Buy-side trading desks have used markedly different proportions of trading protocols between passive and active portfolios this year compared to 2020. The DESK reports.

Buy-side trading desks have used markedly different proportions of trading protocols between passive and active portfolios this year compared to 2020. The DESK reports.

The DESK’s Trading Protocols research captures the average proportion of trading protocols used for corporate bond trading by 32 major asset managers, based in US, Europe and Asia Pacific.

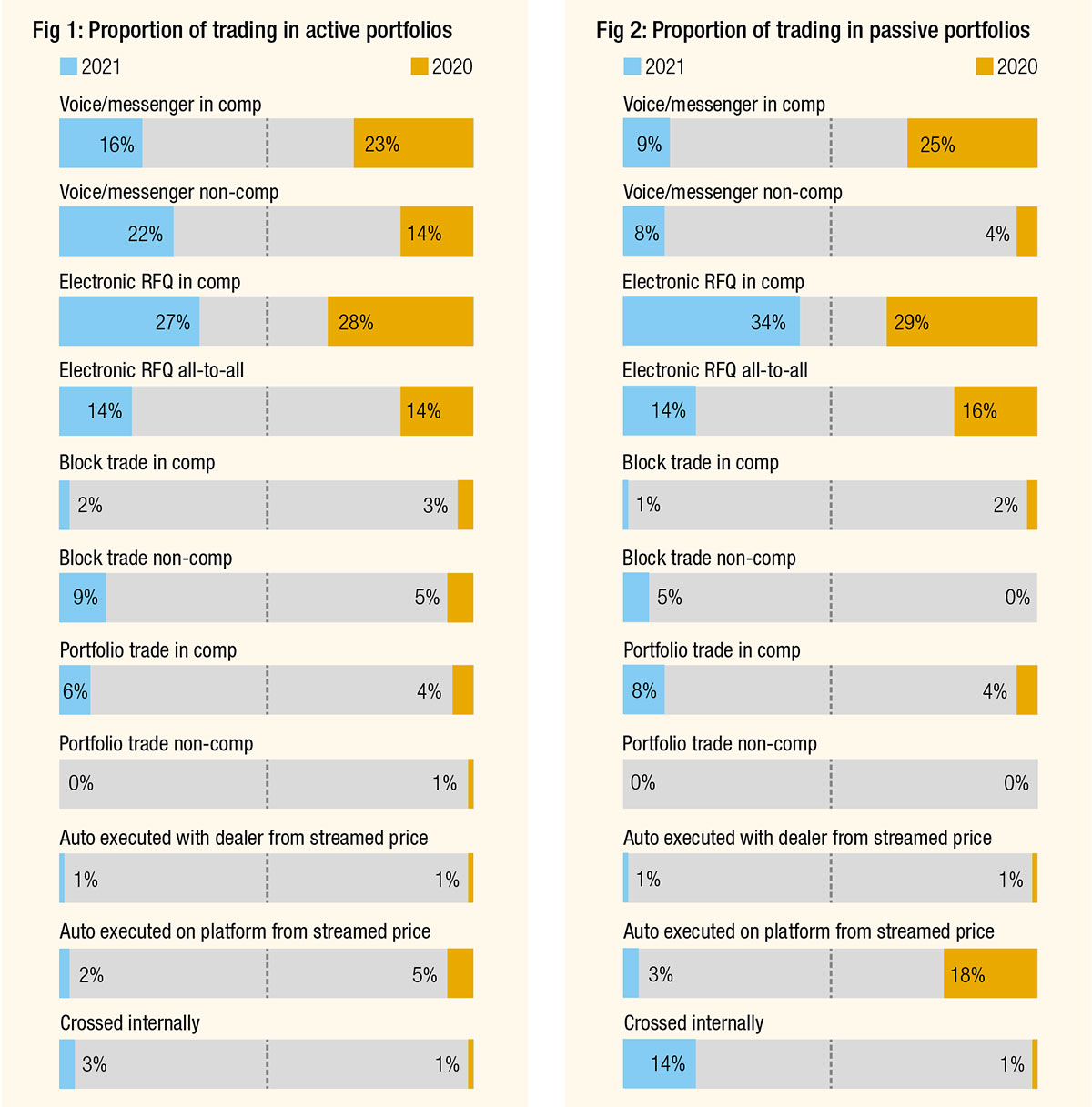

Several big trends are in evidence this year. The first observation is that there is a greater divergence between the trading protocols used to execute orders for passive and active portfolios this year than in 2020 (see Fig 1 and Fig 2).

