By Clare Witts, Director, Market Structure, Asia Pacific, and Tom Augarde, Director, AES Coverage, Asia Pacific, Credit Suisse

How Volatility, Uncertainty, Complexity and Ambiguity are affecting APAC trading – and what can be done to manage them

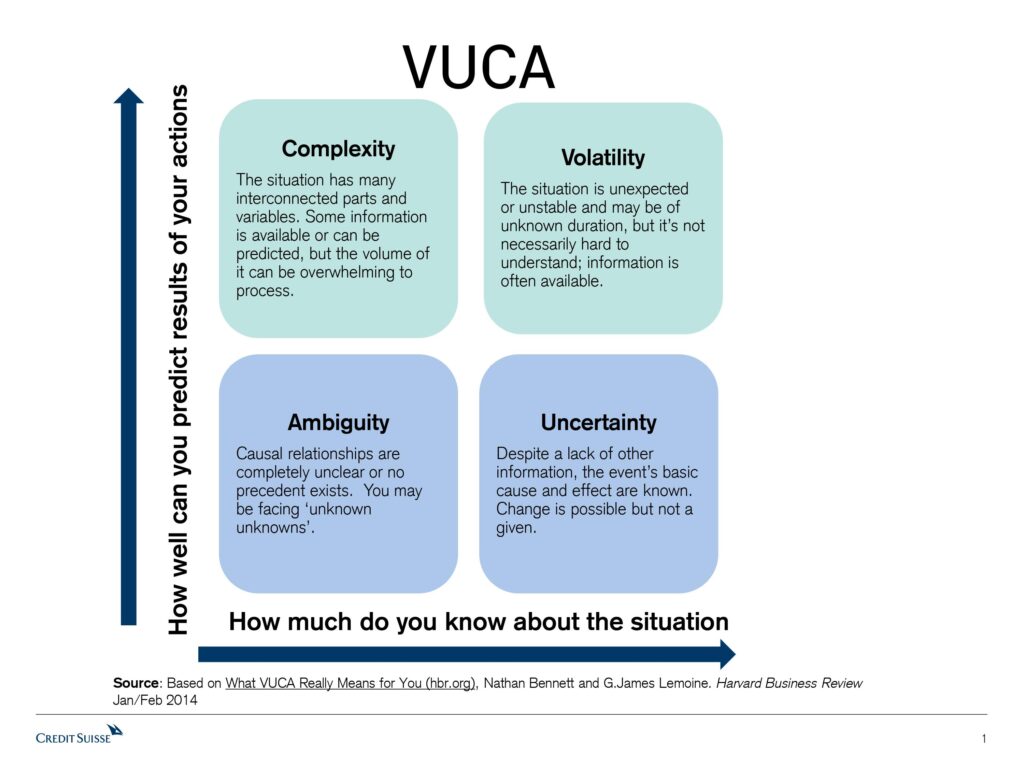

Do you ever feel the markets are crazier than they used to be? You’re not alone. However, the better question is what can be done about it? In military strategy, a framework has been developed to categorize threats and responses and bring a more systematic response to situations that may seem uncontrollable: Volatility, Uncertainty, Complexity and Ambiguity, or VUCA. It describes a state of constant, unpredictable change, an environment that those trading Asia-Pacific will feel very familiar with as complex geopolitics, unexpected regulatory clampdowns or events such as corporate defaults rock our regional markets on a near-daily basis.

So what can be done to mitigate and even optimize these threats to trade performance in a VUCA world? Who is responding, and how? The answer itself requires a rigorous combination of tools and approaches (Figure 1).

