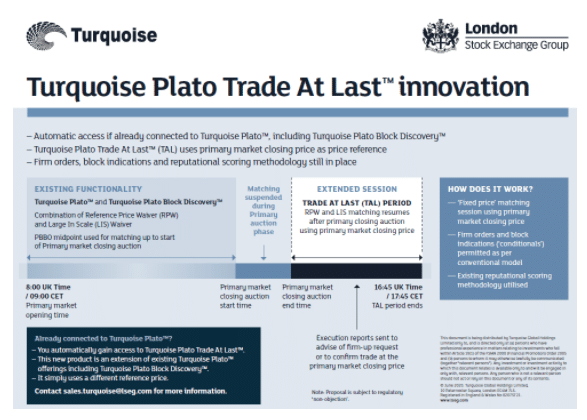

Turquoise Plato is launching a new order type to take advantage of growing volume and liquidity in the closing auction.

Mike Bellaro, chief executive of Plato Partnership, told Markets Media that Trade at Last solves real challenges as it gives access to previously untapped liquidity at a known price.

“Turquoise Plato provides quality execution with minimal market impact and this is another tool to allow traders to continue that process as about 24% of daily volume is now is the closing auction,” he added.

Plato Partnership is the not-for-profit industry group representing asset managers and broker dealers which aims to improve market structure and achieve better results for end-investors. In 2016 Plato announced the creation of Turquoise Plato which brought together the buy side, sell side and a trading venue, the London Stock Exchange Group’s multilateral trading facility, in a formal agreement to increase efficiencies and reduce costs in anonymous European equity block trading.

Turquoise Plato Trade at Last is due to go live on 13 July. Once the underlying primary market has announced the official closing price, both firm and conditional orders can be submitted until 16:45 UK time using existing connections to Turquoise Plato.

Bellaro continued that Plato Partnership and the Turquoise Plato expert group worked closely to create a highly innovative product.

“It is the perfect example of partnership between a venue, the sell side and buy side to improve the trading experience for the whole marketplace,” he added.

Dr Robert Barnes, chief executive of Turquoise and global head of primary markets at the London Stock Exchange Group, told Markets Media that participants wanted access to the extra liquidity at the close without interfering with the price setting process in the primary market.

“The beauty of Turquoise Plato Trade at Last is that it uses the same order process as the intra-day auctions and is fully anonymous,” Barnes added. “The closing auction is a jewel of a liquidity event and Turquoise Plato Trade at Last provides another tool for managers to use Turquoise Plato and Turquoise Plato Block Discovery mechanisms they know so well to further manage strategic liquidity that can match in the period after the close, at the closing price.”

With Turquoise Plato Trade At Last, investors can seek further liquidity following the closing auction. It's completely dark: if you trade, it's a fantastic source of execution; if you don’t trade, no harm because no one knows that you've attempted to trade at that point in time pic.twitter.com/mRgyKLnYVN

— Trade Turquoise (@tradeturquoise) June 24, 2020

Barnes continued that Turquoise Plato Block Discovery has achieved record volumes this year despite the increased volatility due to the ability to execute at midpoint, so the ability to use the same mechanism at the close adds significant value.

“Turquoise Plato has gained credibility within the community which was shown by continued activity during the volatility associated with the Covid-19 pandemic,” he said.

Activity on Turquoise Plato Block Discovery accounted for over half of volumes on the Turquoise Plato platform for the first time, with 57.4% of value traded in the year-to-date to the end of May according to Barnes.

Turquoise Plato Block Discovery™ sets news records in Q1 2020 with over € 46bn traded, +87% higher than the prior record of Q1 2019. pic.twitter.com/J4hpblYb9d

— Trade Turquoise (@tradeturquoise) April 7, 2020

Bellaro said: “The Turquoise Plato brand is the gold standard for cooperation in the marketplace but we cannot rest upon our laurels and will continue to strive for innovation as the technology industry embarks on three years of major change.”

Impact of Covid-19

Belalro continued that the Covid-19 pandemic has already begun to bring drastic change to the financial industry and will catalyse the adoption of new technologies and a greater focus digital services.

Barnes added that the need for the economy to recover from the pandemic will lead to continued innovations.

“For example, regulators have increased the amount of equity companies can raise in a non-pre-emptive issue from 5% to 20%, such as when Compass Group recently raised £2bn via a successful share sale,” Barnes said.

This month the London Stock Exchange Group celebrated the 25th anniversary of AIM, its smaller companies segment.

London Stock Exchange Celebrates AIM’s 25th Anniversaryhttps://t.co/DwPie64TMK

— Markets Media (@marketsmedia) June 16, 2020

Barnes said: “Since AIM stocks were made available for trading on Turquoise in October 2017, 58% of trades by value have matched at midpoint which has provided a huge price improvement for the community.”

In addition, China Pacific Insurance joined London Stock Exchange’s Shanghai-London Stock Connect segment this month. The segment provides the only access to China’s A-Shares on an exchange outside Greater China using international trading and settlement practices and allows established Chinese issuers to raise capital in London.

Effective today, investors can trade the newest Shanghai London Stock Connect security, China Pacific Insurance (CPICl) on the International Order Book using @LSEplc and @tradeturquoise including Turquoise Plato, the industry’s leading midpoint and electronic block trading venue pic.twitter.com/LOV9QeAs83

— Trade Turquoise (@tradeturquoise) June 22, 2020