with Angus McDiarmid, managing director at Tradeweb, and Matthias Zwicker, deputy head of fixed income trading for asset management at Swiss National Bank

(This article first appeared on The DESK, a Markets Media Group publication.)

Getting a two-way price is unusual in fixed income trading, but normal in FX; that is changing and yielding some real results for best execution.

The DESK has tracked the migration of the request-for-market (RFM) protocol from FX, to emerging market bonds and now rates trading. We spoke with Angus McDiarmid, managing director at Tradeweb and Matthias Zwicker, deputy head of fixed income trading for asset management at Swiss National Bank, to discuss the growth of the RFM protocol, the pros and cons of asking for two-way prices, and the potential for it to expand further in the market.

Why is request for market (RFM) so well suited to the rates market?

Angus McDiarmid (AM): RFM proves to be a particularly well-suited protocol when clients trade over a certain size directionally. In such cases, counterparties may widen spreads on the side being asked, reflecting a cautious response to larger trades. However, when asked for a two-way price, dealers tend to price in a more neutral way. That’s why RFM is growing in popularity, and therefore well suited for the rates market, as it helps optimise these nuanced market interactions, enhancing overall trading efficiency for the client.

Matthias Zwicker (MZ): In our Singapore office my focus is on Australian dollar SSA’s and local currency markets – such as Singapore government bonds – as well as interest rate swaps (IRS) trading across currencies we invest.

We heard about RFM being used in local markets like Singapore government bonds. We started to use RFM and soon recognized that the protocol led to much better execution levels compared to request for quote (RFQ) in that market. The inversion in quotes which is sometimes observed is reflective of those better execution levels.

AM: If you compare this to a central limit order book (CLOB) market, or one in which people ask for firm prices in an over-the-counter (OTC) instrument, participants often see a wider market, with a more cautious approach from market makers. If you send out an RFM to a restricted pool of dealers, you’re essentially building your own micro-CLOB for executing a custom size at a specific point in time. Therefore, the winning market maker and client benefit from minimal information leakage.

AM: If you compare this to a central limit order book (CLOB) market, or one in which people ask for firm prices in an over-the-counter (OTC) instrument, participants often see a wider market, with a more cautious approach from market makers. If you send out an RFM to a restricted pool of dealers, you’re essentially building your own micro-CLOB for executing a custom size at a specific point in time. Therefore, the winning market maker and client benefit from minimal information leakage.

Leveraging RFM for off-benchmark swaps trades, a growing trend on our platform, provides a more accurate assessment of the trade price for transaction cost analysis (TCA) purposes. This is because, determining the dealers’ mid at the time, in addition to the Tradeweb mid or mid of the best bid or offer, enhances the effectiveness of price discovery, contributing to a more accurate and granular evaluation of the transaction cost.

Which types of firms are engaging in RFM use?

Which types of firms are engaging in RFM use?

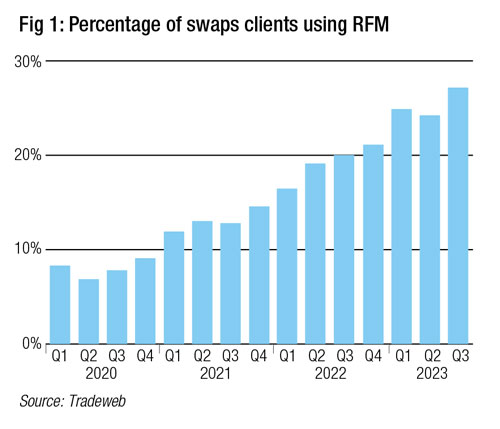

AM: Engagement has been varied with the asset managers most notably taking the lead with significant uptake from real money accounts in particular. Interestingly, hedge funds have also been early adopters. We have also noticed a behavioural change with clients who normally execute their larger sized trades via voice in Swaps, now leveraging RFM to move that risk.

Which rates instruments see the greatest move to RFM?

