TransFICC, which speeds connectivity to fixed income and derivatives venues, plans to double in size following its latest fundraising as workflows became increasingly automated.

The London-based fintech allows firms to easily connect to trading venues using open source technology through its ‘One API for eTrading’ platform, streamlining technology requirements and reducing operational costs.

Steve Toland, founder of TransFICC, told Markets Market: “We enable firms to stream prices on venues such as Tradeweb and Bloomberg in minutes. In a greenfield situation we can build a production environment to go live on these venues in a week.”

Toland continued that TransFICC currently builds connections to a core of between 35 to 50 venues, which typically provide 90% of a bank’s needs.

“But there is a long tail,” he added. “For example, a client has asked us to connect to Peruvian and Chilean government bond venues.”

Another client has asked TransFICC to connect to some credit trading venues, which is a very fragmented market. In March this year TransFICC partnered with SoftSolutions to provide connectivity and workflow solutions for interest rate swaps.

Banks are still operating and trading despite the current Covid-19 pandemic lockdown.

“Their thinking on how they run their systems has changed and the use of the cloud has been forced upon them,” said Toland. “That will not be going away in the long-term.”

Funding round

Last month TransFICC closed its £5.75m ($7.2m) funding round. ING Ventures and HSBC joined existing shareholders, Citi, Illuminate Financial, Main Incubator – the R&D unit of Commerzbank Group, and The FinLab.

Very happy to have closed our Series A investment round for £5.75m. Led by @AlbionVC, other new investors were @ING Ventures and @HSBC – https://t.co/g4OBvvjdma pic.twitter.com/lzsxYZKvgX

— TransFICC (@TransFICC) April 30, 2020

Toland said the fundraising will be used to double the size of the team this year, to build connections to more venues and enable this to be done faster.

“The roadmap of new venues to connect with is not going to end any time soon,” Toland added. “This time next year we would expect to have double the number of clients, including clients from the buy side.”

Mark Whitcroft, founding partner at Illuminate Financial, said in a statement: “With the backing of now six global financial institutions, as clients or investors, the team is successfully executing their vision to become the API layer in electronic trading. As an investor in enterprise technology for financial markets, the proposition aligned with our key theses on electronification of markets and cloud adoption.”

Before the latest fundraising TransFICC was part of the Citi Innovation Lab with Toland described as “transformational.”

“Having Citi involved in the design and testing of the product was a real benefit,” said Toland. “The feedback cycle was very fast, as we provided code on a daily basis and Citi had automated testing.”

Stuart Riley, global head of operations and technology for markets and securities services at Citi, said in a statement: “Providing the company with office space in our lab allowed Citi and TransFICC development teams to work side-by-side and co-create very rapidly, integrating development and testing processes to deliver and release value-add functionality on a daily basis. Our experience with TransFICC has paved the way for a new operating model for Citi with start-ups.”

Toland continued that TransFICC has an advantage with a different business model of providing the connectivity toolkit for clients to build trading components to their own requirements on an open basis. “It is a plug and play model,” he said.

Increased use of trading venues

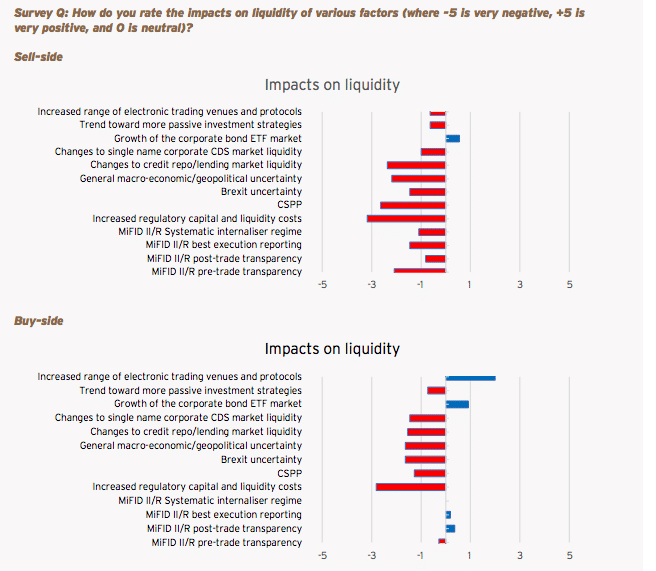

Market, and even security, selection by dealers is becoming more prominent, particularly among firms outside the global bulge bracket, according to the latest survey of Europe’s investment grade corporate bond market by the International Capital Market Association.

Don’t miss @ICMAgroup's latest study, “Time to act”, which delves into the state of the European IG corporate bond secondary market. In the report, market participants share their thoughts on topics including #portfoliotrading, #ETFs and #repo. Read more: https://t.co/X505z1j7VT pic.twitter.com/NwwgKhzw1e

— Tradeweb (@Tradeweb) March 20, 2020

The survey found that the use of trading venues and e-trading protocols to execute trades has continued to increase over the past years.

Selective or multiple request for quote continue to dominate although there appears to be more interest in, and uptake of, alternative protocols to source liquidity according to the report.

“Direct connectivity (or “direct access trading”), whereby dealer banks stream axes or prices directly to their clients, appears to be gaining more interest among participants, which also supports more automated bilateral order execution, such as “click-to trade,” added ICMA.