Volatility and Complexity: where algos excel

In the past five years, trading technology in Asia-Pacific has continued to evolve with the growing adoption of algo wheels and the algorithms that service them. The wheels have become increasingly sophisticated, both in terms of structure and intention, driving a focus on a far more frequent analysis of trading performance in various market conditions. We see this translating into better consideration of the tradeoff between time delay and impact costs and helping to solve a common trader dilemma arising in volatile, complex markets: what’s the right speed to trade to avoid too much risk? We’ve seen developments in three areas:

- Across the Credit Suisse universe of electronic trading clients, there has been a growing selection of liquidity-seeking strategies over schedule-based. Even as market volatility has come off the 2020 peak, we continue to see a sustained behavioral shift towards greater use of tactics that take liquidity early in the order then pace the residual over a more extended period to avoid ongoing impact.

- Another helpful tool for complex and volatile conditions is the inclusion of alpha progression as a factor in trade planning. First, we conduct customized quantitative analysis of clients’ orders to identify their patterns of alpha progression. That has been used to determine whether volume curves should be adjusted dynamically based on volume profile. Generic VWAP strategies schedule trades based on historical curves and live market conditions relative to those curves. However, by adding an additional overlay of order alpha into the algorithm’s decision-making, the VWAP curve is often tilted towards the early part of the order, getting done quicker and resulting in a positive impact on performance for those clients.

Figure 2 shows a variety of VWAP Curve skews based on a factor derived from analysis of alpha progression on a client’s orders - The third technique relates to intelligently adjusting the discretion levels of algo participation based on the correlation of spread and intraday volatility. This ‘Leeway’ model is applied across the Credit Suisse algos, helping answer how long to wait for liquidity. For example, in low volatility conditions for a stock with a wide bid/ ask spread, the leeway model enables the algo to patiently wait on the passive side of the order book for longer. For a stock experiencing higher intraday volatility with a tight bid/ask spread, the algo will stick tightly to its intended participation rate to minimize the risk of falling behind schedule as price moves away. The range embedded in the Leeway model acts as a guardrail for the algorithms, balancing the risk of deviating from the schedule with the likely benefit to performance.

Ambiguity and Uncertainty: test hypotheses and search for actionable information

Despite the evolution of the trading tools, the other two aspects of VUCA, Ambiguity and Uncertainty, require a more adaptive approach focused on process. Firstly, we are tackling this quantitatively through our AlgoKaizen™ ‘continuous improvement’ framework, empowering strategies to evolve in tandem with liquidity patterns and market developments. Different hypotheses can be built into models and can then be randomly drawn and applied intra-day. The algorithms inherit the winning trading model to apply at appropriate times. This helps improve the adaptability of the trading tools and provide higher certainty of outcomes. The value of AlgoKaizen in addressing ambiguity and uncertainty is related to the discipline and process it brings to hypothesis testing. When we lack apparent explanations for what, how, or why performance is being affected by market conditions, a repeatable and systematic process helps answer questions and apply solutions that reduce uncertainty and ambiguity over time.

Another focus area is a more detailed analysis of macro market structure topics and how they affect the microstructure and behaviors of trading. In the foreseeable future Asia-Pacific markets are facing, among other things: the launch of a new stock exchange in China; the potential introduction of T+1 settlement in India; the restructuring of the Tokyo Stock Exchange boards; and the arrival of a new model of dark trading in Australia. These infrastructure developments often arise against a backdrop of political and policy change, with decisions made for reasons not directly related to trading. Meanwhile, different market participants exert different pressures on markets, whether retail trading following meme stocks, or quantitative trading strategies finding new opportunities. These changes deeply affect the structure of markets yet often evolve below the surface of day-to-day notice or have a rapid drip-feed of information that traders need to understand and assimilate.

We combine analysis of market microstructure metrics and trade performance with broader thinking about how regulation, policy, politics and even human behavior affect the markets. This cross-functional approach enables us to monitor and explore the Why of VUCA-driven change as well as the who, what and how; and to distill findings into ideas and product functionality that help improve performance for our clients.

We can’t control the markets. But by bringing together tools well suited to managing volatility and complexity and processes which help navigate uncertainty and ambiguity, we can make them feel a bit less ‘crazy’. And then the VUCA world can become more of an opportunity than a threat to those trading in it.