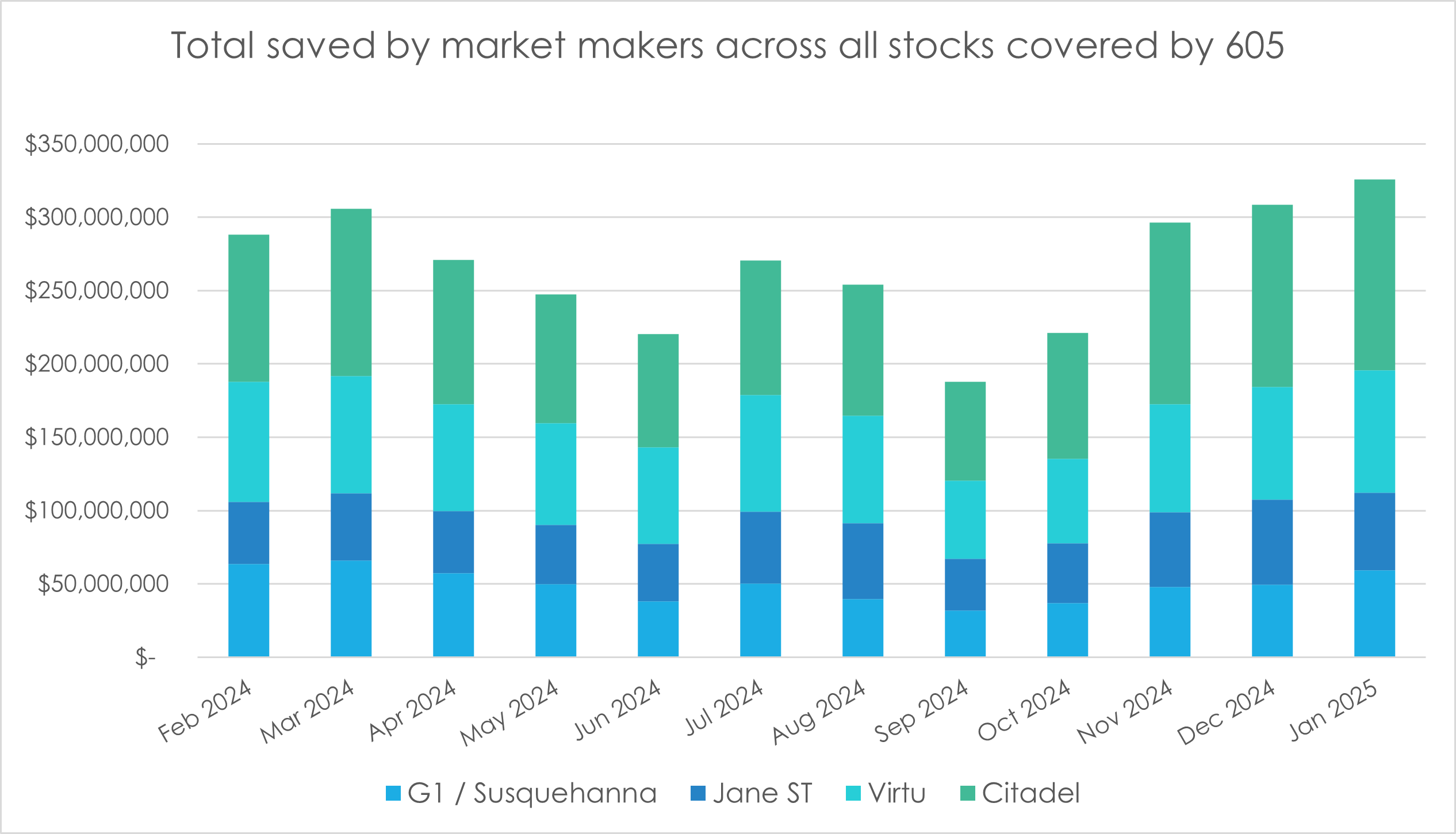

Citadel Securities, Susquehanna, Jane Street, and Virtu offered retail customers of brokers a combined US$3.2 billion improvement on pricing compared to public venues during 2024, according to Global Trading analysis of best execution filings.

US retail brokers such as Robinhood have become notorious for selling their order flow to large market makers.