Secondly, we see an increase in the use of trading in which dealers are not put into competition (non-comp) for prices, with a corresponding decline in the use of protocols which see dealers in competition (in-comp).

Thirdly, internal crossing of trades has increased substantially and auto-execution against streamed prices from platforms has decreased substantially.

Trading for active portfolios

Trading for active portfolios this year (Fig 1) has seen declines in trading in-comp for voice/messenger, electronic request-for-quote (RFQ) and block trading protocols. Non-comp trading for voice/messenger and block trading protocols has increased, while electronic request-for-quote (RFQ) trading has remained on a par year-on-year.

Portfolio trading in-comp is an outlier, rising to 6% of trading in 2021. While this may still be a small proportion of overall trading, it does represent a 50% increase over the previous year. Internal crossing has also increased to 3% up from 1% the year before.

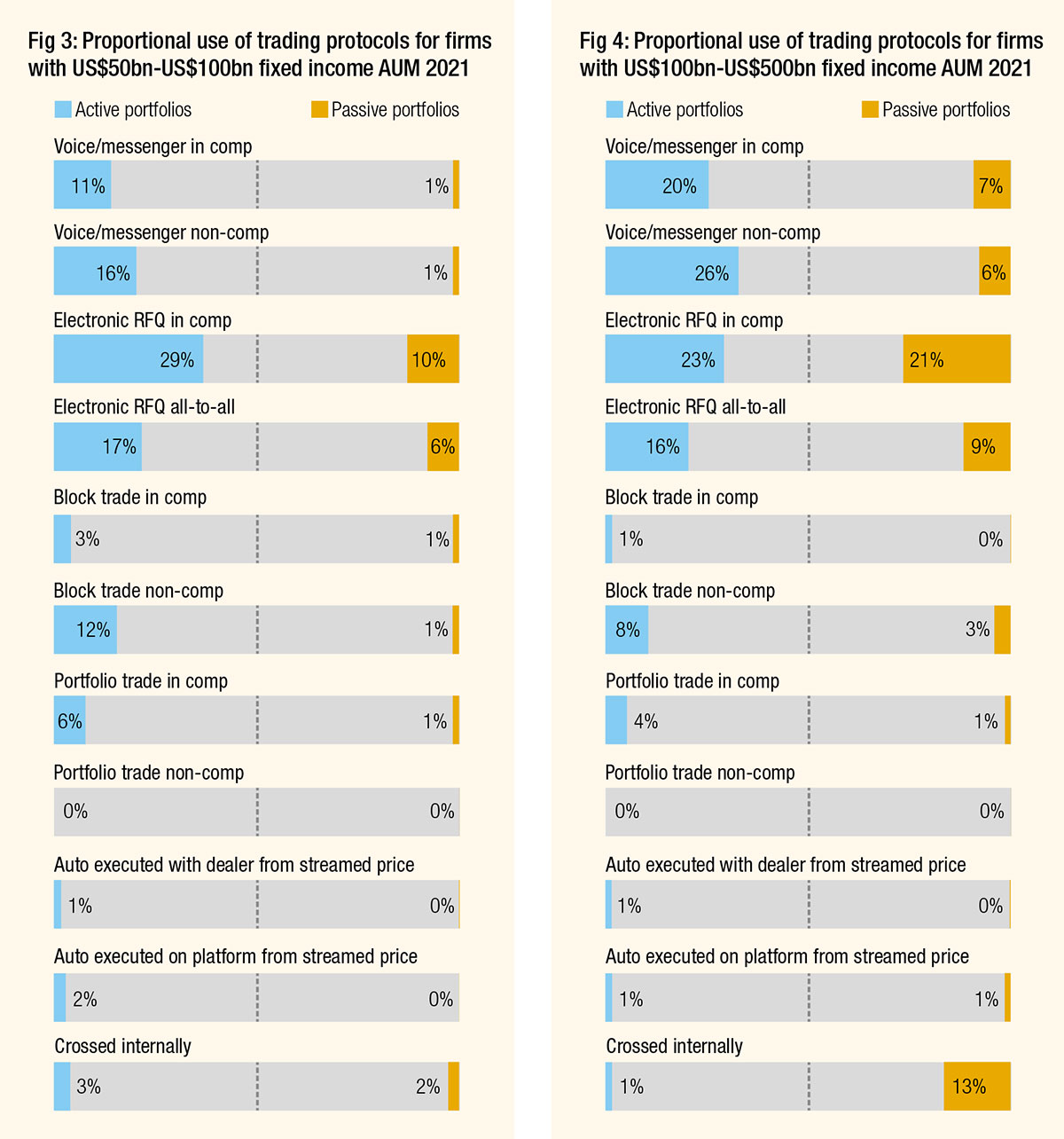

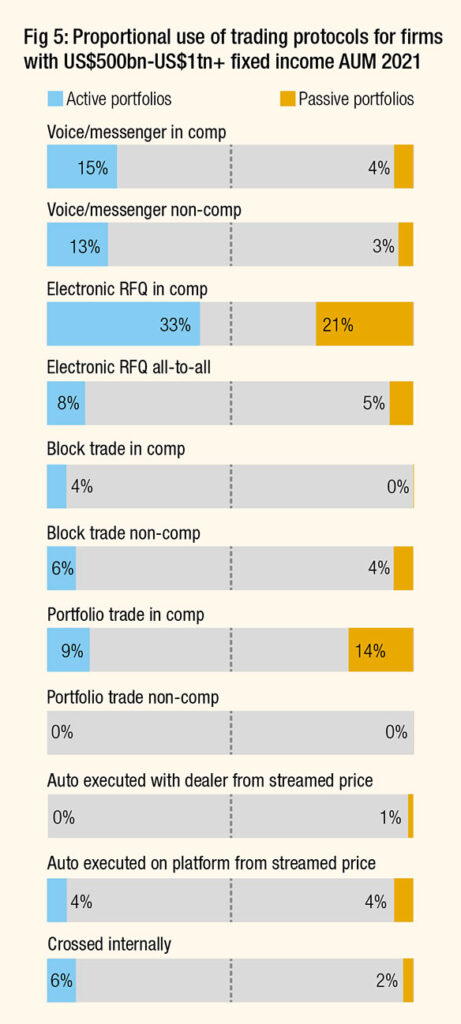

When we break down the 2021 results by size of firm (Fig 3, 4 & 5), it is clear that mid-sized (fixed income AUM of US$100bn-500bn) firms use voice messenger for a higher proportion of trades for active portfolios than smaller or larger firms.

Electronic RFQ and portfolio trading in-comp are used more commonly by both smaller and larger asset managers, as is internal crossing.

Trading for passive portfolios

Traders working on passive portfolios (Fig 2) have made the most substantial drop in the use of voice/messenger in-comp, but have increased their overall use of electronic RFQs in-comp, and doubled their use of portfolio trading in-comp. The shift from auto-execution of trades on platforms from streamed prices, and relative increase in the use of internal crossing trades is more marked for passive portfolios than for active.

