Cut-throat commission rates are hurting both sides of the street, writes Jesse Forster, head of equity market structure at Coalition Greenwich – and it’s the clients who are ultimately losing out.

Cut-throat commission rates are hurting both sides of the street, writes Jesse Forster, head of equity market structure at Coalition Greenwich – and it’s the clients who are ultimately losing out.

Both asset managers and brokers are feeling the pinch of declining equity trading commission wallets and cut-throat commission rates. Neither side has the resources to invest properly in their relationships, and they’re being forced to do more with less. As a result, both sides are re-evaluating their relationships and applying pricing pressure to gain an incremental edge. It’s a vicious cycle. While some asset managers may view this as a cost-saving measure, it’s having unintended consequences: a decline in the quality of services offered and relationships between the two parties, ultimately leading to poor performance and unsatisfied customers.

The buy side is crying out for better coverage from its sell-side counterparts. In fact, over half of buy-side traders in a recent Coalition Greenwich study said that getting proper coverage from their brokers is a top pain point in their daily workflow. What does that look like? It’s about going above and beyond without being asked. And it’s crucial – most traders say that their relationships with their coverage providers are a big driver of their commission allocation, and that customer service is the most important attribute of their trading counterparties. They want brokers to go above and beyond without breaking the bank but feel like they don’t get much in return but mediocrity.

The numbers don’t lie (but they do make us sad)

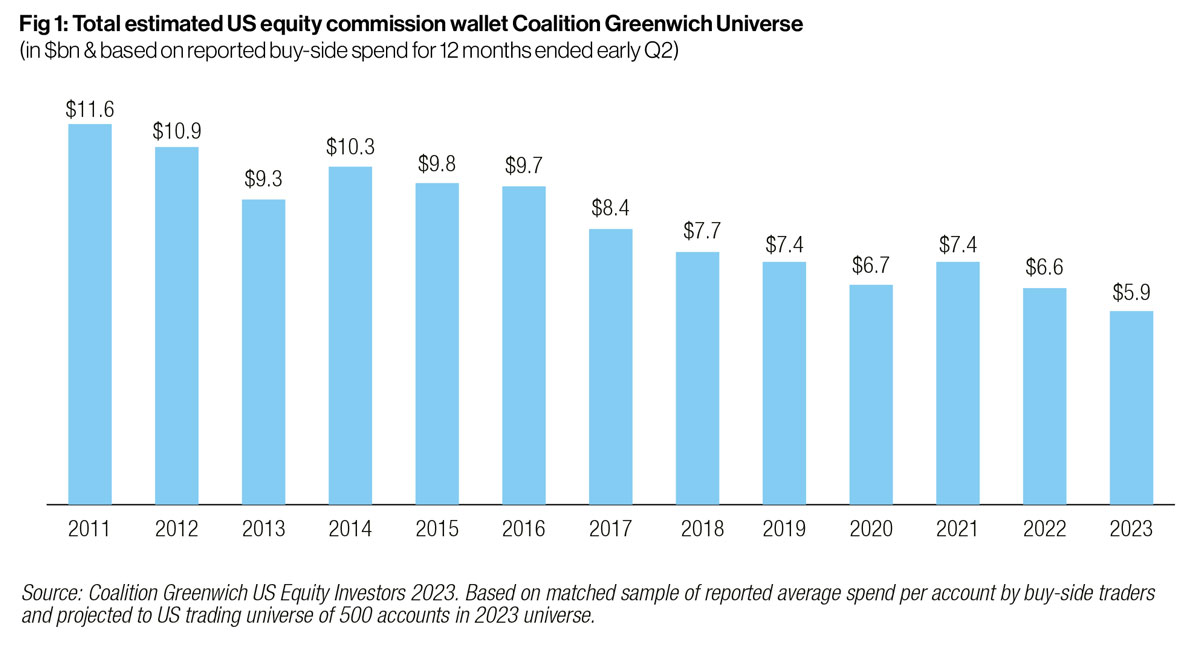

According to Coalition Greenwich research, US equities commissions took an 11% nosedive year over year, plummeting to an anaemic $5.89 billion. And it gets worse – asset managers are now trading almost half their equity flow by notional value electronically, at relatively lower commission rates, and expect this trend to continue. An even greater emphasis on electronic trading is evident among the highest commission-paying institutions, and nearly every manager now trades at least some of their equities order flow electronically. The buy side is voting with its commission wallets, and it’s not a pretty picture.