In return, these market makers are required to provide best execution for retail traders. Evidence of their compliance and performance can be gleaned from regulatory filings. So-called “price improvement,” defined as the difference between the execution price offered by the market maker and the quoted price on public exchanges, must be disclosed under SEC Rule 605.

Yet these disclosures, aggregated across hundreds of thousands of trades, reveal substantial differences between market makers in execution quality, trading strategies, and areas of expertise.

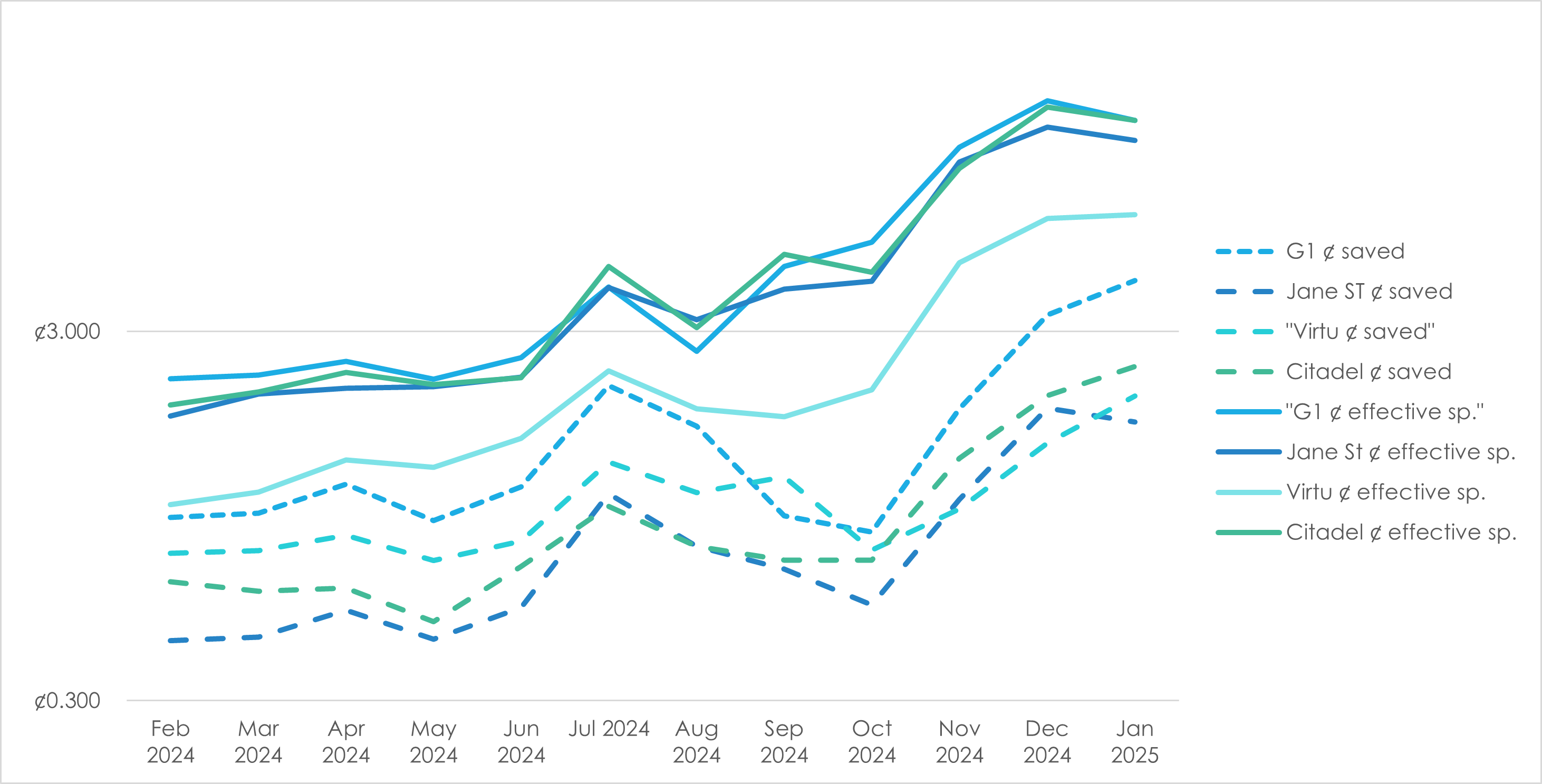

Effective Spread represents the difference between the execution price of a trade and the midpoint of the National Best Bid and Offer (NBBO) at the time of execution. A lower effective spread indicates superior execution quality, as it implies that traders are receiving prices closer to the mid-market price.

