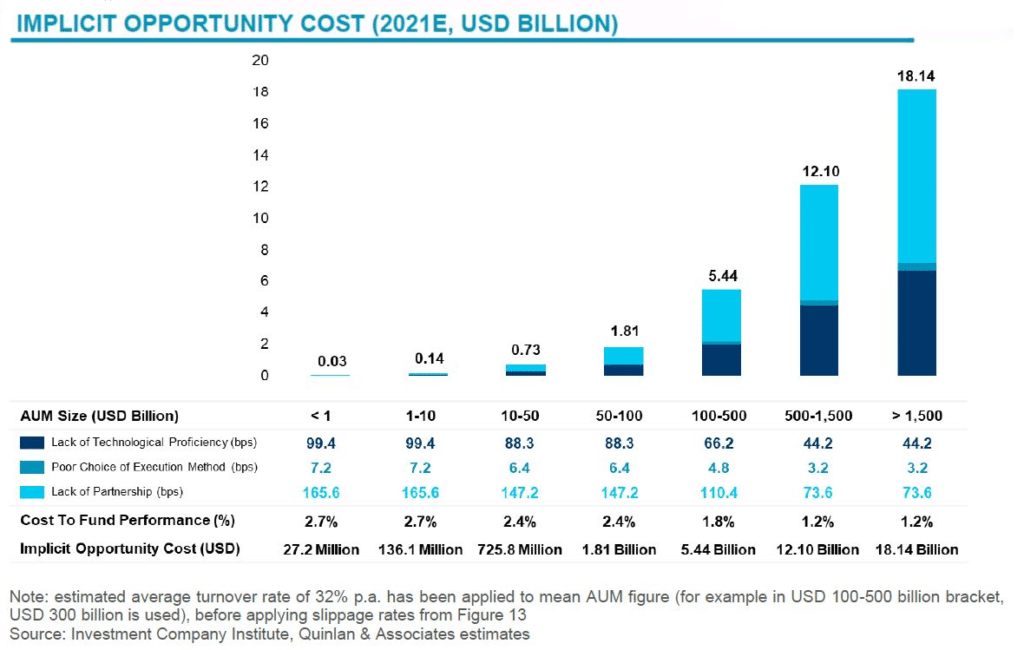

Trading inefficiencies cost asset managers 1.2% to 2.7% of annual return, equivalent to losses of up to $18 billion for the largest players, according to a newly released report titled Trading Up: Optimisation, Outsourcing, and the Reinvention of the Buy Side Trading Desk.

The report, compiled by independent financial services strategy consultancy Quinlan & Associates, looks in depth at the modern buy-side trading function, analyzing its true costs and present shortcomings, and explores the options of outsourcing and/or internal optimization as potential solutions.

“Despite significant and ongoing outlay in running trading desks, along with the expanded remit of traders and the adoption of enhanced technologies, we have failed to see a fundamental evolution in the buy-side execution model since the advent of algorithmic trading in the mid-2000s,” said David Rogers, Partner of Quinlan & Associates and lead author of the report. “Our interviews with industry professionals on both the buy and sell side confirms this.”

The report authors estimate that some of the largest asset managers are losing up to $5 million per annum – equivalent to about 35% of their total running costs – on explicit cost wastage due to idle time, operational issues, and structural problems. “Depending on seniority, a buy-side trader can cost up to $800,000 per year, with overall direct costs going as high as $14 million p.a., for some of the larger global asset managers,” added Rogers

“More worrying are the implicit costs associated with maintaining a suboptimal trading construct,” continued Rogers. “We estimate that many asset managers are taking a 1.2-2.7% p.a. hit to their fund performance, irrespective of absolute performance, resulting in an implicit opportunity cost of $18 billion p.a. for the very largest funds. In a climate characterized by widespread underperformance, we see an urgent need for change.”

The report discusses three key paths through which the buy-side trading model can become more operationally and culturally efficient: outsourcing (i.e. outsourcing of the fund manager’s business, in part or in whole), internal optimization (i.e. optimization and rationalization of practices with existing human and technological capital), and a hybrid solution (i.e. targeted outsourcing and optimization based on personalized needs).

On the topic of outsourced trading, the report goes into specific detail on the rapid growth in the industry over the past year, with multiple participants – ranging from small independents to established global financial services firms – entering the space, noting that the latter group has the capacity to significantly disrupt the status quo through structural change. However, the authors believe that outsourcing is not necessarily the panacea that it advertises itself to be, given that many providers are not skilled experientially or technologically to cope with even a moderate increase in trading volume or complexity.

“Larger asset managers will likely not use the service; as such, we believe recent growth estimates for the industry to be overstated. Further, when larger firms such as the brokers themselves enter the segment, we predict a drastic reduction in the number of participants over the long term, particularly the private, independent operators. There is also potential for the sell side’s core offering to be meaningfully altered,” said Rogers.

The report concludes that there exists significant scope across the spectrum of asset managers to reduce costs and deliver better investment returns through optimizing trading practices, including fixing inefficient structures, sub-optimal cultural dynamics, and most importantly, poor technological adoption and/or implementation.