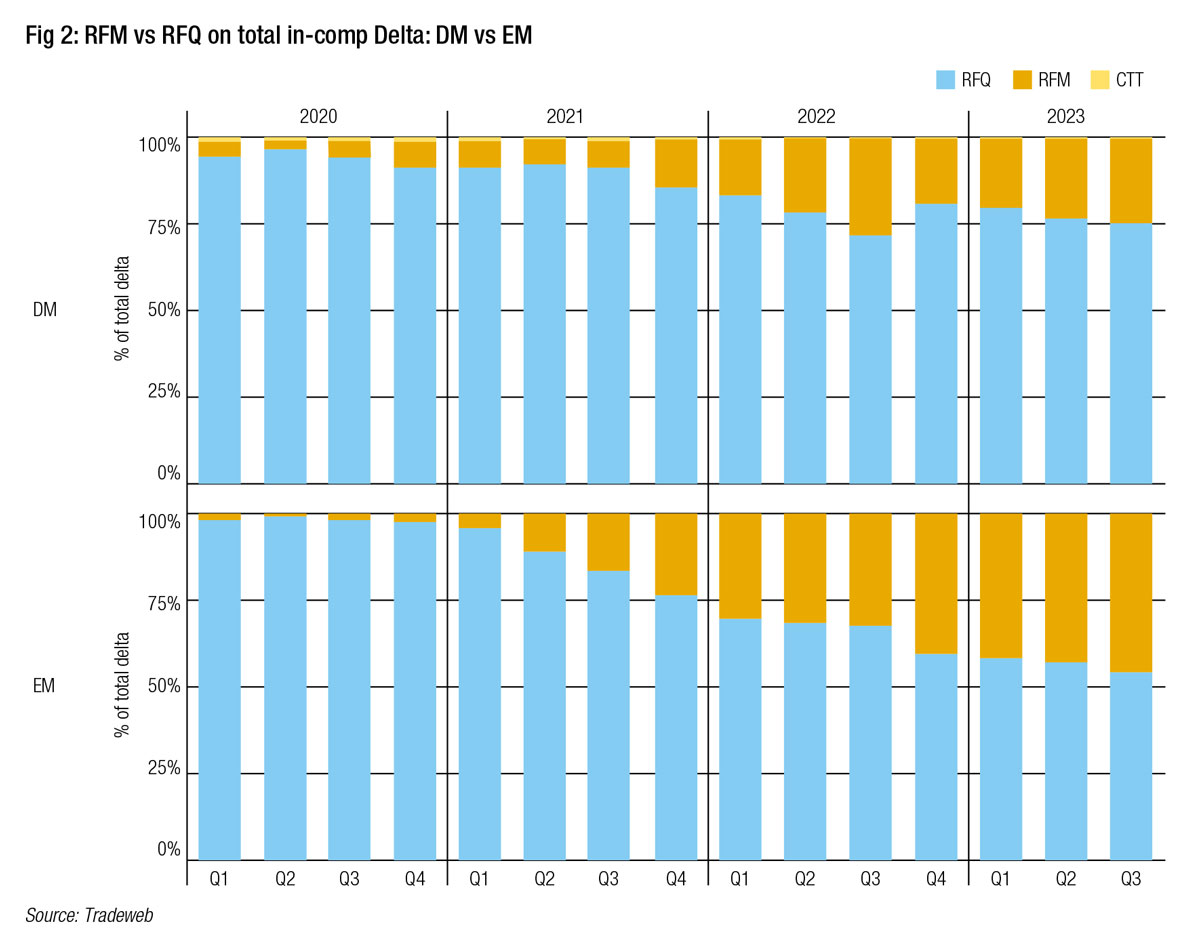

AM: Because RFM is helping to address some of the major challenges associated with Emerging Markets trading, including geographic fragmentation, less transparency in pricing and language barriers, we have seen the adoption of the protocol significantly increasing over the last few years particularly on our EM interest rate swaps (IRS) platform.

We are also starting to see RFM growing in popularity within the government bond space, where dealer support continues to grow.

How is trading performance affected?

MZ: In a hypothetical situation where all the axes on all the bonds of all counterparties are disclosed, you could always select exactly those counterparties (or a subset of it) that are axed on your side. However, problems like stale or non-existent axes and dealers not streaming their bonds (for whatever reason) are the reality. So you never know the full liquidity picture.

MZ: In a hypothetical situation where all the axes on all the bonds of all counterparties are disclosed, you could always select exactly those counterparties (or a subset of it) that are axed on your side. However, problems like stale or non-existent axes and dealers not streaming their bonds (for whatever reason) are the reality. So you never know the full liquidity picture.

From our analysis, we usually see that the top ranked dealer on one side (e.g. offer-side) are very low ranked on the other side (e.g. bid-side). So essentially, the dealer reveals, by means of the protocol, their true trading interest. Hence, they are willing to show their true liquidity because with RFM nobody knows the side that is traded and/or if a trade happened at all (depending on the venue and market). This protects the dealers and the client. In other words, information leakage is minimised.

AM: Preventing potentially sensitive or strategically valuable trading information from being revealed while preserving client intent are definitely some of the main factors affecting behaviour. We are however, seeing the ancillary benefits of better price discovery. Another performance driving trend we are seeing is RFM, used initially for larger sized trades, now been extended into smaller tickets too.

Have dealers become more willing to make a price on RFM?

AM: Most definitely; so much so it’s become standard practice in some areas of the swap market. Most liquidity providers on the swap’s platform now provide two-way pricing, both in list trading and in RFQ. This shift is mainly prompted by certain markets falling under trading obligations, necessitating a transition from voice to regulated platforms. Traditionally, these voice trades involved quoting two-way prices. To maintain the same level of price transparency, dealers will continue to service their clients in this way.

MZ: For a sell-side trader responding to an RFM is certainly more complex, you need to take the likelihood of trading each side into account and what that means for your position and balance sheet restrictions. Therefore, integrating RFM in dealers’ internal systems is important but no precondition for using RFM. We see that some markets are well advanced, while other markets lack way behind. Although that protocol is not new, everybody needs to get used to it. The more important RFM will get meaning the more it is used by the buy-side, the faster the natural adoption process should be.

©Markets Media Europe 2023