If we assess responses based upon the AUM of the firms (Fig 3, 4 & 5), there is an outsized use of portfolio trading by firms with US$500-US$1trillion+ in AUM, which likely reflects that large passive houses have been successfully engaging with both banks and platforms to manage their portfolio rebalancing. Given their lead in portfolio trading for active portfolios as well, it would seem the big firms have led the charge in driving PT forward. They are also the main users of auto-execution for both active and passive mandates.

If we assess responses based upon the AUM of the firms (Fig 3, 4 & 5), there is an outsized use of portfolio trading by firms with US$500-US$1trillion+ in AUM, which likely reflects that large passive houses have been successfully engaging with both banks and platforms to manage their portfolio rebalancing. Given their lead in portfolio trading for active portfolios as well, it would seem the big firms have led the charge in driving PT forward. They are also the main users of auto-execution for both active and passive mandates.

Another curiosity here is that mid-sized firms are championing internal crossing for passive portfolios, by some margin. By cross referencing with the country in which firms are headquartered, it is clear that asset managers based in the US are exclusively driving this.

Conclusion

The major shift away from in-comp trading and auto-execution, towards non-comp trading and internal crossing is likely reflective of market voaltility, which is making it harder for liquidity providers to offer risk trades.

The increase of portfolio trading – which offers greater certainty of execution over trading individual line items – is also reflective of trading desks finding liquidity and volatility a challenge, notably for larger orders.

These changes also tell us about the maturity of the market. Auto-execution against streamed price on platforms can work most effectively for the bigger investment firms who have larger trade sizes and/or the resources to invest in supporting autoexecution even in challenging markets.

Buy-side trading desks have used markedly different proportions of trading protocols between passive and active portfolios this year compared to 2020. The DESK reports.

Buy-side trading desks have used markedly different proportions of trading protocols between passive and active portfolios this year compared to 2020. The DESK reports.