With Winnie Khattar, Head of Market Structure iShares APAC, BlackRock

How are the ETFs market structure shaping across Asia?

ETF industry both regionally and globally has witnessed phenomenal growth in the last few years. APAC ETF AUM has grown 240% over the last five years making it the fastest growing region globally while iShares assets in Asia in the same period have grown nearly 400%. The growth has been driven across industry participants increasing their exposure to ETFs. Japan and China are world’s second and third largest ETF markets after the US with $520B and $120B in assets respectively.

As popularity and adoption of the ETFs across investor types continues to grow, exchanges and regulators have taken steps to promote growth and participation in ETFs. Hong Kong exchange last year removed the trading tariff for Fixed Income ETFs and Tokyo Stock Exchange adjusted tick and lot size tables to improve on screen liquidity and accessibility of ETFs. Australian regulator ASIC is currently running a consultation on enhancing ETP naming convention which is critical to create transparency and help investors clearly understand the risks associated with different types of exchange traded products.

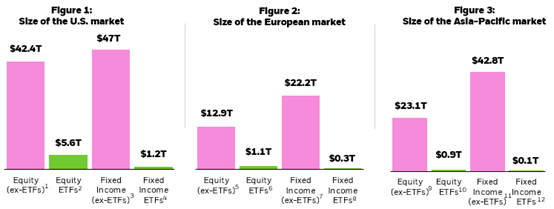

However, there is a long runway for growth, ETFs still only account for a fraction of the overall market. Only 3.4% of assets invested in APAC equities are equity ETFs, versus 6.6% for Europe and 10% for the US.

Regulatory reform can unlock new opportunities for increased adoption ETFs in Asia. Pension funds are a good example, whereby current rules or structural challenges in some of the major markets inhibit pension funds to utilize the full suite of domestic and foreign cost-efficient ETFs in their portfolios to maximize investor returns. Structural reform is necessary to scale the adoption, create transparency, promote innovation to attract more competition in turn will result in lower fees and more efficient, robust ETF market.

Where do the use of listed derivatives and ETFs cross over/differ?

ETFs can be used for both rapid risk transfer and longer-term market access. Institutional investors often compare the relative merits of ETFs, listed derivatives like futures and total return swaps. Like many technologies, ETFs benefit from a network effect: as the number of investors using them increases, their operational utility relative to derivatives increases as well.

Recent regulatory and market structure changes including Basel III, Dodd Frank, OTC margining rules, have made ETFs more competitive as a replacement for, derivatives strategies. Market structure/ETF tailwinds include fee compression and wide range of benchmarks tackled by ETFs.

Key drivers for investors to use ETFs include low cost (while derivatives’ costs may be explicit, like break fee or spread, and implicit, eg. implied dividend pricing or roll cost), stability of tracking, absence of counterparty risk (vs. OTC derivatives), precision of the exposure and the relative operational ease of ETFs compared to derivatives.

What effect have fixed income ETFs had upon liquidity of the underlying bonds in APAC?

In Asia, bond ETFs have seen promising shoots of growth. For instance, in China rates, ETFs have become the vehicle of choice for investors to source liquidity from a China onshore market, difficult or operationally complex to access. Since 2020, foreign investors have added about ~US$300bn into China bonds, and ETFs led the charge consistently taking in between 5 to 10% of monthly inflows, with iShares’ UCITS and HK listed ETFs taking >70% market share.

Moving into credit, ETF assets are also accelerating as their market share in the Asia credit and high yield mutual fund landscape more than tripled in 2021. That said, both the size of the underlying bond market and ETF turnover is growing at a relatively low rate compared to global averages.

As both the underlying market and ETF ecosystem in Asia grows, we expect Asia ETF liquidity to positively impact the Asia bond market liquidity, as we see in US and Europe.

Which markets have foremost adoption of ETFs to date and where will be the greatest growth over next 18 months?

The U.S. is the largest ETF market globally with an AUM of $7.2 trillion, Japan is the second biggest single country ETF market at $545bn and China next at $164bn in assets. Europe as a region has a combined ETF AUM of $1.6 Trillion surpassing both Japan and China.

ETF markets across Asia Pacific have seen strong growth in recent years with 27% CAGR (2017-2021), albeit starting from a lower base relative to the U.S. and Europe, driven by investor’s search for low-cost and efficient vehicles. Over the same time-period, iShares ETFs in Asia have grown by 36% CAGR with 23 new product launches across our multiple trading hubs in the region. The Asia Pacific ETF market currently stands at ~$1.0 trillion AUM.

Equity ETF assets in the region amount to only for 4% of the APAC equities market capitalization versus 9-10% in both Europe and the US; and Fixed Income is even smaller. We expect to see strong growth in this region stemming from client demand and regulatory advancements.

Where are the barriers to trading in markets today and to what extent can ETFs support investors in overcoming those barriers?

In today’s fast evolving markets and changing investor dynamics convenience matters, the convenience of ETFs— the ability to access a multitude of markets, in a diversified way and at a low cost —is and will continue to drive growth across all types of investors.

How is BlackRock leading the development of Asia’s ETF formation and structure?

BlackRock has more than twenty years of experience managing ETFs in Asia and continues to drive progress for the financial industry. We bring our global knowledge and experience to help the industry setting better market standards and identify ways to continuously improve ETF products and trading platforms, as well as ensuring the ecosystem of liquidity and trade execution is robust and diverse so that ETFs continue to grow and thrive in multiple markets.

APAC is still at an early stage of ETF development cycle due to traditionally low usage. While ETFs only account for a fraction of the equity and fixed income markets at 4% and 0.2% as of Q1 2022, there is tremendous growth potential in the region. We are excited to see growing ETF adoption, increased financial literacy among Asian investors and improving regulatory framework.

All these factors will foster the ETF market development in the region. By leveraging our scale, global expertise, and product breadth, we are committed in making investing more accessible, affordable, and transparent for investors in the APAC region.

What is the future of ETF structure in Asia, say this year and beyond?

The unique power of ETFs lies in their accessibility across the world. Competition is global and APAC is still very fragmented (many different markets). If APAC doesn’t keep up with innovation and reforms (eg. staying with a rebate-based distribution model), they may lose the race to the U.S. and Europe.

BlackRock is a strong advocate for transparency and standard best practices for ETFs. Clear and consistent policies on disclosure, risks, product classification will boost investor confidence in ETFs and provide issuers more visibility into market to improve liquidity and attract new participants. Market access programs such as ETF Connect will help increase adoption and foster demand.

Structural reform will drive innovation, allow issuers to scale, attract more competition and participation which in turn will result in lower fees and more efficient, robust ETF market in coming years.