This isn’t necessarily the buy side’s preferred path forward. One of the reasons they’re trading more electronically is because they have to. Managers are being squeezed by increasing technology and compliance costs while their own management fees dwindle exacerbated by the movement towards lower-fee ETFs.

Some on the buy side are worried about the effects of this trend and are advocating for increasing commission rates or moving to cost-plus models to fairly compensate brokers for their services, while still incentivising them to optimise trade execution.

Some asset managers are willing to pay higher rates to get access to higher-quality brokers, reducing their overall implicit costs to a point they offset increased commission rates. They want their brokers focused on optimising service and performance rather than profitability and margin. But not all sell-side desks are lucky enough to have such clients.

Despite the challenges, the demand for skilled sales traders to source liquidity and manage order flow remains strong. Sourcing natural liquidity remains the buy side’s primary determinant in allocating a diminishing commission wallet, and desks are reducing their broker lists while concentrating flow to their top providers. The buy side wants to pay for liquidity and performance. They just need the sell side to deliver more. And more. And more.

Brokers are running on empty (and it shows)

Top performing brokers get to strut around like peacocks. But it’s tough to be so confident when they are facing a two-pronged battle to stay profitable and relevant. Brokers are getting squeezed from both sides. On one hand, their buy-side clients are reducing commissions, while on the other hand, their own costs are increasing. Besides the “lights on” costs of technology and infrastructure expenses (including ever-increasing market data fees), execution costs like access fees and connectivity are eroding their already slim margins.

In fact, a recent Coalition Greenwich study found that about a quarter of brokers spend 25% or more of their net electronic execution commissions on access fees and market connectivity costs alone. Many brokers we speak with believe this trend will only worsen as the buy side increasingly leverages liquidity-seeking algos, which often incur even higher access fees for the executing broker. This means that, in addition to overall execution costs increasing, the flow brokers receive is increasingly lower-margin. It’s not hard to see how this could lead to higher implicit costs and subpar execution quality.

The buy side expects brokers to deliver high-quality coverage, performance, and liquidity while paying lower commissions on lower volumes. It’s no wonder, then, that half of the sell side in a recent study cited short staffing as a top pain point. Brokers are resource-constrained; they can’t afford to hire quality desk talent to meet the buy side’s demands.

Brokers are running on empty, with staff shortages and juniorisation putting resource strains on their desks, leading to customer service issues. In fact, few brokers themselves say their own trading coverage is a selling point, despite the buy side’s demand for better service. The buy side is clear in its need for better (more proper) coverage from their sell-side counterparts. This often means having multiple specialists to call upon at each broker, but that comes at the cost of doing the appropriate level of business.

Consolidating among the easy

Asset managers are paying lower commissions, their broker’s service suffers, and they find less value in these providers. Rinse and repeat. It’s no wonder traders consistently prioritise ease of use, reliability, and high-quality support in their counterparty selection. They just need something that works.

Traders simply don’t have the time or inclination to learn new platforms or take a chance on new providers. For the most part, they need to stick with what they know works even if that formula is no longer the best solution. As any manager will confess, adding a broker to their counterparty lists has become increasingly challenging. In fact, they’re still reducing their broker lists and concentrating order flow among their best providers. With over half their equities business allocated to their top brokers, the unfortunate reality for many is that if they’re not inside, they’re outside.

Despite these challenges, brokers remain relatively optimistic, accepting the reality that they must adapt and invest to survive and potentially thrive. They’ve done this time and time again for decades. We’ve seen this movie before – think decimalisation, electronification, RegNMS and MiFID. High quality brokers are not only still relevant but needed more than ever.

Perhaps it’s time for asset managers to rethink their approach to commission rates and consider the long-term implications on trading performance. By better compensating their best brokers, they can incentivise them to optimise trade execution and maintain an appropriate level of service. Maybe it’s time to break the cycle and focus on what really matters: quality, performance, and relationships. After all, you get what you pay for.

Cut-throat commission rates are hurting both sides of the street, writes Jesse Forster, head of equity market structure at Coalition Greenwich – and it’s the clients who are ultimately losing out.

Cut-throat commission rates are hurting both sides of the street, writes Jesse Forster, head of equity market structure at Coalition Greenwich – and it’s the clients who are ultimately losing out.