Dollars Saved quantifies the tangible benefit retail traders gain from market makers’ price improvements relative to public exchanges. It effectively captures the direct economic advantage transferred from the market maker to the retail investor.

Across the period from February 2024 to January 2025, retail investors trading through these four market makers saw average monthly savings of approximately $267 million, underscoring the significant scale and economic impact of price improvement. This translates into an total of more than $3.2 billion saved for retail traders across the entire year.

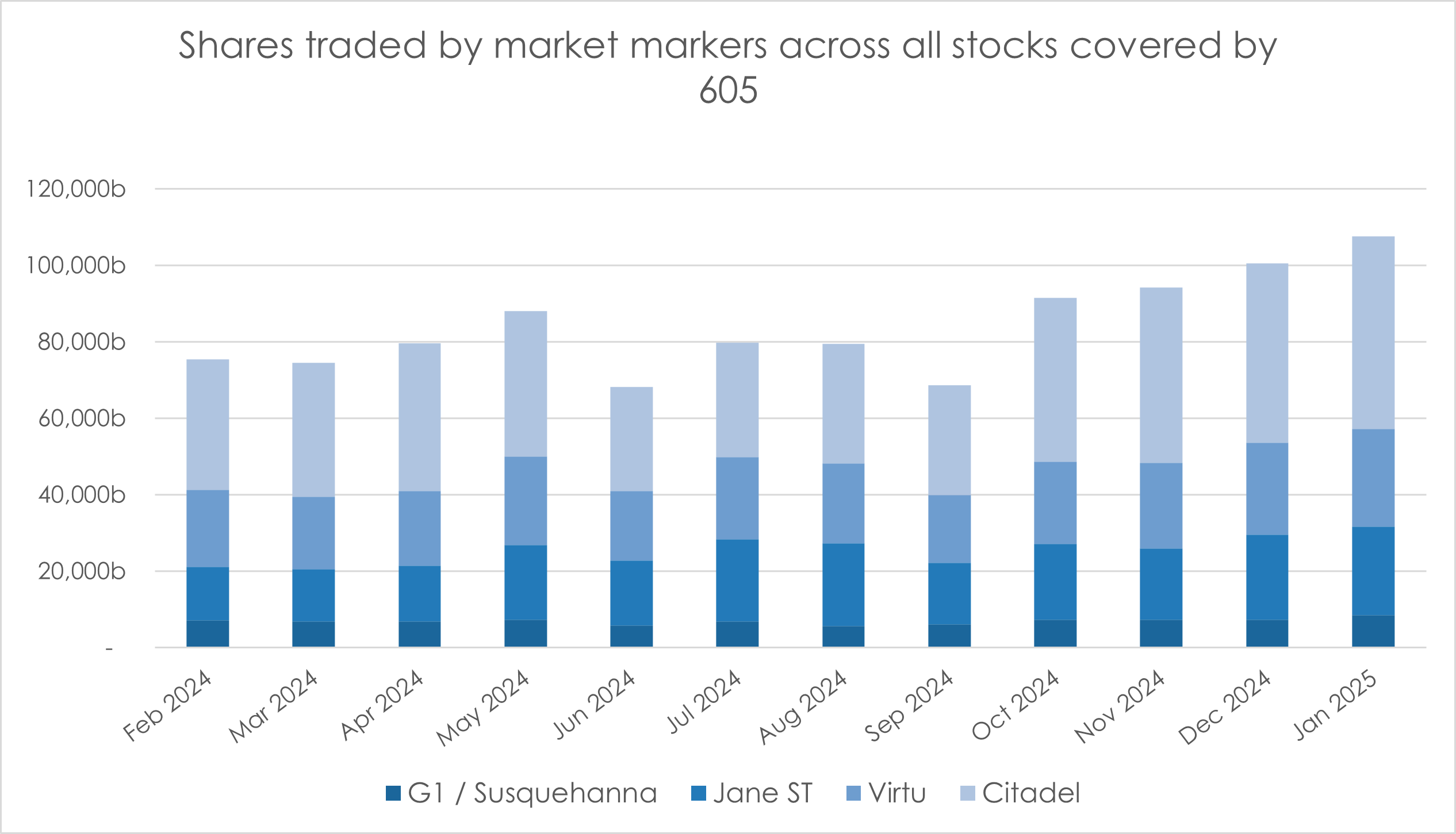

Trading activity was equally robust, with the market makers collectively handling over 567 billion shares during the year. This volume indicates substantial retail engagement, highlighting the critical role these market makers play in facilitating market liquidity.

