Shaking off a hit from last summer’s volatility, Goldman Sachs finished 2024 with US$13.43 billion in equity trading revenue – up 14% year-on-year (YoY). With Trump in the White House, things can only get better, the bank says.

After another year of unprecedented events, Goldman Sachs finished 2024 with US$13.43 billion in equity trading revenue – up 14% year-on-year (YoY).

“While there remains some policy uncertainty, there is an expectation that the regulatory burden will be reduced, which should serve as a tailwind to risk assets and capital deployment,” CEO David Solomon told analysts.

Banks shared positive outlooks on the year ahead, anticipating a positive environment for equity trading – in part due to the expected regulatory relaxation in a second Trump term. A lighter touch to regulation would be welcome for big banks, which are pushing up risk exposures as they try to keep revenues growing.

READ MORE: Goldman lost $687m on two days during August turmoil

Earlier this month, the Fed’s chief banking regulator Michael Barr announced that he was stepping down as vice chair of supervision. A supporter of stricter rules for banks, Barr’s actions since his 2022 appointment included pushing for larger capital requirements for systemically important banks under the Basel III Endgame proposal.

Both of those expected to be Barr’s Trump-appointed replacement, commissioners Michelle Bowman and Christopher Waller, have opposed Basel III.

READ MORE: Fed’s top banking watchdog, Michael Barr, steps down amid political transition

Predictions of easing regulation under Trump were clear from November. Alastair Borthwick, chief financial officer at Bank of America, noted the positive macroclimate for the asset class: “Equities benefited from increased activity around the US election. This quarter, our sales and trading revenue marked a fourth quarter record.”

Solomon also highlighted the recent suit filed by a number of US banks against the Federal Reserve. “We have long been concerned that the lack of transparency and the Fed’s current stress testing creates uncertainty and at times produces results we cannot understand and which can lead to higher industry-wide borrowing costs, reduced market liquidity and inefficient capital allocations.

“For the industry, the bar to take this step was incredibly high. And while the Fed has announced that it’s seeking to improve the stress test, the suit was filed to protect our rights. We believe it is our responsibility to continue to press for a more transparent regulatory process in order to foster a more efficient financial system that supports growth and competitiveness of the US economy.”

JP Morgan’s chief financial officer Jeremy Barnum added: “We are happy to see the clear recognition on the part of the Fed that many of the things that we’ve been talking about for a long time in terms of transparency and volatility. Let’s just hope that we see some significant progress on that front.”

Goldman chief financial officer Denis Coleman reflected on strong equity market performance across 2024, and the impact this had on equity underwriting revenues – which reached US$499 million over the year.

Growth at the bank has also been influenced by its narrowed focus on global banking and markets and asset and wealth management as its key businesses, Solomon said. “The organisational structure that we’re creating allows us to take advantage of [the] intersection between both public markets and private markets and the way you marry capital with issuers, but also marrying issuers and their need for capital with all different kinds of investors.”

Furthering this goal, the bank recently established the Capital Solutions Group to consolidate financing, origination, structuring and risk management solutions under the Global Banking and Markets group.

“[This positions] Goldman Sachs to operate at the fulcrum of one of the most important structural trends taking place in finance: the emergence and growth of private credit and other asset classes that can be privately deployed,” Solomon said.

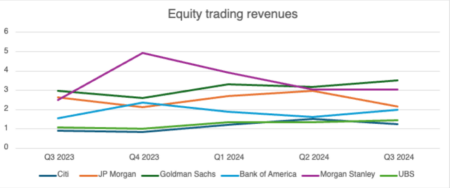

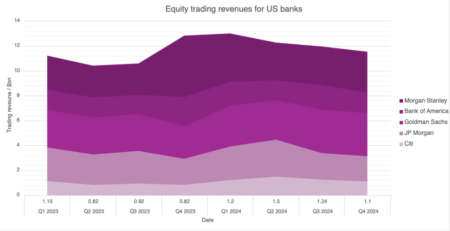

Morgan Stanley fell behind its peers, plateauing after a steep decline in revenue from over the year. The bank hit highs of US$4.94 billion in Q4 2023, spiking from Q3 2023’s US$2.51 billion, but this steadily declined over the next two quarters. Overall, revenues were up just 5% YoY.

Sharon Yeshaya, chief financial officer at Morgan Stanley, stated: “Results were largely driven by accelerating strength in equity underwriting as follow-on and IPO issuance saw meaningful improvements over the comparison period.”

She cited a particularly strong performance in the company’s Asian operations and increased interest in retail and alternative products as influential factors in this growth.

JP Morgan followed the opposite pattern, with steadily increasing revenues falling short in the final quarter and returning to the same levels seen in Q4 2023. Year-on-year, equity trading revenues remained static.

Agreeing with Yeshaya and Coleman, Barnum commented: “Underwriting fees were up meaningfully, primarily driven by favourable market conditions.”

“In terms of the outlook for the overall investment banking wallet, we remain optimistic about our pipeline,” he concluded.

CEO Jamie Dimon, only recently out of the race for US Treasury secretary, was probed during the bank’s earnings call to name his successor. “It’s not determined yet,” he said, but shared that he will not be leaving the bank immediately.

Citi ended the year with US$5.04 billion, marking the greatest improvement of the banks in equity trading revenues YoY – up 35% from 2023.

Jane Fraser, CEO, commented: “Markets saw its highest fourth quarter revenue in a decade and increased 36% with broad based gains across all products. Equities revenues increased 34%, driven in part by strong execution of strategic client transactions in cash equities.”

Bank of America remained fairly steady in its revenue performance across 2024, reaching a peak of US$2 billion in Q3 and ending the year with a total US$7.14 billion, down marginally from 2023’s US$7.15 billion.

Looking ahead, Goldman’s Solomon warned, “there’ll be some surprises to the ups and there’ll be some surprises to the downs – as there always are.”

©Markets Media Europe 2024