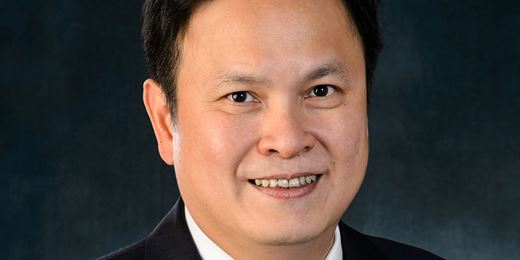

China’s stock markets have experienced significant recent selloffs following a spate of regulatory and policy changes. In a recent investment note, Kai Kong Chay, Senior Portfolio Manager, Greater China Equities at Manulife Investment Management suggested that despite these policy headwinds, the Chinese government does not seek to curb its key sectors, but merely to keep them in check, while encouraging innovation.

Investors no doubt wonder whether China’s recent slew of seemingly adverse policy announcement and resultant market volatility is “the old, new or recurring ‘normal,'” observed Chay. He contends it is the latter, pointing out that “sector-focused regulatory and policy changes are not unusual for emerging markets like China. In the past, risk-off and indiscriminate sell-offs often created mispricing opportunities for long-term investors.”

“Beyond the near-term volatility, we believe China’s fundamental, structural growth story remains intact,” wrote Chay. “As China continues to elevate its economic composition, policy makers will continue to push ahead with corporate governance and sector-specific policy reforms, ensuring growth is managed and can navigate through a sustainable trajectory.”

Sectors under pressure

The three sectors in China that have recently been the subjects of major policy announcements are technology, property management and education.

In early July, the Cyberspace Administration of China (CAC) announced a cybersecurity inspection on certain ride-hailing platforms following the IPOs of a few such companies in the US. This is in line with China’s ongoing revamp of its policy towards privacy and data security. It is drafting a Personal Information Protection Law, which calls for tech platforms to impose stricter measures to ensure secure storage of user data. In addition, the country is set to implement its Data Security Law in September, requiring companies that process “critical data” to conduct risk assessments and submit reports.

Chinese tech stocks have also been shaken by recent antitrust investigations, but as Chay points out, there have also been positive developments after a record fine was imposed on a leading player for monopolistic practices in April. Subsequently, in mid-July, most of the internet players summoned (33 in total) are reported to have signed anti-monopoly self-regulatory conventions and pledged to gradually open up their platforms to promote fair competition.

As for property management, a notice was issued on July 23 that regulatory oversight and control would be tightened, but this did not prompt a selloff. More broadly, property management is one of the sectors the government intends to support under its 14th Five Year Plan, which is perhaps contributing to a positive outlook.

Meanwhile, education stocks, and especially companies involved in after-school tutoring, have not fared well following a policy released on July 24 calling for all such firms to be converted to non-profit institutions and prohibiting foreign investment in the sector. The policy, which is intended to protect students’ well-being, has necessitated a reassessment of the sector’s fundamentals and an adjustment of expectations.

Sectors benefiting from policy tailwinds

On the other hand, Chay noted that several sectors in China are benefiting from policy tailwinds. Among these are renewable energy, healthcare innovation, industrial automation, manufacturing upgrade, and semiconductor supply chain self-sufficiency, all of which rank highly on the Chinese government’s agenda.

In particular, Chay expressed optimism about renewable energy in light of the government’ s goal to reach carbon neutrality by 2060. As for companies in the healthcare sector, specialized medical services providers such as those offering assisted fertility could benefit from China’s three-child policy push.