Virtu distinguished itself by consistently providing the lowest effective spread among its peers, averaging $0.004 per share. This indicates a strategic focus on highly liquid and stable stocks, where competition and efficient markets lead to narrower execution margins.

Susquehanna (G1SUS), in contrast, achieved the highest average dollar saved per share, at around $0.0085. This suggests that Susquehanna specialises in trading environments characterised by greater volatility and lower liquidity, where opportunities for price improvement—and therefore potential dollar savings—are more pronounced.

Citadel Securities and Jane Street occupied intermediate positions, successfully balancing tight execution spreads with substantial dollar savings. Citadel, for instance, averaged effective spreads around $0.005 per share while providing considerable savings. Jane Street delivered an effective spread averaging $0.0052 per share, maintaining a solid middle-ground performance. Citadel traded 150 billion shares and saved retail traders over $900 million during this period, while Jane Street dealt around 110 billion shares, achieving savings close to $650 million.

The data revealed clear specialisations among market makers. G1SUS frequently prioritised trading in volatile or less liquid stocks, accepting wider effective spreads—sometimes exceeding $0.01 per share—as a trade-off for delivering higher price improvements, often above $0.009 per share, to retail clients. G1SUS’s total volume for the period exceeded 140 billion shares, contributing over $1.2 billion in dollar savings. Virtu, meanwhile, was clearly more comfortable operating in stable, liquid markets, achieving superior execution quality with narrower spreads but lower average dollar savings, typically around $0.003 per share. Virtu traded 160 billion shares, saving retail traders about $450 million overall.

In the most actively traded stocks and the high-profile ‘Magnificent Seven’ (Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, and Tesla), Virtu again led in execution quality, recording effective spreads averaging just under $0.004 per share across approximately 65 billion shares traded, saving around $180 million. Susquehanna notably excelled in providing greater dollar savings in complex and volatile stocks such as Tesla and Nvidia, saving traders on average over $0.01 per share, equating to about $320 million across 45 billion shares traded, reinforcing its expertise in handling challenging market conditions.

Leveraged ETFs

Notably, among the ten most actively traded stocks handled by these market makers were leveraged exchange-traded products (ETPs) such as SOXS, TQQQ, and SQQQ, popular vehicles among retail traders for speculative bets on market direction. SOXS provides triple-leveraged inverse exposure to semiconductor stocks, TQQQ offers triple-leveraged long-exposure to the Nasdaq-100, and SQQQ provides triple-leveraged inverse exposure to the same index. Trading activity in these leveraged ETFs was remarkably high, collectively accounting for approximately 45 billion shares traded during the period. Effective spreads on these products varied significantly, from as narrow as $0.003 per share with Virtu to above $0.008 per share with Susquehanna. Susquehanna demonstrated notable performance in volatile conditions, delivering substantial average dollar savings of $0.009 per share, totalling approximately $150 million. Virtu maintained the lowest effective spreads, consistent with its preference for liquid and stable trading conditions, with total savings around $50 million on similar volumes.

As the only publicly traded entity among the four market makers, Virtu Financial provides transparency into the economic scale and profitability associated with its market-making activities. During 2024, Virtu executed an average daily volume of 554 million shares specifically under Rule 605 disclosures, peaking at 612 million shares daily in the fourth quarter. This represents but a tiny fraction of the actual volume of shares traded by Virtu which stood at 12.2 billion shares on average daily in 2024. This translates into daily average adjusted net trading income (NTI) from market making increasing from US$4.5 million in Q1 to US$5.5 million in Q4.

Virtu’s financial results also highlight significant expenses related to Payments for Order Flow (PFOF), brokerage, exchange, and clearance fees. These totaled $674 million for the year, with $207 million incurred specifically in the fourth quarter. Although Rule 605 disclosed activities represent a substantial and measurable segment, it is crucial to acknowledge they form only part of Virtu’s and other market makers broader and more opaque market-making and execution services, particularly in derivatives markets and other asset classes.